Healthcare Stocks Soar On Shutdown, Here's Why

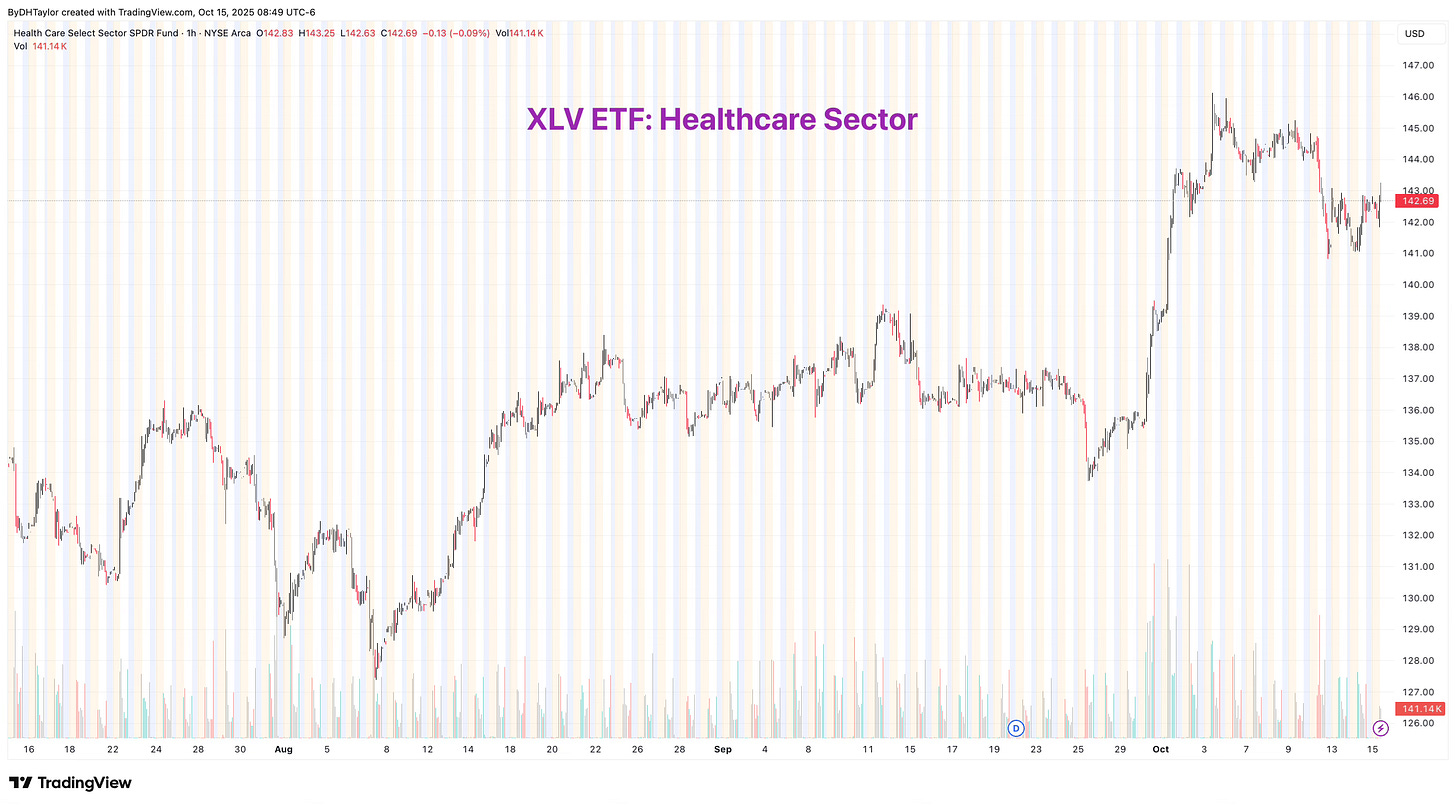

The healthcare industry will do well if the Republicans get their way with this latest shutdown. The sector has shot up on the shutdown; here's the breakdown.

