Hot Inflation Tames Rate-Cut Expectations

Inflation is climbing and will continue to do so. In the meantime, the pressure on the Fed will push them to lower rates—inflation will worsen from this

Inflation, driven by the tariffs, has shown up. Market pundits are starting to debate many new outcomes for what is next, and there are an infinite number of two-handed opinions as to what is possible. For myself, I have been internally debating so many pathways that I have lost track of the possibilities. Ultimately, we still do not know, and the market may not like that uncertainty.

Over the past few meetings, the Federal Reserve has been on a wait-and-see approach for moving interest rates. The big crux is not knowing the full extent of the tariffs, nor their effect on the economy. This past week’s economic data shows that price pressures are starting to appear. For now, the bigger gains are in producer prices. My thinking is that price pressures will continue to increase, and the consumer will start to feel the pressure more and more.

What will the Fed do, then?

The Fed has been somewhat steadfast in its desire to wait and see. While the entire market is expecting rate cuts, I have wondered about the possibility of rate increases. Why not? The Fed, after all, is waiting to see. What are they waiting to see? How inflation will play out. If inflation starts to show up rapidly, the Fed could increase rates in order to contain inflation.

All through the COVID-induced inflation spike, I had said that the Fed was behind the curve. Eventually, they caught up to that, albeit with a bit of egg on their faces. I also have been steadfast in that the Federal Reserve should not have been cutting interest rates in late 2024, but instead wait on cuts until inflation moved down further.

Now, I wonder if it is possible that inflation is starting to heat back up, and the Fed may pivot to increasing interest rates rather than decreasing. Job growth is slowing, of course. But the unemployment level is sitting at near-record low levels. This begs the question: How much more capacity for job growth could there be?

Given the latest inflation reports, at the very least, I believe a 50 basis point cut is now off the table, and possibly a continuation of waiting and seeing remains. With the employment situation still firm, albeit with slow increases, there really is no argument for a cut from this perspective.

If the Fed were to cut, this could affect price pressures even further. However, the other side of this is that price pressures from the tariffs are not demand-driven, and therefore could be considered a one-off that does not merit a response from the Fed.

Consumer Price Index

Consumer prices have increased and are no longer trending downward to the 2.00% target. So far, most of the effects from the tariffs have not materialized just yet, and likely, the future CPI data points will show further increases. This is inflation. But, again, it is not demand-driven inflation, which begs the question of what the Fed could do.

We keep going back to the wait-and-see approach: If the Fed was not going to consider the effects of the tariffs on price pressures, then why wait to see?

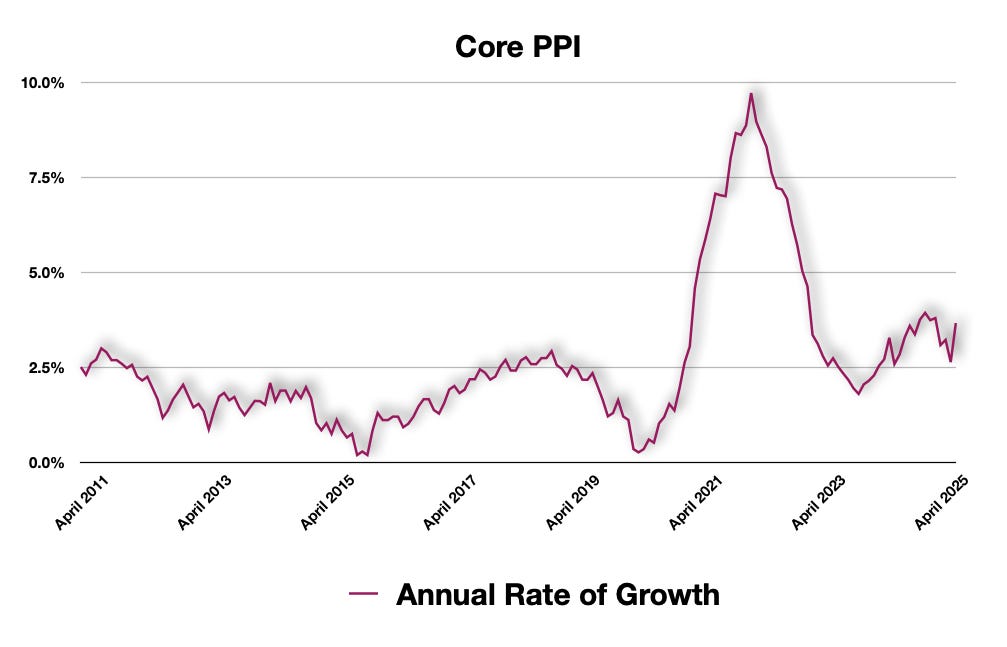

Producer Price Index

The real jump in price pressures came from the Producer Price Index released on Thursday. There was a clear jump in prices paid by producers, which eventually will work its way to the consumer, or end-user. Producers will not be able to hold out forever with regard to the prices for what they pay and passing them on to the end consumer. Eventually, the costs will be borne by the consumer.

Inflation is purely a monetary phenomenon. From time to time, such as the COVID shutdowns, outlying factors will affect prices, of course. But even the latest surge in price pressures was owed largely to an increase in the availability of money.

The money supply is expanding. The Federal Reserve is not likely to push the brake pedal to slow this. With the Federal Government set to take on extraordinary debt, the Fed will have to do the opposite of slowing price pressures by

In the meantime, the effects of a surge in available money is still working its way through the economy. The banking system continues to expand its balance sheet. This is done via fractional banking, of course. This continues to iterate that the economy is expanding.

With an expanding economy, no matter what the pace, we will continue to see increasing prices. Factoring in the tariffs, price pressures could heat up significantly more.

Inflation & Money Supply

The chart above shows the strong correlation between monetary policy and prices. With the money supply continually moving higher, even without the tariffs there are going to be issues.

The Fed is going to want to maintain its independent stance, and this may be what really drives the Fed’s next decision in September. During this time, markets may pull back from new all-time highs until a clearer picture is drawn about price increases driven by inflation and how the Fed will move.

Conclusion: What to Watch?

The bond market. Keep all eyes peeled to the bond market. These guys are some of the most savvy traders on planet earth. If bond yields start to rise, the stock market will wobble. Already, yields have inched higher since this past week’s inflation reports. The stock market has softened very slightly. Going into this week, there may be some nervous fingers, and some selling may come to play.

This coming weekend is the Jackson Hole economic summit for the Federal Reserve, and there are usually statements made. Since the latest meeting, the unemployment situation has been significantly revised, but so has the inflation data. The Fed Chairman is very likely to remain staunchly in the wait-and-see camp, as I expect he will be very hawkish versus the latest inflation numbers. However, Jerome Powell is only one voting member.

The two past dissenters may make further statements regarding their own position. The inflation data may be thought of as one-offs since tariffs are not demand-driven. However, the pass-through effects will still be there.

The bond market, then, will vote this week on what it thinks is the pathway for interest rates, and the stock market will take that lead. I am betting we do not see a big rally in stocks through this week, but instead a slow and smallish slide downward.

Then, we will wait and see.

Please refund my subscription