Big Potential For A Sluggish Economy - The Missing Piece

Data is showing that the economy is below median, but I continue to look beyond the current state to the tariffs getting struck down.

We are starting to see economic data trickle back in after the shutdown. The economic picture remains consistent. The tariffs are having the effect of restricting economic activity. This is reducing both economic output and having a downward push on employment. Although I see cracks appearing because of the tariffs, I also see these cracks being short-lived.

That being said, I fully expect the tariffs to be struck down. The Supreme Court is considering this right now, and they appeared dubious of the constitutionality of a president imposing widespread tariffs unilaterally. This is especially true given that the law in question never even mentioned the word tariffs. Further, all taxation is constitutionally supposed to originate in the House of Representatives—there is no delegation-clause.

Read: I fully believe the tariffs will be struck down and am gearing up for this to occur. Once that happens, then it is a matter of what economic foundation we are standing on, and what a post-tariff economy could look like.

Our economy is primarily a consumer-driven economy. Because of this, I always look at the money supply first, then move to both personal income and personal consumption, as well as consumer sentiment. Understanding where the consumer is right now will give clues as to what is possible for the post-tariff economy.

Mostly, I see an economy that has seen its potential slightly handicapped, and once the tariffs are removed, there will be a large amount of investment and expenditures in the future. That’s the good news, of course.

I also see increased inflation along with this economic growth. While some inflation is an essential part of any economy, there may be heightened price pressures. The tariffs will immediately reduce prices for direct-to-consumer goods from overseas producers. Those price declines will happen immediately. Eventually, however, I see costs going right back upward because of the removal of the tariffs—there will be a massive hole in the budget without the tariffs, and long-ned interest rates are already moving higher.

Personal Incomes & Personal Expenditures

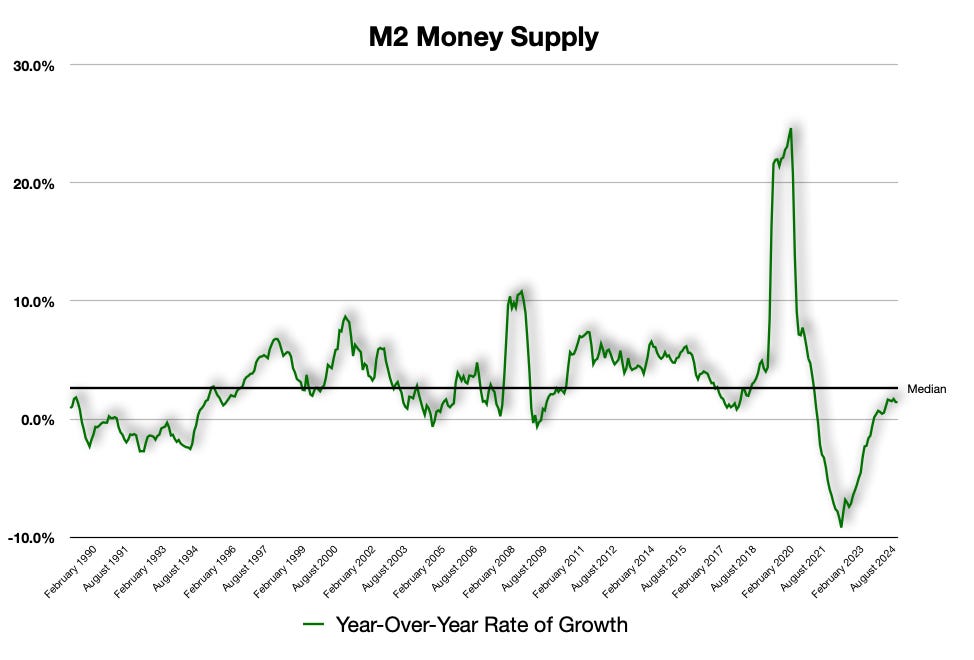

The first chart above is the rate of growth of the money supply. In a fractional-banking economic structure, money is the driver of all things. If you want to know what will happen in an economy, or the respective stock market, looking at the economic growth rate is the first place.

