Consumer Confidence Plummets—Stocks Will Soar

The consumer is feeling it, but the future is brighter. The shutdown will end, the tariffs will go away. AI will still lead. But inflation will push the stock market through the roof.

The University of Michigan Consumer Sentiment Index was released Friday, and the number was basically in the gutter. When you think about it, why wouldn’t it be? The tariffs, which have pushed consumer prices upwards are impacting families across the board; especially at the grocery store. Then there is the government shutdown, which is now the longest ever. This has impacted services, especially the government SNAP program; again, food.

Will a deal happen? Absolutely! The Senate just passed something that is headed to the House.

Then, there are the tariffs, which Justices appeared highly dubious of their constitutionality in last week’s hearing. More likely than not, the tariffs go away (I would expect results will be released within 2-6 months—the timing is difficult to decide as factors of how divided the court is, or who does the writing, are the real factors in how long it takes to get a decision).

Looking beyond these major factors are the best thing to do at this point. It is this, that I have been focusing on over the past few months. The tariffs will go away. Then, there will be a massive hole in the budget. The Federal Reserve will dilute that debt, and that means an infinite amount of inflation is coming. Prices of all assets will move higher and higher to include, stocks, gold, crypto, housing, and many other classes.

Keep an eye on the bond yields as that is what will be next to make its move.

If The Tariffs Are Shot Down

The tariffs are unconstitutional. They’ve been declared so by multiple courts, and it does not take a rocket science degree to think this through. When the question of the constitutionality of the tariffs hit the Supreme Court, the Justices were highly doubtful.

Think through the process of the tariffs being struck down from this point. First, consumers will get a break for everything they buy, especially food products. This will reaccelerate economic activity. This will help draw in business expansion with hiring all over again. The unemployment rate remains low at what economists currently think is ~4.5%—there’s no data! This is still considered full employment. If the consumer begins spending again at a growing rate on more and more products, this will push economic activity rapidly upward.

Keep in mind something I have said over and over again: Personal Incomes are a finite number. The tariffs are a tax. This taxation is a direct tax on consumption. This removes potential economic activity if the government taxes consumers; via their respective finite personal incomes. If the government shaves down that income level, there is less to spend in the consumer-driven economy. While it is true that the taxed income would be spent within the economy, it is done so at a less efficient rate.

Given all of this, with the tariffs more likely than not going away, the debt will need to be considered.

