Higher Inflation & What That Means

Last week's inflation data came in slightly higher than expected, and here is what that means for the stock market & economy

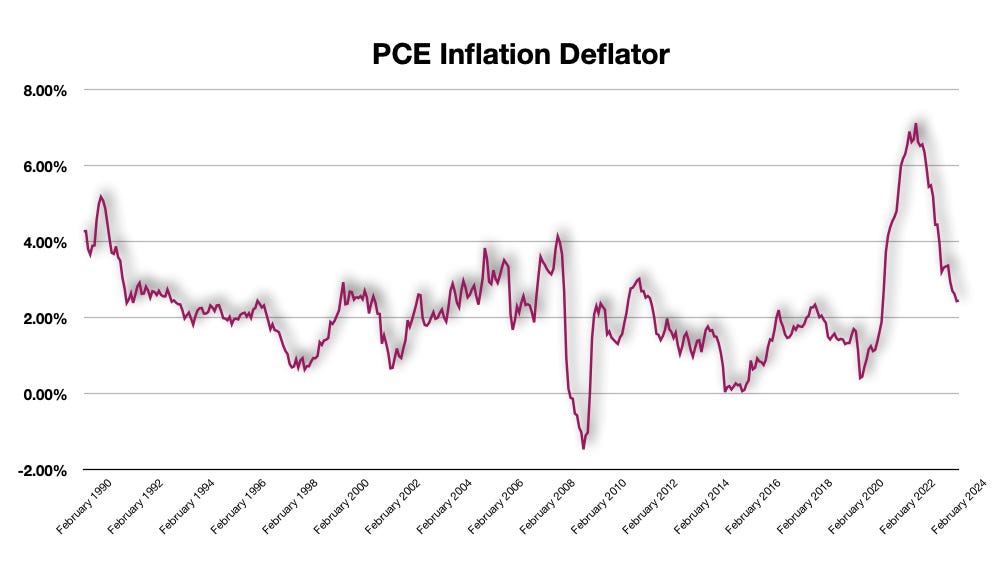

Last week, just before the Easter holiday break, the Bureau of Economic Analysis released the latest numbers for personal Income, personal expenditures, and the all-too-important PCE deflator. The PCE is the preferred inflation gauge of the Federal Reserve, and as they decide when to ease interest rates that they have pushed to highs not seen in more than two decades, the stock market is following the PCE intently.

There are two components of the Personal Consumption Expenditures Price Index, or PCE for short. There is the headline number and then the core rate that removes the more volatile energy and food components. Both numbers went higher on a month-over-month basis. And, my take continues to be consistent that inflation numbers are not falling fast enough - the Federal Reserve will not be a able to lower rates as soon as they like, nor as fast as they hoped.

Beyond these numbers, the real focus remains what drove inflation upward like it did, accounting for ~70% of the latest inflation gains: housing. The housing portion of the PCE is still lofty and remains well above the 2.00% overall target at a massive 5.85%.

Breaking Down Inflation

PCE inflation data came in slightly higher than expected, but is generally trending downward as the Federal Reserve is hoping.

The above is the headline Personal Consumption Expenditures Price Index. As you can see from the chart, there are two basic takeaways. First, after surging to a high not seen since hyper-inflation back in the 70s & 80s, the trend is definitely heading lower. The other takeaway is that the number, or the year-over-year growth rate, is still above the 2.00% target rate. But, this also included food & energy.

The core rate is a slightly different story.

Core PCE

The one thing that I noted was the month-over-month change in the core PCE Price Index, and that was about 0.261% month-over-month increase. Multiply that by 12 and you get a number annualized at about 3.13%. That is simple math and does not take in to affect compounding, which would increase the rate to a number closer to 4.00%, if not higher.

While the overall trend is lower, the rate of increase on a monthly basis is not moving lower at a pace that will push annual growth below 2.00%. The Federal Reserve is going to have to keep interest rates at a higher level for longer.

Housing PCE

One of the main drivers of the big move higher in inflation was housing. With mortgage rates as low as they were - clocking in as low as 3.00%, there was a massive rush to refinance and buy homes. This drove prices upward. While home prices have seen their rate of growth decline, the year-over-year rate is still ~5.85% annualized:

The housing portion of the PCE increase is still too high. For the record, the other portion of the increase in inflation is suspected to be profits to corporations. That is a group of individuals that are never in a rush to let go of their well-earned gains. And, home buyers are just the same.

There is a significant skew in both supply and demand for housing. Since so many either bought a home while mortgage rates were at significant lows, or refinanced their existing mortgages, this keeps supply artificially low since there is no rolling supply. This means that there is no clear fix tot he housing supply situation and therefore, prices will remain pressured upward.

Bond Yields

For the day, Thursday, just prior to the three day holiday, bond yields remained largely mute. However, at the time of this writing (Monday morning), bond yields are heading back upward:

My take on this has been as consistent as it could be that interest rates are going to remain higher for longer because inflation is not heading lower at a fast enough clip to get to the 2.00% target level for the Federal Reserve. Because of this, any moves lower in bond yields are largely premature. But, eventually bond yields will go lower once inflation gets on track for its 2.00% target rate.

Stock Market Reaction

Mostly, the stock market barely budged on the news, and this may have had a lot to do with the fact that the data release came out just prior to the

Overall, there is still a lot of fuel left in the tank for value when you look at all 500 of the components of the S&P 500. As long as the majority of these stocks remains above the US 10-year Treasury, the benchmark investment rate, of 4.325%, there will be buyers coming in to chase value and yield. This will keep the stock market moving in an overall trend upward.

I do not see much from this latest economic release that changes what is going on in the economy, the future of interest rates, nor the stock market. Interest rates are largely not having much effect on the overall growth of the economy. Likewise, the current level of interest rats is also not having much of an effect on the consumer, employment, nor the stock market.

I still believe that interest rates will remain higher for longer. But, this will not contain the economy too much, at least given the current state of the economy. I will post more on this as it is ongoing.