The money supply has grown, but at a pace that is just below median. That feels like what is occurring with the economy, that we are seeing inflation (see below), and that economic growth doesn’t necessarily feel like it is moving at a pace it could.

When you consider the fractional-banking aspects of our economy, the pace of growth of the money supply tells us how much in terms of loans are being made, which expands the money supply. For example, if businesses believe there is a continued possibility of profitability, and if they also believed that taking on new loans would not only be paid for, but be a profitable venture, business in a purely competitive landscape will expand to grab further market share. That expansion means building new infrastructure for the respective business, and the pace of this shows up in the money supply.

The money supply itself has grown to 1.42%, down slightly from the most recent peak of 1.70%. For reference, the median growth rate is just over 2.00%. That means not only has the money supply growth rate failed to achieve a median level, it has hit its most recent peak and started to fall further. But there are two things that will flip this:

Current interest rate decreases via the Federal Reserve’s recent move; and,

The removal of the tariffs.

Equally, when business expand, they typically hire. In an economy that is more than 70% consumer driven, the tariffs are reducing the consumer’s capability of full expenditures of their disposable income because the tariffs are taxing a chunk of that capacity.

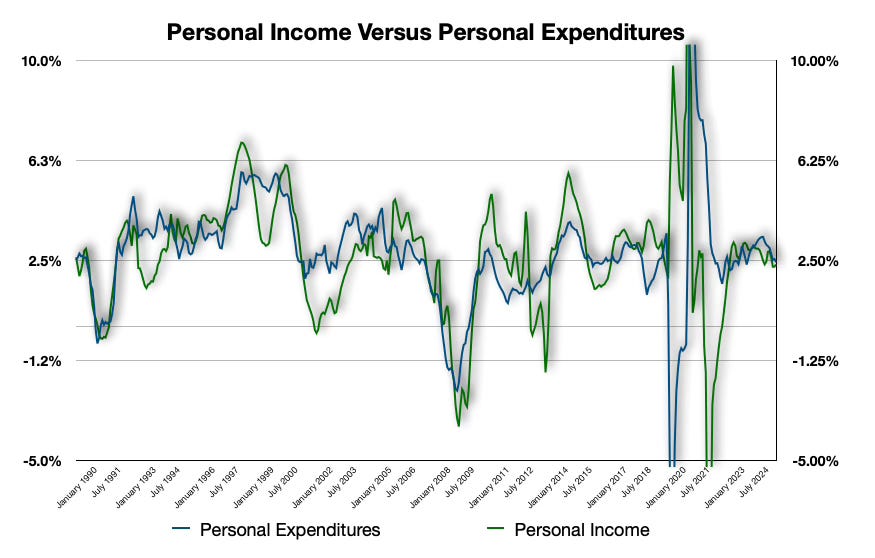

Just after I look at the money supply growth rate, I also look to the growth rate of personal incomes and then personal expenditures, which the chart above shows a strong correlation.

Incomes drive consumption. If there is a growing pace of income, driven by more and more individuals being hired as well as currently employed individuals seeing pay increases, that pace then drives consumption.

While not a perfect science—economics never is—the correlation is very strong. Just as the money supply is showing, both incomes and consumption have expanded, but fallen short of median growth rates.

With the Federal Reserve having just dropped interest rates, this will help consumers with expenses as rates paid to credit cards as well as loans for housing and vehicles will move lower. In aggregate, this helps.

But it will be the tariffs that have the biggest effect on reducing price pressures, which will help drive consumer expenditures. Right now, the tariff tax is reducing finite incomes from their full consumption capability. Take the tax away, and there is more available disposable income. Decrease the interest rate being charged for financing, even more potential is unleashed for the consumer, which will drive expenditures, which will drive businesses to take on additional future expansionary possibilities.

Once the tariffs are gone, the consumer side of this economy will expand rapidly. I am positioning myself for this. But, there will be consequences.

