Bank Earnings Impress, Stocks Do Not

We are in the beginnings of the earning season, and bank stocks have come in hot, the stocks have not - What to know

With this earnings season just starting, bank stocks have been reporting better-than-expected results. Revenue and profits are improving, and Net Interest Margins (NIM) are widening suggesting a strong finish for the year.

However, there are concerns with the overall health of the economy and the banking sector. There have been two strong warnings so far in the past two weeks; there could be more profits ahead, but the possibility of a bank meltdown is also on the horizon.

Bad loans may hit banks soon, and this could cause a selloff in bank stocks. While many banks have been getting ready for these potential loan losses, if the economy were to falter significantly, the planning could be for nothing. Still, there is a lot of hope the economy does not slip into recession, and with that, bank stocks could maintain higher valuations.

That’s a lot of talking with two hands.

Winners & Losers

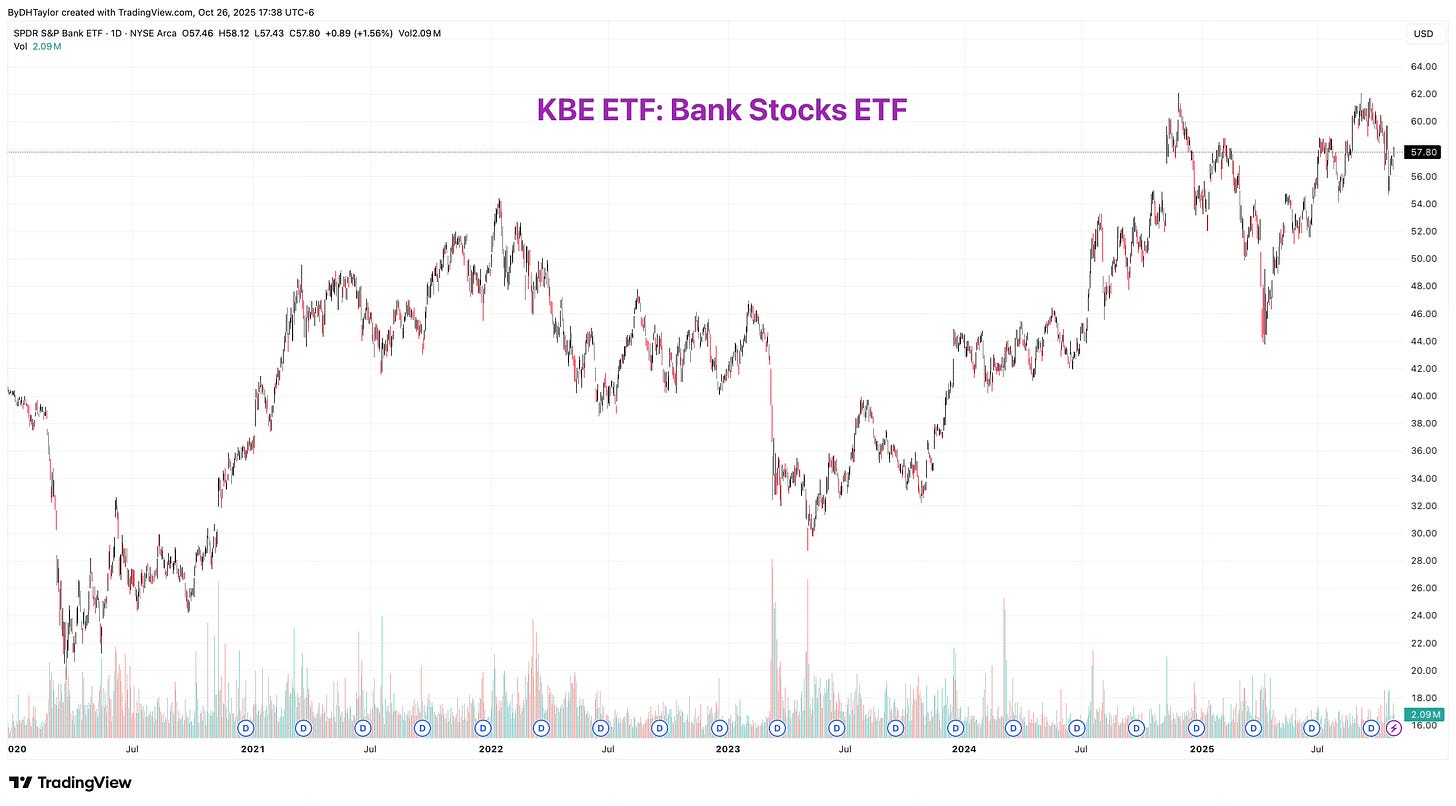

Within the KBE ETF, the bank stocks ETF, which holds some of the bigger-name banks, the results show strong earnings and revenue growth. Of the top 15 stocks within the ETF, 13 have reported so far, with only one missing EPS expectations and two misses on revenue:

EBT Stock: Eastern Bankshares

EPS Expected/Reported - $0.398 / $0.35

Revenue Expected/Reported - $245.93M / $241M

FBK Stock: FB Financial

EPS Expected/Reported - $0.96 / $1.07

Revenue Expected/Reported - $167.75M / $173.8M

PFSI Stock: PennyMac financial

EPS Expected/Reported - $2.70 / $3.37

Revenue Expected/Reported - $591.24M / $632.9M

JPM Stock: JP Morgan

EPS Expected/Reported - $4.846 / $5.07

Revenue Expected/Reported - $45.47B / $46.43

NTRS Stock: Northern Trust

EPS Expected/Reported - $2.259 / $2.29

Revenue Expected/Reported - $2.03B / $2.03B

BK Stock: Bank of New York Mellon

EPS Expected/Reported - $1.764 / $1.88

Revenue Expected/Reported - $4.97B / $5.07B

CFG Stock: Citizens Financial Group

EPS Expected/Reported - $1.028 / $1.05

Revenue Expected/Reported - $2.1B / $2.12B

C Stock: Citigroup

EPS Expected/Reported - $1.729 / $1.86

Revenue Expected/Reported - $21.09B / $222.09B

BAC Stock: Bank of America

EPS Expected/Reported - $0.952 / $1.06

Revenue Expected/Reported - $27.52 / $28.09

TFC Stock: Truist Financial

EPS Expected/Reported - $0.992 / $1.04

Revenue Expected/Reported - $5.19B / $5.24B

BOKF Stock: BOK Financial

EPS Expected/Reported - $2.171 / $2.22

Revenue Expected/Reported - $540.38M / $542.08M

WFC Stock: Wells Fargo

EPS Expected/Reported - $1.547 / $1.66

Revenue Expected/Reported - $21.15B / $21.44B

CADE Stock: Cadence Financial

EPS Expected/Reported - $0.703 / $0.67

Revenue Expected/Reported - $523.34M / $517.24M

I broke out the most recent earnings reports for the top 15 stocks that trade within the biggest bank ETF (2 have yet to report, they are not listed here just yet). So far, one miss on EPS and two misses on revenue. Otherwise, the numbers have been impressive, and likely to continue.

That being said, bank stocks have seen a jolt higher, but overall the banking ETF is down. Revenues and profits are one thing, but it is the debt tsunami that we’ve been hearing about for so long that is showing up on balance sheets.

To start, understanding the revenue and profits is key with banks.

Net Interest Margins (NIM)

Understanding bank stocks is slightly different than other, more traditional stocks. While banks have many sources of income, such as fees, one of the best ways to understand the profitability of a bank is to know their Net Interest Margin.

Net interest Margin is the difference between the growth rate of revenue less the growth rate of non-operating costs. If revenue is growing fast, but non-operating costs are growing at a slower pace, this suggests a bank is ‘efficient’ at deploying its capital. If a bank can acquire funds for savings from depositors, then lend out these funds at a higher rate, this is a way to bring in revenue. If that bank also keeps non-traditional costs low, such as technology investments, compensation, and other non-interest expenses, then a bank is being efficient.

So far, banks have been able to mostly increase their revenues with higher loans while keeping their payouts lower - the mathematical sum that gives us NIM. I expect that this will actually widen to some degree given the Federal Reserve’s position, and the overall economic outlook.

The Yield Curve

The yield curve is a great place to start when you want to know how well banks may be doing versus previous periods. In this chart above, I have pulled out the yield curve from January 1st versus the present.

The spread from the 1-month then to now is down some 34 basis points. In contrast, the longer-dated spread is down only 20 basis points. What that tells us is that on shorter-term deposits, banks would be paying less in interest on a relative basis. However, banks are lending out at a higher basis level. This differentiation leads to lower costs versus higher revenues.

The yield curve will be crucial in determining what is next for banks. If the yield curve remains relatively lower - or falling more - on the short end, but the long end remains higher, banks will perform well… all else equals.

The Fed’s Next Moves

The Federal Reserve is likely to lower interest rates at its next meeting. Inflation numbers, the ones we are getting, are showing increasing price pressures, but not at a blistering pace relative to what one would expect with the tariffs.

However, employment is slipping. The wear and tear of tariffs is slow… for now. Over the longer period of time, this will not be the case. Prices will continue higher as pass-through inflation kicks in, which will erode the consumer’s ability to keep up, leading to slower revenues for firms.

The Federal Reserve will have to weigh both the employment situation as well as price pressures, which are pulling in different directions. I do not believe that the Fed is a given that interest rates will continue lower and lower.

What’s The Big Deal?

You can see the big drop in ZION stock above. This came from a major write-off that Zions Bancorp announced along with its earnings. The real estate industry for office properties is taxed and has been so for some time. Due to COVID, offices have vacated. Those rents are no longer paying for the mortgages of these office buildings, and because of that, mortgage defaults on offices are increasing.

Zions Bancorp just wrote off a $50M loan. This is what is spooking the market at this point. There will be far more coming. But that massive wave has time, and because of that, banks are setting aside funds, readjusting their portfolios, and taking advantage of the time variable allotted them.

Zions has served as a reminder of what is potentially going to show up.

My Take

Some bank stocks have done very well, and have soared from their most recent reports. JPM Stock, JP Morgan, has continued up through the past few years. The bigger banks have performed overall well, and look to continue to do so. If the spread differential widens further, this will enable the bigger banks to take advantage of friendlier terms.

The Federal Reserve will more likely than not lower interest rates in the coming meeting. However, moving forward, it is far trickier to tell without adequate economic data.

Eventually, price pressures and lower revenue growth for firms will weigh on the economy, and that may start to show up during the first part of the coming year… if we get data. While the Fed can alleviate some of the pain being caused by the tariffs, there are limitations to how much they can do.

For now, the stock market continues its upward, unabated push driven by the AI trade, which has seen a renewed resurgence. We do not have key economic data, and this is hampering any real analysis.

That being said, M2 Money Supply report comes out in just a few hours. This, ultimately, is the best gauge of future economic activity. In the meantime, I am going to be focusing more and more on individual sectors, breaking down the bigger stocks in order to get a feel for what the economy is doing, and by extension, the stock market.