Healthcare stocks actually shot up higher overall when the government shut down. While both parties are very willing to stand their ground, healthcare stocks stand a good chance of winning in the longterm if the Republicans get their way. The sticking point in the shutdown is Democrats wanting COVID-derived cuts and credits to be extended for healthcare. Republicans want firms to be more free to charge whatever they deem fair for their products.

Both parties are willing to go as far as it takes to win; the government shutdown shows that.

In the meantime, what long-term potential is there for healthcare stocks?

What is driving the move?

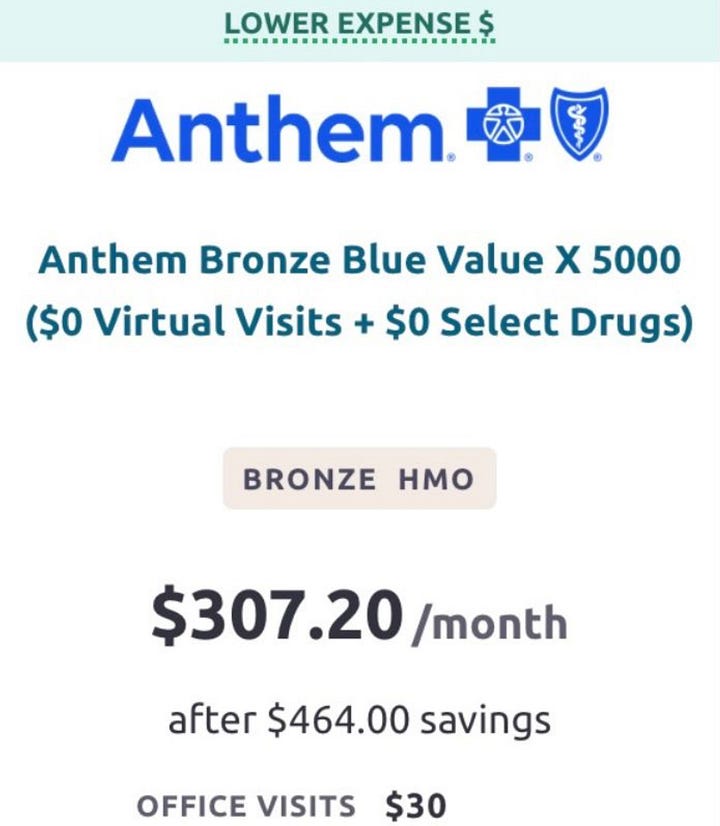

The tax credits embedded within the current law for of the Affordable Care Act, a.k.a., Obamacare, are set to expire on December 31st of this year. These benefits were added during the COVID crisis. Democrats want the credits to be extended permanently; Republicans are set to allow them to expire. This is the main driver of the standoff with the two parties and the subsequent shutdown.

Because of potential expiration of the tax credits, firms in the healthcare industry could allow premiums charged to go higher. Already, individuals who use the ACA Marketplace are seeing notices that their premiums are going higher.

Ultimately, higher premiums would mean more revenue for firms in the healthcare industry across the board. This is the reason healthcare stocks have shot upward; in summary, Republicans are willing to do whatever it takes to ensure they win this fight, including the shutdown of the government over this one, highly-contentious issue.

My honest take on this? First, I don’t think the shutdown has anything to do with healthcare and Congress passing legislation to fund the government, but instead, shutting down the Congress has everything to do to not release a certain set of files… More on that below.

Stocks To Watch

First, it is not simply healthcare premiums, but also all healthcare services. If premiums go higher, other products and services would be able to go higher. Companies that provide healthcare related products could charge insurers higher prices.

Notwithstanding this, I wonder on what is available for upside on healthcare stocks, so I broke down the entire sector.

Here are a few standouts.