Inflation

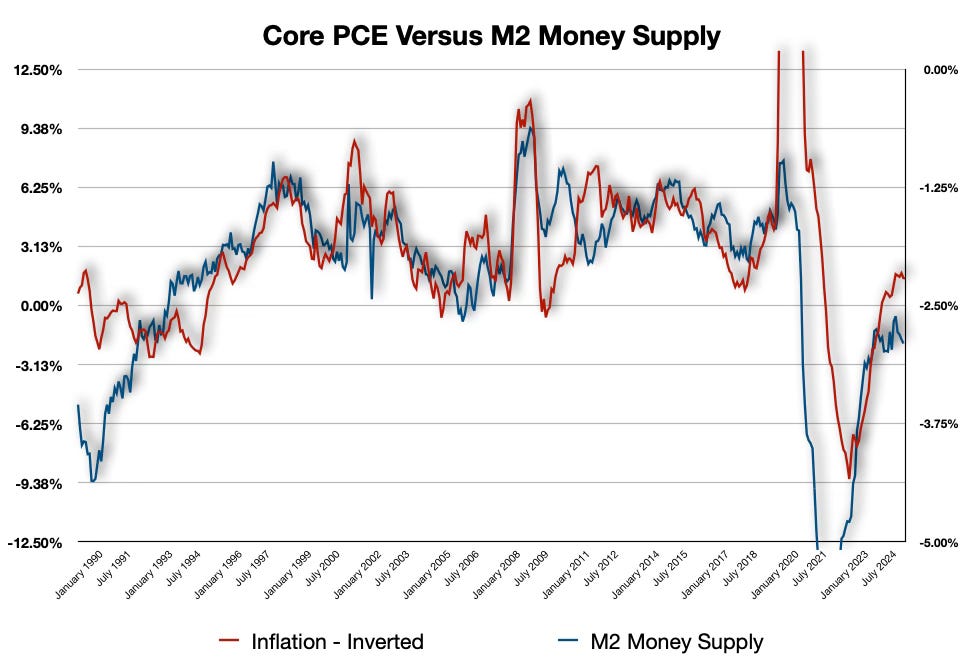

The above chart compares the money supply growth rate with the inflation rate. I say this often: Inflation is a purely monetary phenomenon. If the pace of the money supply expands or contracts, inflationary pressures do the same in a highly-correlated relationship.

The Fed has just reduced its target rate for overnight lending, and banks will follow suit for their lending products. The reduction of the overnight rate is correlated to the increase in the money supply because the cost of borrowing money is less expensive, and therefore there will be higher demand—all else equals.

But it is the tariff tax that will be the ultimate consumer-reliever that I believe will have the bigger effect on the consumer economy.

That drive from consumer expenditures is both a push and pull on price pressures. The money supply will expand because of the reduction of interest rates via the Fed’s moves. But the increased demand from consumers will mean consumers will have a greater amount of their disposable income for purchasing products that had previously seen price hikes because of the tariffs. That, too, will drive price pressures up.

While the tariffs being removed will reduce their import costs, demand will push these prices right back upward.

Prices on goods directly imported will drop immediately at the register. But intermediate goods imported, which then work into a broader price for a finished good—think each individual part to a car—will take time to push the price down on vehicle purchases.

It may be highly likely that the Federal Reserve reverses its position shortly after the tariffs are removed because of price pressures moving right back up. There will be turbulence in pricing over any period of time until new equilibrium pricing levels are discovered from secondary inflation.