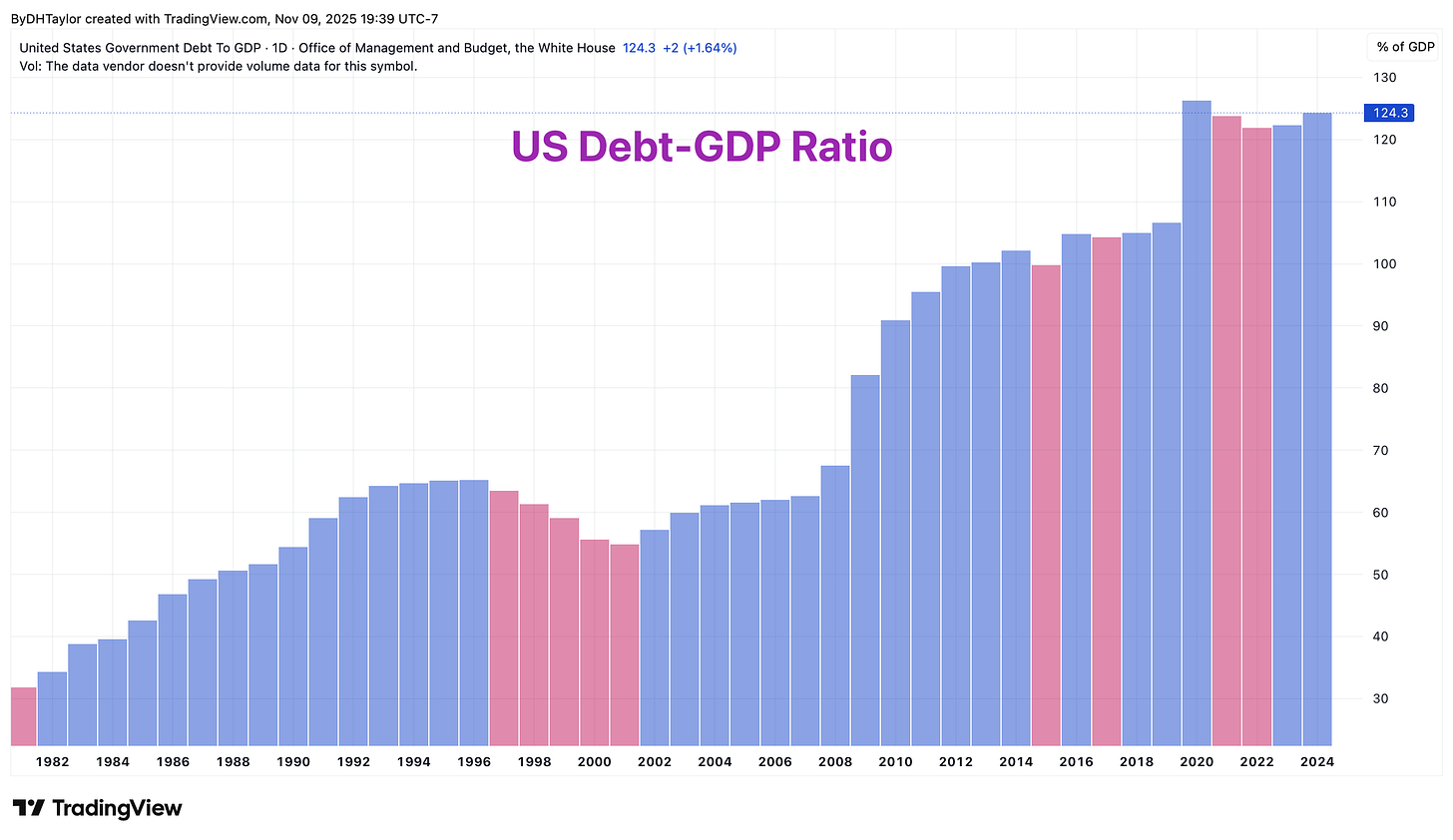

The US debt burden is widening, and removing a key taxation method is only going to make that far worse.

Debt-To-GDP Percentage Will Surge

I fully expect this chart above to expand further upward once the tariffs are struck down. There will be a penalty for that in the form of higher interest rates for US Treasuries.

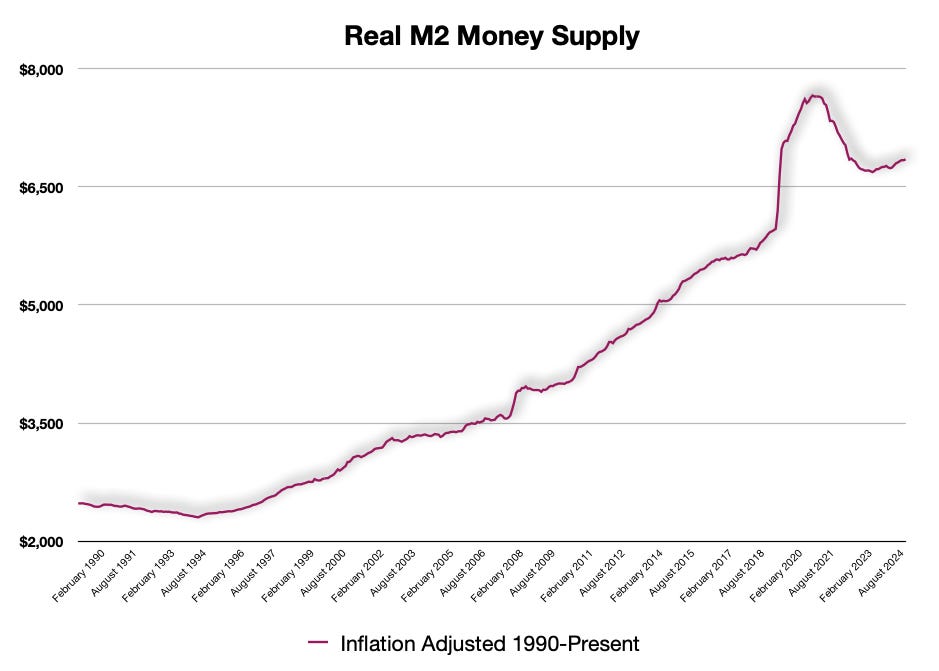

The Federal reserve will need to '“deflate” that debt, and by deflate, what I am really saying is there will be more and more inflation coming. With all of this debt, the money supply will expand—along with renewed economic activity.

What The Yield Curve Is Telling Us

The Federal Reserve has signaled that they are not necessarily going to lower rates at the December meeting. The yield curve is starting to move higher on the long end; this has started to move quickly over the following few days.

The Fed typically targets the short end of the curve, and although the shorter end has responded to the latest interest rate cut by the Fed, the long end is moving up.

The taxes being collected by the government from the tariffs will vanish. Those tax dollars were a key aspect of paying for the Big Beautiful Bill. Where will the funds to pay for the bill come from without the tariffs?

The Money Supply Will Expand

All of the debt that is being printed by the Federal government will require money. Funds from around the world will be brought in to pay for the debt. But US citizens, ultimately, are going to have to pay for that debt via taxes. In order to blunt that, the money supply will be expanded. By doing that, deflating the value of the debt, inflation will happen. All asset prices will increase in value. Prices across the board will move even higher. This is not necessarily a short-term effect as much as it is a longer-term move.

The AI Trade is Still Trading

The news on the Senate bill passage pushed the markets back up. This is one of the hurdles being cleared that really did not seem to bother the stock market much. I expect that this trend will continue as the world gears up for the AI economy.

While this is overall positive for the economy, the prices being paid by consumers is stretching them thin.

Consumer Staples Sector—the only sector in the negative

A good indicator as to how far the consumer is stretched, the only sector of the 11 sectors that is in the negative for the year is the consumer staples sector. Consumers have been stretched beyond reason, and the stocks within the consumer sector have not performed nearly as well as the AI-loaded stock—if only Coca Cola and Procter & Gamble can figure out how to produce AI versions of their products.

The reality is that AI is good for investment within the economy. But our economy is not AI, and is not functioning properly—it will likely get worse.

I will break down the consumer staples sector next week to show how detached this sector is becoming.