AI Trade: NOT A Bubble–What To Know

Many are leaving the AI party in fears the trade has gotten over played. But are they too early to grab their coats and head for the doors?

Wednesday after the bell, the much-awaited Nvidia financial release hit the wires. NVDA stock shot up like a freshly-lit rocket, flaring up the hopes of the AI-trade die-hards that there is still plenty of juice left to squeeze.

Prior to the release, there had been ongoing concerns that the AI trade was turning into a bubble, and the earlier an exit, the more the greediest could keep. Those fears of a potential bubble starting to pop were swiftly, and deftly tossed aside: Nvidia’s financials, and their future expectations are showing continued increases.

Nvidia reported higher-than-expected revenue and earnings, and future revenue growth will continue its frothiness. Then, CEO Huang set the tone that he does not see a bubble, but something entirely different.

Notwithstanding this information, the next day, while initially the market held up, there was an eventual sell-off in one of the biggest stock market intra-day turnarounds in a decade—what started as a 2.50% increase on the day for the S&P 500, ended down -2.50% for the day—a full 5.00% swing.

What happened?

With a newly printed revenue beat, then future earnings that are sure to continue to increase further, why would the stock move lower?

Something that may be missing within is other information that affected the stock market last week. The other bit of information is the economy and potential of interest rate moves in the upcoming December Federal Reserve meeting.

But first, what is NVDA stock worth today considering future revenue and earnings?

Nvidia Valuation

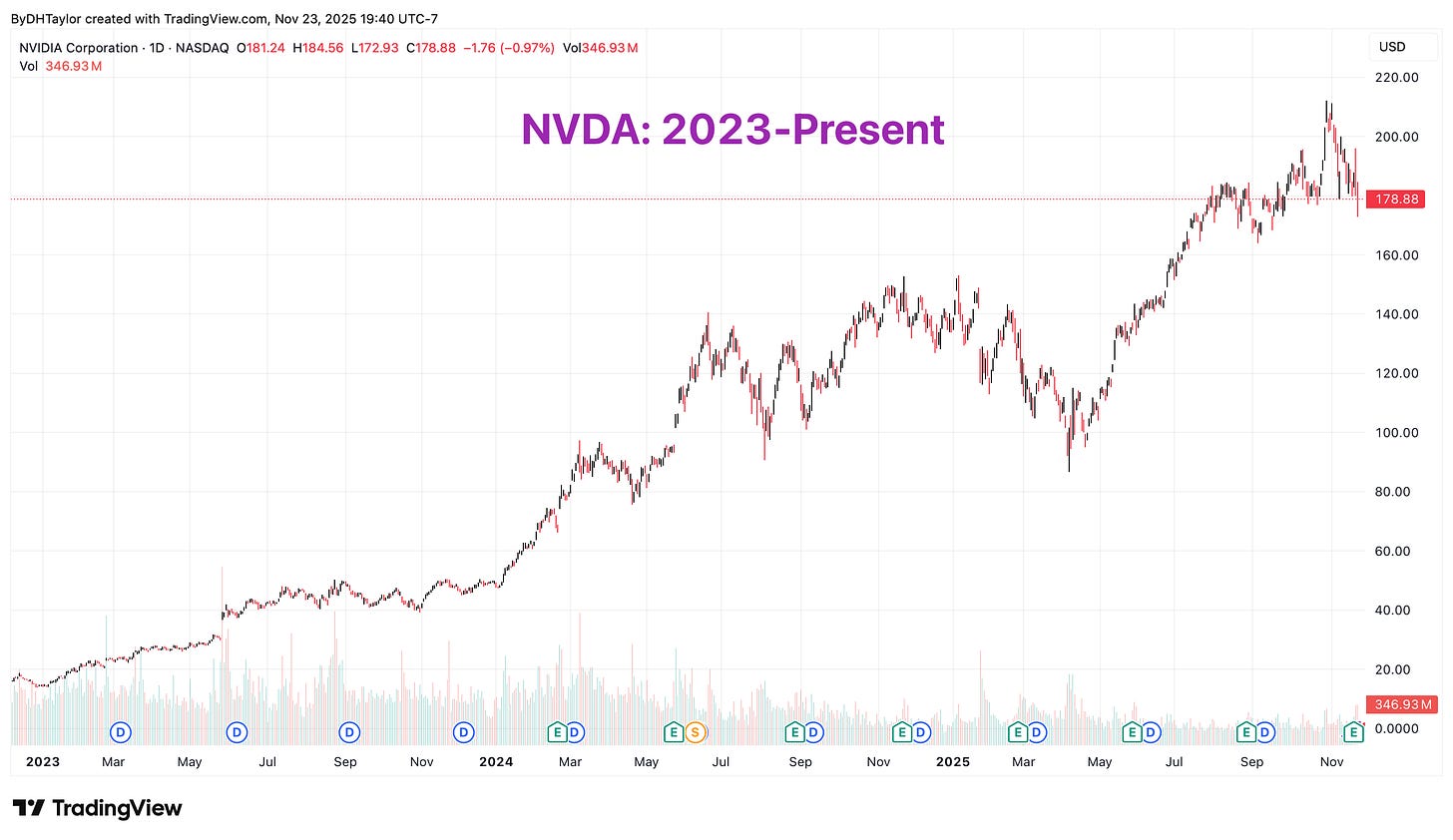

How much is NVDA stock worth? The stock has been on a tear since the AI revolution really kicked off in 2023. Nvidia is leading the charge as they are the main producers of the workhorse AI chips that power data centers.