Eli Lilly

Ely Lilly (LLY) stands out as the stock that is leading the sector. The forward P/E is somewhat below the overall average. With earnings coming due at the end of this month (October 30), and the prospect of higher medical costs paid by consumers without government restrictions, the possibility of increased future earnings could drive ELY stock further:

Halfway through the reporting year, Lilly is on target to earn a 36.1% revenue increase. This has driven LLY stock higher throughout this year, but the stock has stalled lately.

Q3 2025: $6.15

Q4 2025: $6.92

Q1 2026: $6.72

Q2 2026: $7.70

The total of this is $27.49. With a forward P.E of 30, this should put LLY stock at $824.70. With the government shutdown, there will be market volatility, and LLY could move back lower. That would be a buying opportunity if Lilly were to see increased revenues. With the Fed lowering interest rates, that will expand the money supply somewhat, and this could drive the P/E ratio higher.

LLY stock ran rich previously. With the current forward P/E ratio sitting at a mere, 30, relatively, this could push LLY stock up further.

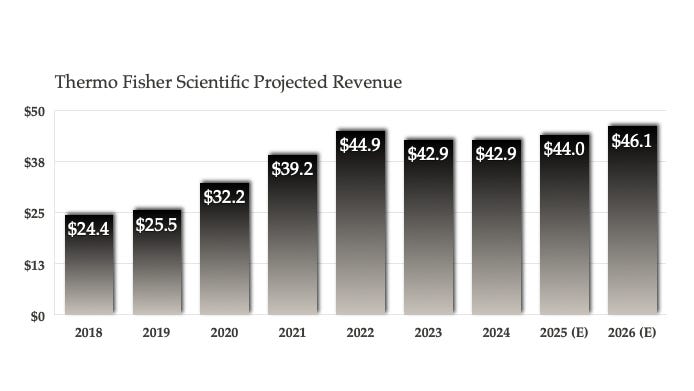

Thermo Fisher Scientific

Along with LLY, Thermo Fisher Scientific (TMO) has seen a rich move upward over time, and lately, with the shutdown and Republicans standing firm, TMO has shot back up to the higher range.

Growth in revenue is slower than Eli Lilly. However, and as the move in TMO stock shows, expectations are that there will be increased moves up.

Along with revenue growth, EPS growth has slowed, but is turning back upward. Thermo Fisher is expected to earn $23.44 in EPS over the next four quarters.

Price to earnings remains consistent for TMO stock, and with a P/E ratio of 31, this would put TMO stock up around $726.64, which is an increase of nearly 50% from its current levels.