Sentiment versus Expenditures

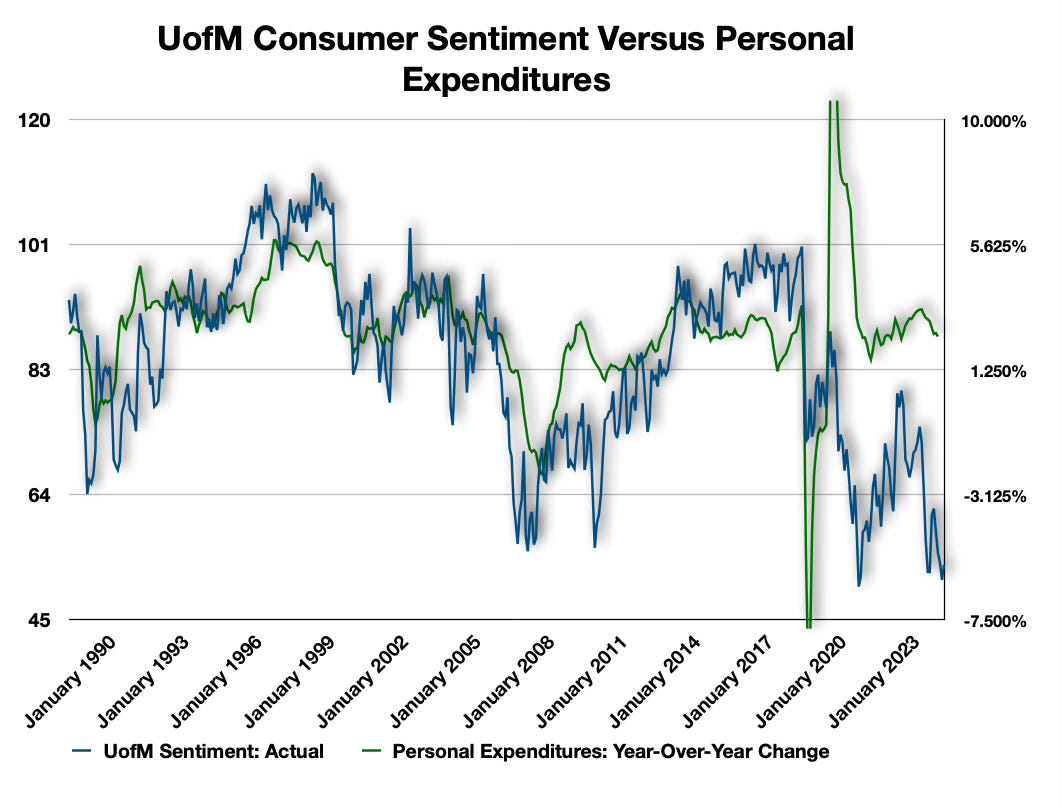

Another key chart I follow is consumer sentiment versus consumer expenditures, which looking at the chart above shows that consumer sentiment is just above the all-time low from the COVID shutdowns. Consumers are beholden to their overall confidence level in the future when they consider long-term, bigger purchases such as a vehicle.

The two factors that are driving such low sentiment:

Government shutdown

Tariffs and overall affordability

The government shutdown has ended… for now—the current resolution is set to expire on January 31st, which the Republicans have promised Democrats they would address healthcare related tax credit extensions for the next resolution. I have almost zero faith in Republicans keeping that promise… let’s see. Given that, it is not too far out of the realm of possibilities that the Republicans allow the government to shut back down when the Dems don’t submit. Then again, Republicans are feeling the pain in what will be an election year where there are record numbers of individuals not re-upping for reelection… let’s see.

The other factor that had driven confidence to near all-time lows is affordability, and consumers have placed the blame squarely on the tariffs which has driven prices upward. If the Supreme Court does, in fact, strike down the tariffs, then there is a significant chance that there will be a newfound boost in confidence for consumers, which that will drive expenditures… which that will drive business who have been wary of taking on new investment projects because of uncertainty of the future.

I see consumer sentiment moving back up rapidly in a post-tariff economic landscape.