The chart above shows the extraordinary move NVDA stock has done since 2023. In January of 2023, NVDA stock was just below $20.00. The most recent all-time high pushed above $200.00—a 10x move in two years’ time.

Some say the party is overdone. Fine. But ask yourself what is a proper valuation for the world’s most valuable company?

Plainly, future EPS for NVDA shares are set at $6.02. This is the current expectation of future earnings—it may very well move higher. What would you pay for that $6.02 EPS?

The comparative investment grade

All investments start with a comparison of the US 10-year Treasury yield which is currently just above the 4.06%. If you give the United States money to pay for its debt, the US will give you about 4.06% per year over the next 10 years, which at a $100.00 lent is $4.06 every year for the following 10 years. This is considered the best investment grade there is, and this is what I use to compare all investments versus.

Given that, the ‘forward’ price of the 4.06% is 24.63x.

The future earnings on NVDA over the next four quarters is $6.02. NVDA stock is currently trading at $180.00. This is a forward P/E ratio of 29.09x. This is just slightly above the investment grade of the US 10-year Treasury.

An investment in NVDA yields a higher return than the US 10-year note. But there are more variables at play, and that always needs to be taken into consideration. One of those variables is that the AU trade may in fact be a bubble that could burst. The other variable is that Nvidia could see even higher increases in revenue and EPS returns—an investor needs to balance these concerns.

A Bottom-Up Look

My thinking has been consistent with where Nvidia and the AI trade are right now in that this is not a bubble looking at only NVDA. The demand is there, and it continues to be off the chart.

At a 29.9x future earnings, NVDA is still within a reasonable valuation. With increasing revenue, the price should shift accordingly.

Notwithstanding this, there are other variables to consider.

The Other AI Trade

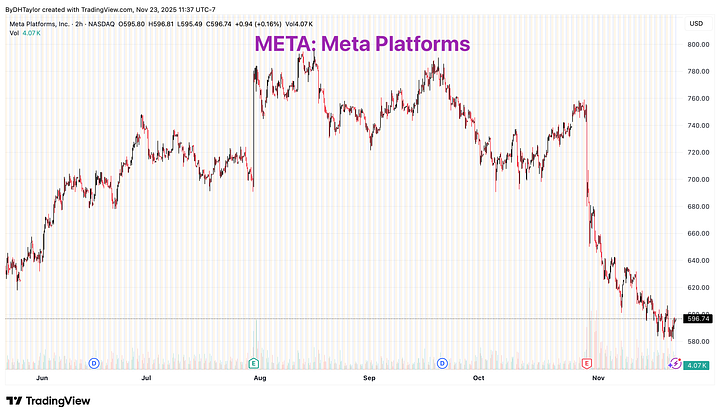

The biggest of the other AI trade stocks above are Microsoft, Amazon, Meta, & Google. Each of these are investing heavily in AI data centers with Microsoft leading the spend.

But these companies may be the real root of the AI bubble selloff scare. Are these individual companies earning a requisite return on their respective investments?

Looking from a bottom up angle, there are continued increases in earnings from these companies, but it may not be enough to sustain their individual stock valuations. This may be a better way to look to see if there is a potential bubble burst—I will do an individual company analysis on these players to break down where they are.

My Take

The numbers we keep seeing are eye-popping with how much is still left to spend on the AI infrastructure buildup. CEO Jensen Huang had addressed the so-called ‘bubble’ issues and made it clear that Nvidia is seeing something completely different. Nvidia is backlogged. Demand for its chips is still very robust and will continue to be for some time.

There are concerns of the turnover rate on chips, however. The average of how long these chips lasts is ~2 years’ time (between 1-3 years). Companies building up their data centers will need to swap out initially acquired chips for newer, better chips in about 2 years’ time.

There are no hard data points to reference regarding to how much capacity is currently being used. It is believed that 50% is about the current rate. This means that while demand for AI chips is still high, the rollover rate may not be as high as thought.

This may be why some bigger players are selling out NVDA positions, and in the case of Michael Burry of Big Short fame, taking a short position on the company (I think he is early and wrong).

Several of the bigger companies above are missing their returns, and their respective stocks have sold.

The Other Economy

While NVDA stock, et. al, have outpaced the broader stock market because of the AI buildup, Artificial Intelligence is not the entire economy. The consumer still drives some 70% of the US economy. That has been hobbled by tariffs. Fortunately, the tariffs will more likely than not be struck down by the United States Supreme Court. That would mean the ‘other’ economy could reignite itself.

This, too, could very well prop the economy up further moving forward.

I am looking for continued growth in the AI trade, albeit there may be some concerns along the way. Also, and equally important are tariffs that likely will be struck down, and then the other portion of the economy can begin to expand further. I still see more upside in this economy.