Gauging The Economic Heartbeat Without Economic Data

Without the jobs reports because of the shutdown, here is what to look at for jobs data

The government is shut down, of course, and because of this, we won’t be getting economic data. The all-too-crucial jobs data was due on Friday. Without this key economic data point, how do we know what the jobs data would have been?

First, jobs data is a lagging indicator. While stock market participants hyper-focus on this particular data point, personally, I have never even been a big fan of the non-farm payrolls data. This is because it is a survey of respondents, and it is always delayed, then revised when newer, better information comes in.

Mostly, however, the data lags. Businesses do not necessarily hire & fire in large quantities very quickly, but wait until continued information arrives. Once it becomes obvious that either the economy is moving forward rapidly, or is slowing fast, then businesses will make decisions. This is why jobs data are considered a lagging indicator.

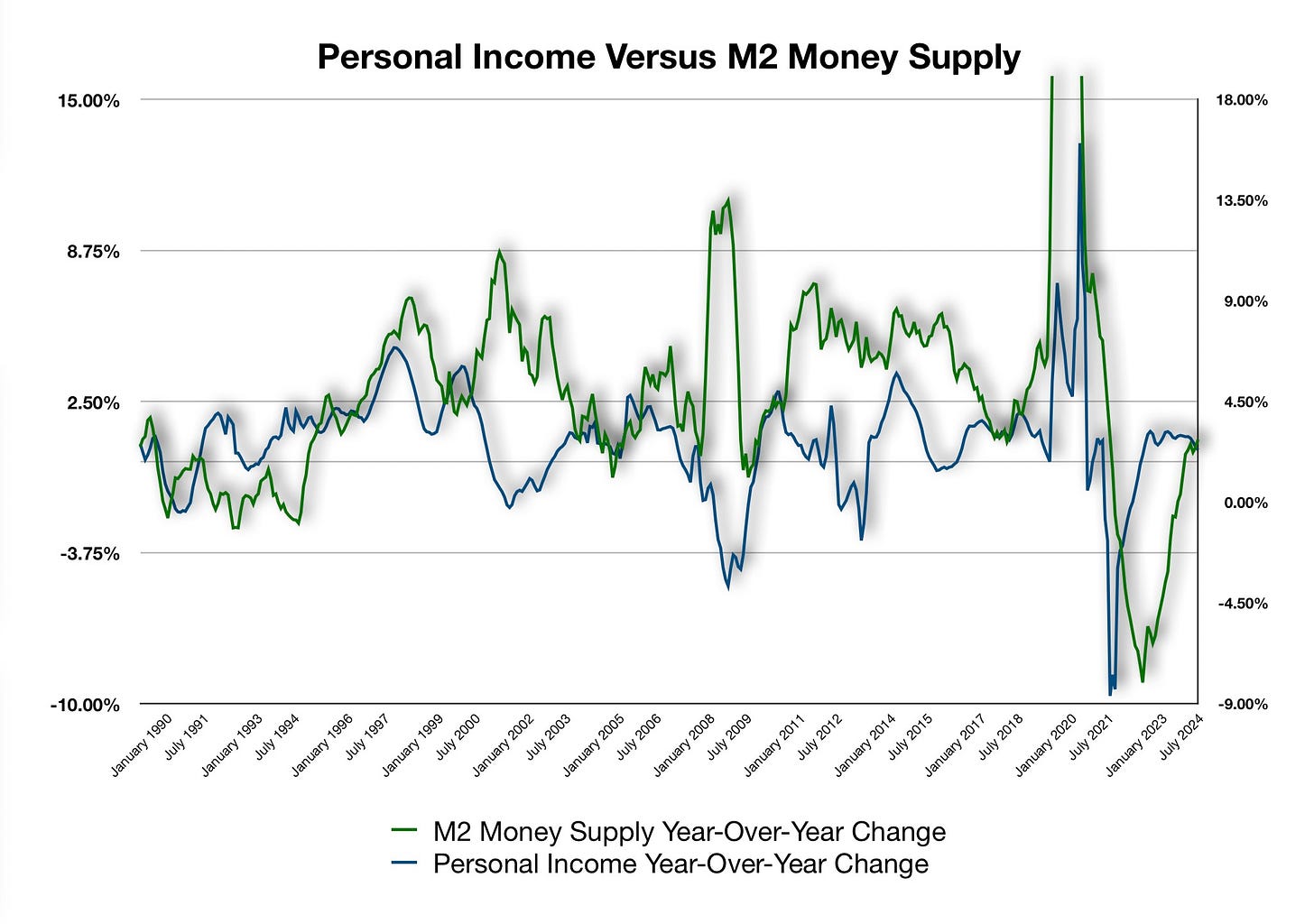

Instead, I always look to other data points such as the money supply and consumer incomes and expenditures. These two data points will push or pull jobs at a later point.