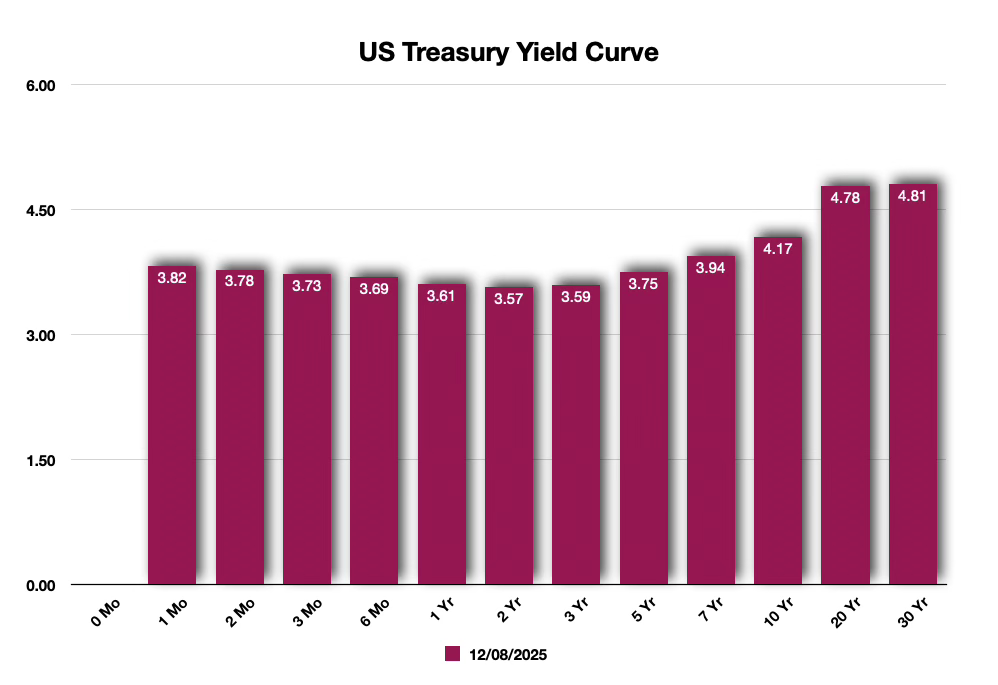

Interest Rates

But… hold up a sec: longterm interest rates have steadily climbed back upward. The Federal Reserve has just lowered interest rates (yesterday, in fact) and long term interest rates such as the 10-year, 20-year, and 30-year Treasury yields have all move back upward despite the lowering of interest rates.

What gives?

The tariffs were a tax transference from higher taxation rates of upper-income earners down to all consumers via a consumption tax, which disproportionately favors the wealthier versus the lower income brackets. If you take away the tariffs, there will be a very large hole in the budget creating a larger deficit.

Investors are loath to lend money to the government without due compensation; they are demanding higher interest for the money lent to the government. The markets are considered the world’s greatest discounter of information, and they always get ahead of the reality of the landscape. Investors believe the tariffs will go in the dust bin, and so will the government’s finances.

Higher interest rates will be the norm with a large deficit. But, so will inflationary pressures both because of the removal of the tariffs and the effects of the removal of the tariffs.

