Employment Situation: Is this the beginning of the end?

Employment is slowing and investors are fretting that the Federal Reserve has waited too long to lower interest rates—are markets going to sell further?

Last week, economic data came in for employment. Non-farm payrolls printed a softer-than-expected number. Revisions were the big stand out for the print this month, however, with the previous months’ data being revised downward. This actually made this month’s number look more impressive than thought.

So, what does a softer-than-expected non-farm payrolls for the overall economy and the stock market? As it turns out, the real driver of economic growth, personal incomes, moved higher for the month. This says that although new jobs are not necessarily being created at a fast pace, there is still resiliency in the economy. If the income growth trend continues, this will eventually support the overall economy, resulting in a miss on the stock market’s fears that we could see a recession in the future.

In the meantime, however, jobs data is lagging. The next few months of prints could send shudders through the stock market. This could be a solid buying opportunity.

Employment: The Big Picture

There is no real growth in employment, as the above chart shows. The Civilian Labor Force is trending higher and higher as more and more individuals are considered actively involved in the labor force. But, there has not been any meaningful moves higher in those employed. Looking at non-farm payrolls, this is corroborated with a continued move sideways to the lower side of gains with non-farm payrolls.

Those not employed are considered unemployed. The math on this is that if those considered within the civilian labor force are not employed, on a percentage basis, they show up as unemployed, and that is why we continue to see this trend moving higher:

While the unemployment rate has moved somewhat higher over the past 4-6 months, the move upward has started from a near-record low. Unemployment is only printing 4.2% for the month of August. This is historically strong with regard to employment–the economy is a long way away from being in a downward spiral.

Personal Income Versus Personal Expenditures

For me, the main driver of the demand curve is personal incomes. Government expenditures can certainly play a part in expanding and contracting economic growth. But, government expenditures tends to be fairly consistent and growth rates relatively flat simply because of the entire bureaucratic process to make changes. At the same time, businesses also contribute to economic growth, but decisions to expand or contract enterprises is in direct response to supply and demand from consumers.

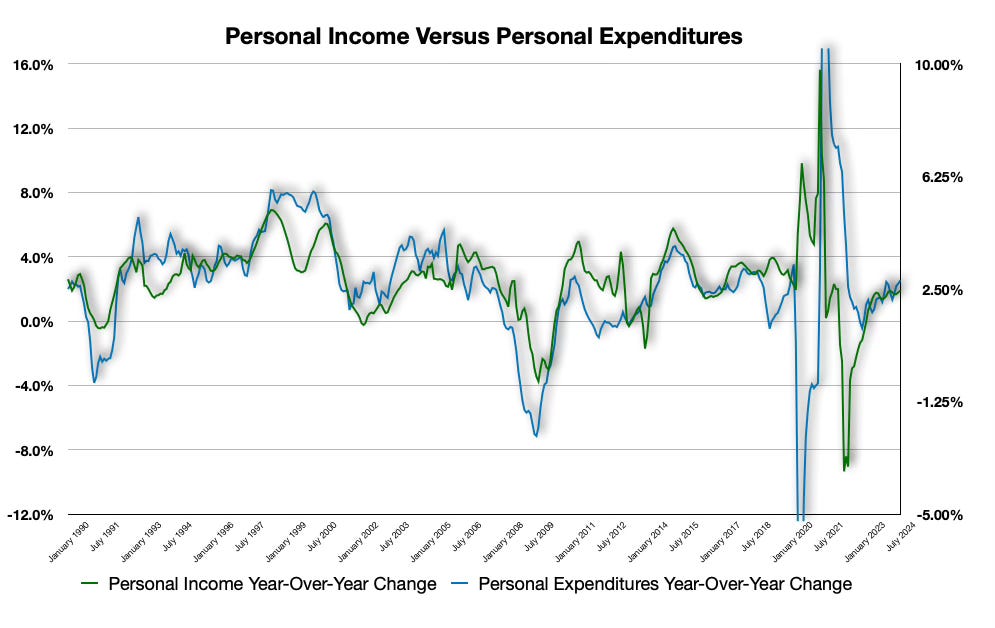

Therefore, keeping a sharp eye peeled toward the year-over-year growth rate of personal incomes would show what these consumers will do within the economy. The two overall drivers of personal incomes on a year-over-year basis is both the total number of employed within an economy as well as the income earned by those within the economy. And, the correlation between income growth, increasing or decreasing, is strong with expenditures as can be seen in the chart above.

Personal incomes and personal expenditures both increased for the month and are maintaining a relative upward bias at this point. This is important because if the Federal Reserve were to begin to lower interest rates, this will affect expenditures by freeing up finite income that would have gone toward interest income to being able to spend funds on other expenditures.

The upward move came as a bit of a surprise and this may help drive further economic growth in the near-term. Couple that with lower interest rates, and the Federal Reserve may have pulled off an easy landing.

The Market Reaction

The stock market was worried on Friday, but I believe that will be short lived. This week, inflation data will print with both CPI and PPI. Neither of these will likely be worrisome but, more than likely, reiterate that the Federal Reserve will probably lower interest rates. The only question will be by how much: 25 basis points or 50 basis points.

Bond yields are trending lower, and this is a result of the continued economic data showing that there is room for easing policy constraints by the Federal Reserve. But, I do not believe this will be a massive move quickly by the Federal Reserve, and therefore I also do not believe that interest rates are going to race back downward. The other variable in all of this, the warning flag, if you will, is mortgage rates. If the Federal Reserve were to loosen policy too rapidly, mortgage rates would fall quickly. This will merely reignite the housing market, which 70% of the inflation gains from the previous spike upward in inflation was driven by housing. This is now the balancing act the Federal Reserve must maintain.

My Take

I believe that the Federal Reserve has room to move interest rates lower. But, I do not believe that the Fed can do so at a rapid pace that would push interest rates downward by big numbers. The balancing that the Fed has to encompass will not be a direct pathway forward. At the same time, the Federal deficit is massive despite having employment at the level that it is. Moving interest rates lower would push the needle for growth and that could keep the Fed restrained. Mortgage rates moving lower too fast would be a problem for the Fed. The overall supply of federal debt via Treasury bond issuances is high and that supply will weigh on the market.

For now, I think employment numbers are going to continue to show weakness, but the increases in personal incomes and expenditures could help to propel the economy forward, along with lower interest rates. I still believe that we see some additional selling through the remainder of the year and into next year. I do not believe the market will get big moves lower in interest rates from the Federal Reserve that could perpetuate the stock market upward. I think the Fed has a lot of work ahead of itself, and this is going to be tricky to balance.