Still, jobs data tells a story, even if it does lag by other inputs.

Here are other key economic data points to watch to gauge the health of the economy.

Private Sector Data

In lieu of government data, we turn to private-sector data. There are a few data points that would give us a good look at what is happening.

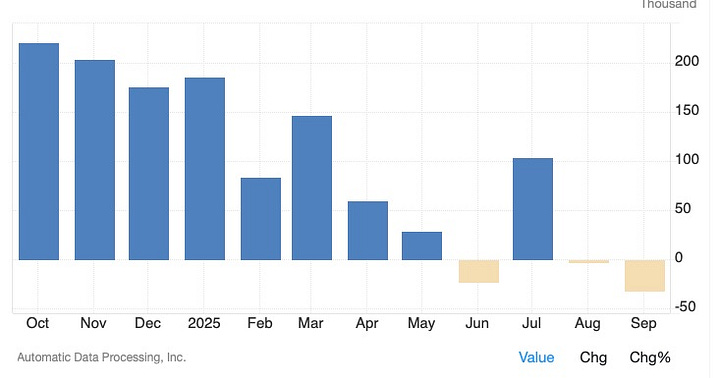

ADP - Automatic Data Processing

The ADP data is more focused on private-sector payrolls overall, and the data points show us how many individuals are added to payrolls. ADP, of course, is a data processing company, and they are the biggest paycheck processor in the United States; they get a good look at payroll additions and subtractions.

The latest figures are negative. While the non-farm payrolls data will show a more broad look overall, the correlation is not entirely the strongest. Still, this is valuable information.

Believe it or not, this is good news. If the economy is slowing down and we are beginning to see a drop in jobs creation, which we have been, then this gives the Federal Reserve more evidence to lower interest rates. This will help propel the stock market further.

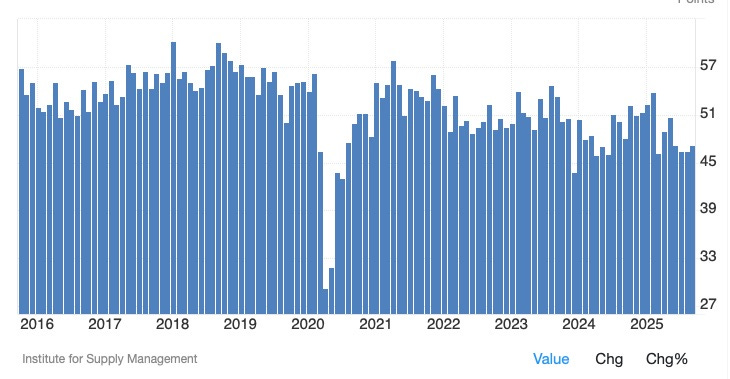

Institute of Supply Management

Over the past few months, ISM Services Employment has softened, reiterating the picture of a slowing jobs outlook. In this chart, anything over 50 is considered expansionary. The latest numbers are on the lower end historically, notwithstanding COVID.

Supply Management involves just that: managing supplies. This indicator tells us that there is continued slowing in this sector of the economy. But it is not an absolutely dire situation:

If you look at the Services PMI data, the number has been low for some time. This tells us that economic expansion is dwindling, but it sits very near the 50 mark, which anything above would be considered expansionary.

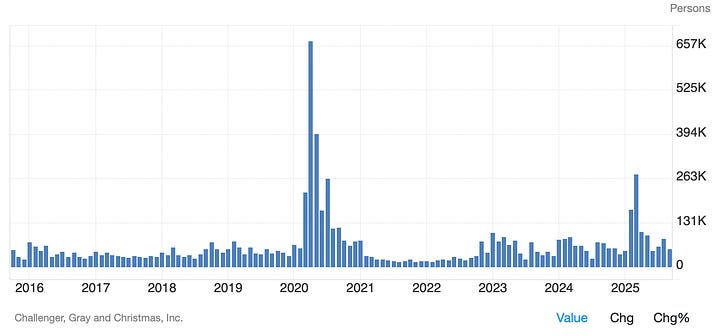

Challenger, Grey, & Christmas

The Challenger, Grey, Christmas report is the job cuts and job announcements for corporate America. There are seasonality sways here, but overall it is the same as other employment economic indicators in that it continues to move sideways at the lower end of recent ranges.