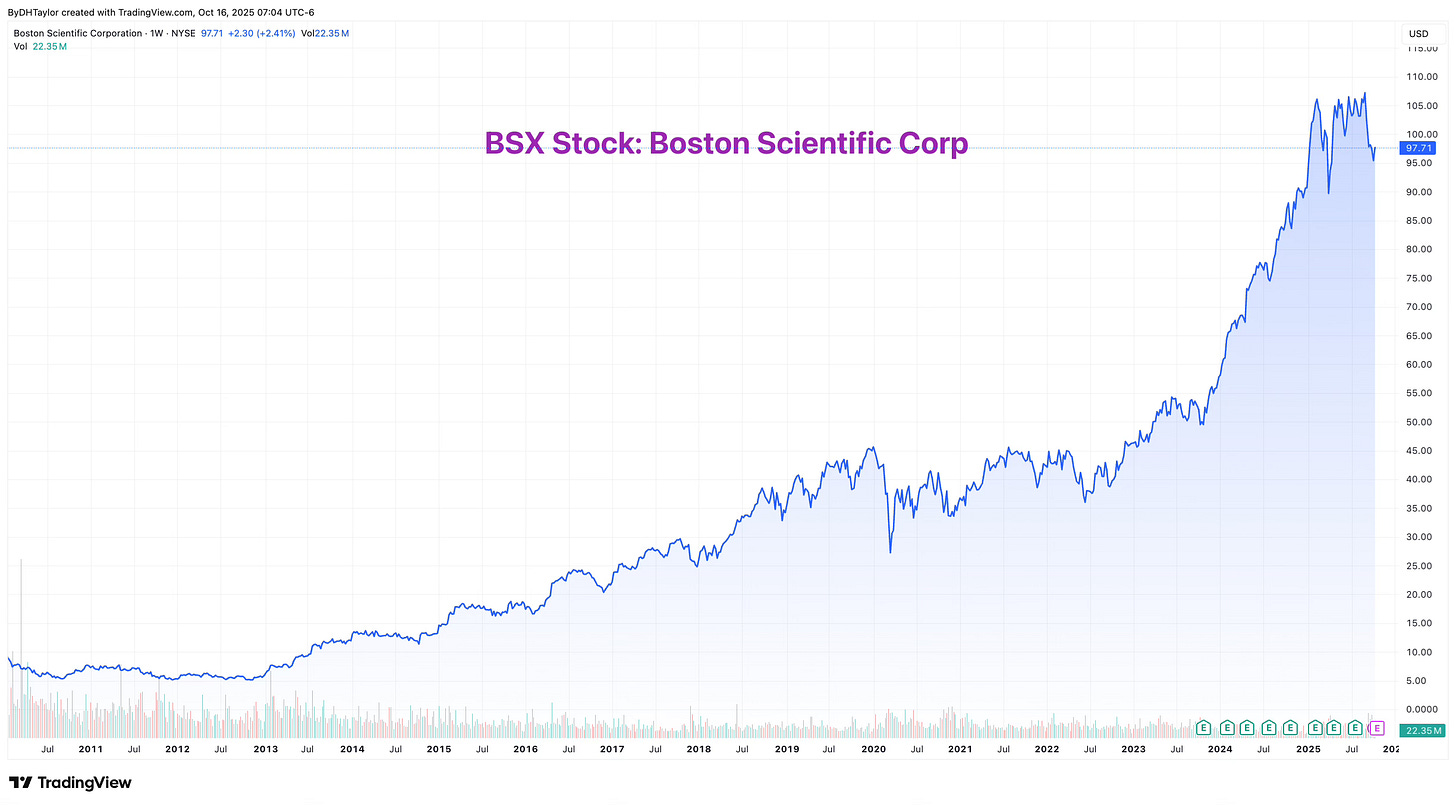

Boston Scientific

Like the other two stocks I’ve mentioned, Boston Scientific (BSX) has moved solidly. There could be more potential, especially with future revenue gains.

As with the other two companies within the healthcare sector I am highlighting, Boston Scientific is seeing an increase in revenue over the next two years.

Like the other two companies, increasing revenues will translate into increasing EPS, all else equal. However, what would you pay for about $3.20 in future EPS? At 30x the earnings, likely a solid price would be about $96.75. BSX stock just cleared $100.00 as of today.

So, the question becomes: will future revenue and earnings be more than the $3.20? Probably, but understanding how any one particular company’s revenue moves relative to what pricing changes will appear in the future is unknown right now. However, I believe it would likely push the EPS higher, and therefore push the stock up.

But the margins are thin.

My take

I don’t, for a second, believe the shutdown is 100% related to a sticking point in the funding of the government.

First, I see an executive that wants to dismantle the government as much as he can. By eliminating as much as possible, he can then dictate what he wants without the nagging speed bumps.

Second, I also believe that many federal employees will simply quit. The shutdown, for Trump, is a way to get rid of as many individuals as possible without really lifting a finger.

Third, if the government is shut down, then the House of Representatives has no reason to be in session, and therefore there is no mechanism for a certain set of files to be released.

Given this, expect a very long, and protracted shutdown. Expect that there will be negative consequences. This could offer opportunities to buy these stocks on a dip should the stock market itself sell off.

I will be looking at more and more sectors in lieu of economic data, and the overall effects of the government shutdown on teh economy.