My Take

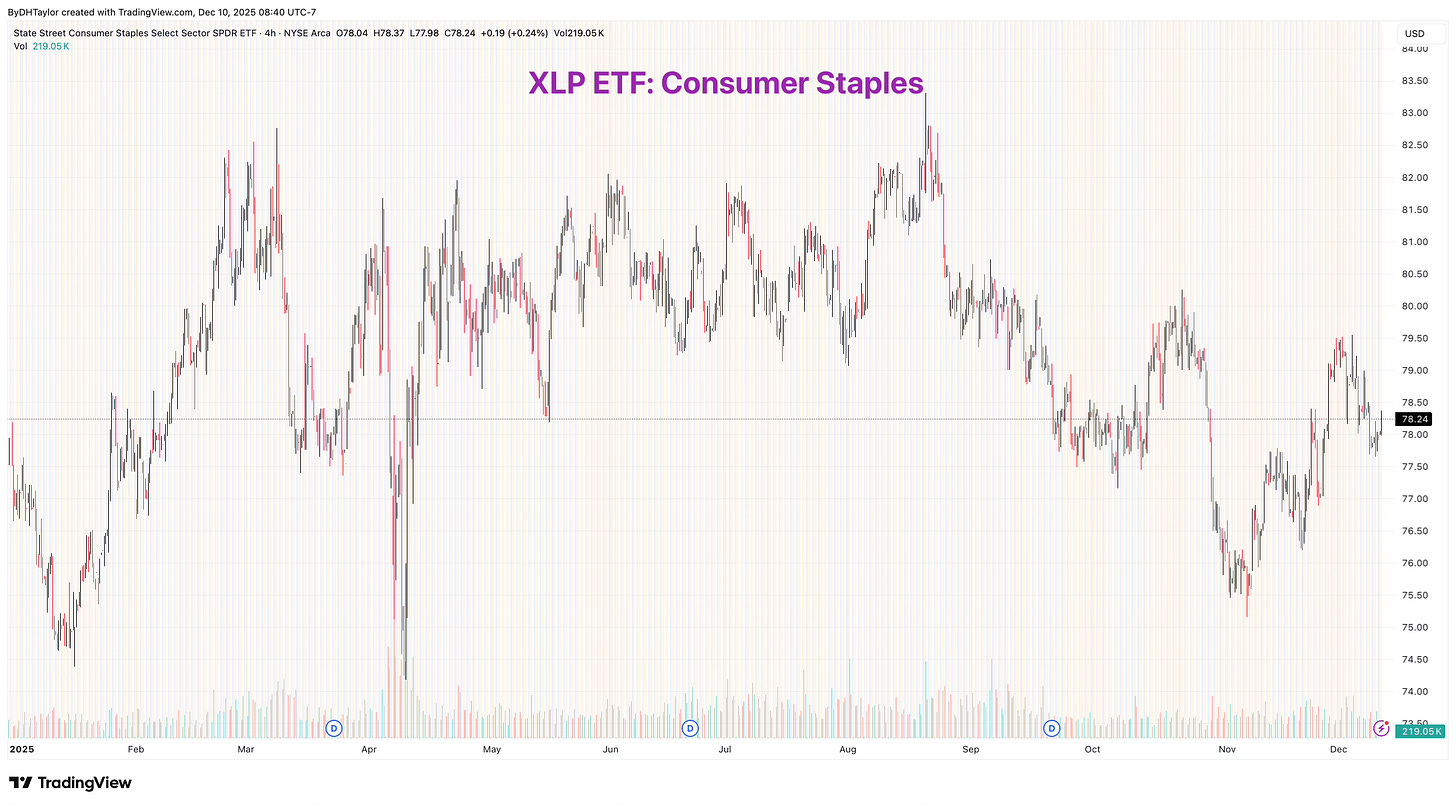

I see consumer stocks moving back upward. Above, XPL ETF is the consumer staples sector of the S&P 500, which as you can see, has been flat for the year. Keep in mind, the tech sector, specifically the AI-driven stocks, have pushed the S&P 500 up to all-time highs for the past two years continuously. This has left the economy “feeling” like it is K-shaped in the sense that the AI boom has generated a massive surge in infrastructure buildup as well as minting millionaires in their 401(k)s. But the consumer economy has felt like it was left at the train station.

There’s likely a second train coming, and that one will pick up the consumer sector of the economy. However, ticket prices are likely to have “additional fees” in the sense that there is going to be higher inflation because of higher interest rates, which could wear on employment.

I am still holding onto my long TBT ETF position, and have done so for several months after exiting my long TLT ETF position in April when it spiked higher. What I have been doing in the meantime is selling options against TLT ETF, typically call vertical spreads, and bringing in option premium. While my positions and profits aren’t going to fall short of my buying me a mega-mansion, the strategy has brought in consistent profits over the course of this trade. It was not exciting trading, of course, but profits don’t have to be.

I see the government’s finances looking bleak because of the tariffs being struck down. Because of that, I see continued longterm interest rates at higher levels, higher than they currently are. I also see my TBT position moving to larger level of profitability.

While there are possibilities for consumer stocks to move higher, this will happen with increased inflation because of the tariffs being struck down, and the budget deficit this will create; it is a double-edged sword.

The AI Boom still has a lot of legs left in it, but some companies will fare better, and others will poach current success. Coupling that with increasing consumer expenditures, and the other portion of the so-called K-shaped economy will pick up steam.