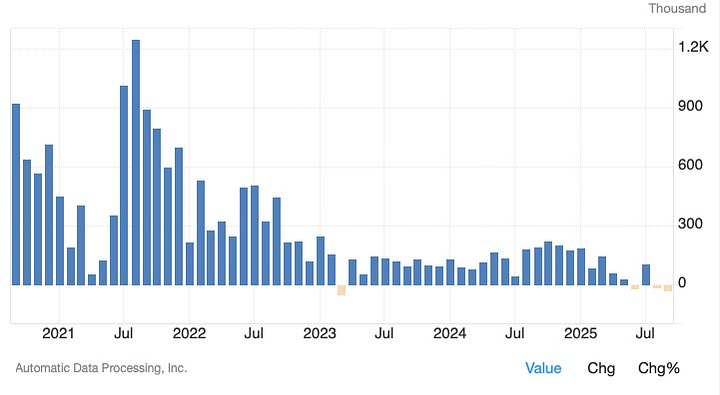

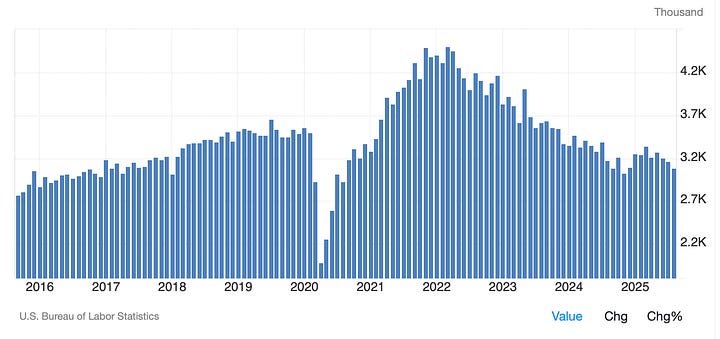

Federal Reserve Chicago Hiring Rate

The hiring rate is slowing, as can be seen here. There was a massive resurge of hiring after the COVID lockdowns. Then, the rate fell.

However, while the rate was continually sliding lower, the overall employment level was very high. The pace could not necessarily move much further seeing that the economy had an unemployment rate of some 3.4% at one point. The context of that helps to better understand the continually diminishing level: there simply wasn’t any real slack to pick up with hiring.

This coincides with the ADP number above in that additional hirings are not happening at a rapid pace, which, after all, the unemployment level is sitting at 4.4%.

JOLTs Job Openings & Quit Rate

Janet Yellen, the former Federal Reserve Chairman, popularized JOLTs. This is the job opening & quit rate. The opening shows us firms capability of adding new employees to their payrolls. The quit rate tells us just that, the rate at which employees quit on their own. Presumptively, this tells us that

Job openings still remain high on a historical basis, but the quit rate is nearing its median level during a normalized economic landscape. This tells us that there are still jobs available, but anyone who does have a job is not quitting at a commensurate rate.

From here, we can tell a great deal about the jobs landscape. It remains consistent for now.

University of Michigan Consumer Sentiment v Personal Expenditures

Consumption and confidence go hand-in-hand. If consumers are feeling confident, it is likely driven by their perception of the future economic outlook. If consumers are feeling confident, they will consume. This drives the consumer-driven economy which is some 70% of the US economy.

Unfortunately, the consumer is not feeling it so much right now. But if the Federal Reserve continues with its interest rate lowering policies, this will help alleviate a lot of costs being felt by the consumer from tariffs, and this could spur future economic expansion from consumers spending. At the same time, businesses will respond and take on more projects. The combination expands the money supply, which both pushes and pulls the economy forward.

This indicator, too, shows that while there are some declines overall, we are not heading to zero, nor negative, just yet.

Eventually, and fortunately, the tariffs will go away.

The Key Takeaway

The data does not, yet, support a recession or an overall economic decline. Yet. Employment remains solid for now, but strains will begin to show up.

Tariffs are a tax. While Trump continues to state that the government is bringing in a significant amount of money Fia the tariffs, he states that it is countries on the other end that are doing so. Nothing could be further from the truth, and all in the United States are getting that lesson at every register in America.

Incomes are finite. Americans pay the tariffs. Since each individual’s income is limited, what is being taxed cannot be used to consumer other products or services.

Economics is zero-sum. If American consumers are paying taxes, from a zero-sum perspective, businesses overall are going to see less revenue as the government drains consumer’s potential via that taxation.

While economists believe that the tariffs will lower economic output, so far the economy remains lofty and supportive despite the tariffs. However, this ultimately will drain the economy of long term economic potential; growth increases will suffer.

Two things should be kept in mind:

First, there is sufficient strength and stability in the economy to weather the downside risks of slower economic growth and still remain in the positive… for now.

The second thing is that I believe the Supreme Court will rule the tariffs unconstitutional. While there will have been economic damage done by then, overall the economy will then be able to rebound. If you think that through, almost immediately consumers will see a purchasing power increase because of the drop in prices. Keep in mind, countries like China are selling their goods at the same prices to the United States as well as to everyone else on planet earth. Once the tariffs are lifted, that tax goes away immediately. That would mean more disposable income for consumers, which will drive an economic expansion.

However, the downside of that will then be the massive hole in the deficit once the federal government stops bringing in all of that tariff revenue from US consumers. Interest rates will shoot upward sharply as the Treasury has to finance a massive fiscal hole. That, will offset some gains in consumption with higher long-term interest rates.

That is an entirely different post.