Hot Jobs Market - When too much might be too much

Non-farm payrolls arrived on Friday and the numbers continue to show that the US economy is still very strong - but, that could be a bad thing

The Bureau of Labor Statistics released non-farm payrolls and other employment indicators of Friday. The economy added ~303K more jobs for the month of March - far more than the market, and I, expected. The figures reiterate my economic thesis that this economy is far more robust than what the stock market is pricing in with regard to potential interest rate cuts. The stock market is pricing in interest rate cuts from eh Federal Reserve in order to remove policy restrictions that would be, um… er, hampering?

I have been saying for some time that the stock market is misaligned with the reality of the economy. The Federal Reserve raised interest rates at one of the fastest clips in history in order to contain sharp increases in inflation. Expectations at this point are that the Federal Reserve will lower rates to levels are at a level that is more accommodative for the economy. Given the latest employment data, it does not appear that the economy is being restricted in a manner that, at the very least, is restricting employment.

Breaking Down the Data

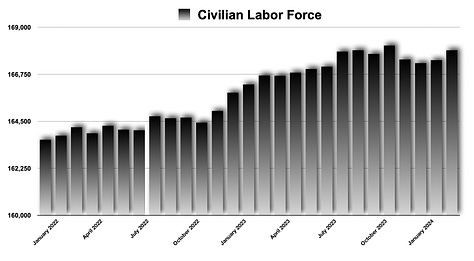

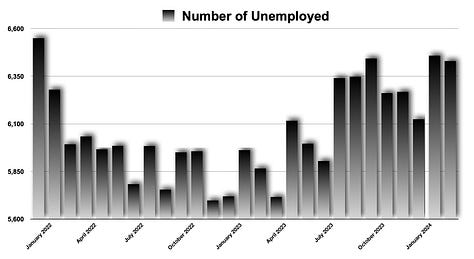

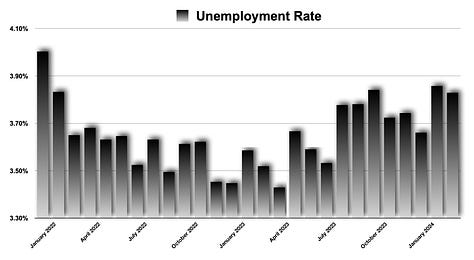

The above charts are the key datapoints within the latest numbers. Shown are the Civilian Labor Force, which shows the total number considered within the population as potentially wanting jobs, or having jobs. Next, is the Number of Unemployed of the Civilian Labor Force. Finally, the Unemployment Rate shows the number of unemployed in percentage form of the civilian labor force. Both the civilian labor force and the total number of employed went higher. This pushed the unemployment rate lower.

Interest Rates: Accommodative or Restrictive?

The above is the US 10 Year Treasury yield, the benchmark investment gauge. Last Thursday, just prior to the Easter holiday, the Personal Consumption Expenditures Price Index - PCE Index - printed numbers that show that inflation is still elevated and not likely to move lower to the Fed’s target rate of 2.00%. However, the bond market waited until Monday to send yields higher.

Then, on Thursday, a Fed President mentioned in an off-the-cuff comment that he did not necessarily see how interest rates could be cut this year given economic activity. That sent bond yields back upward and today those yields are continuing higher. The market has been pricing in the opposite.

Inflation - First

The primary focus is inflation, which is the Fed’s main concern at this level. Inflation is elevated and sticky, and not necessarily moving to the 2.00% target level this year. The above chart is the Core PCE price index. Although the number is falling, the year-over-year rate is currently 2.75%. But, the month-over-month increase was elevated coming in at .33% increase for the month. Without compounding, if you do simple multiplication that would be a year-over-year increase of over 4.00%. On a monthly basis, the change needs to drastically drop in order for the Fed to achieve its 2.00% year-over-year growth rate.

Dual Mandate

The Federal Reserve is mandated by Congress to balance two things: Price stability & maintain full employment. Price stability is the primary focus, albeit this is something that is rarely an issue like what was recently seen. The main takeaway with price stability is that the Federal Reserve will sacrifice jobs in order to get prices under control.

Given that the unemployment number came in at 3.829%, there are more than enough jobs to sacrifice before there are large-scale issues.

While inflation has moderated considerably from the recent highs, the current inflation level is not where it needs to be and therefore the Federal Reserve will likely have to maintain its current interest rate levels for some time, if not push interest rate higher in order to achieve its goal of price stability.

Jobs Will Be Sacrificed

Price stability needs to be achieved. The cost of this may be jobs - a lot of them. If job growth moderated and the economy saw a declining economic growth rate, price pressures would likely hit the Fed’s 2.00% inflation level. But, this is not happening. Instead, job growth is continuing and this will continue to elevate price pressures. And, until the economy’s expansion starts to contain itself, prices are likely to remain elevated.

Conclusion

For some time, I have continued to maintain that the current level of interest rats is not sufficiently high enough for the Federal Reserve to achieve its price stability objective. And, until we see a contraction in employment gains that could alleviate price pressures, the Federal Reserve is nowhere near where it needs to be to achieve its target rate. Read: The Fed needs to raise interest rates and is likely, to at the very least, start talking up interest rates.

This will send the 10-Year US Treasury yield higher. That will also very likely pressure the stock market, which continues to push for higher levels.

Until I see a much lower month-over-month rate of increase in inflation, the 2.00% rate is nowhere within site. While there will be signs that the economy will be contracting and that the move lower could be starting, this month’s non-farm payrolls does not fit the bill for seeing inflation come into check.

What to watch for?

On Wednesday, we get inflation numbers from the CPI data. The Federal Reserve’s preferred inflation gauge is the Core PCE Price Index - which comes out at the end of the month. The CPI data is a good indication of what is possibly coming up in the PCE at the end of the month. If the CPI is elevated - as it has been, look for the market to start getting anxious over the future of where stocks are. If the 10-year Treasury continues higher, this will absolutely pressure the stock market. We may get a selloff if numbers do not start to line up with the Fed’s objectives.