Inflation & Employment Are Likely to Push Interest Rates

Inflation data this week will more than likely show continued month-over-month gains as we have seen the past several months - Here is what to expect

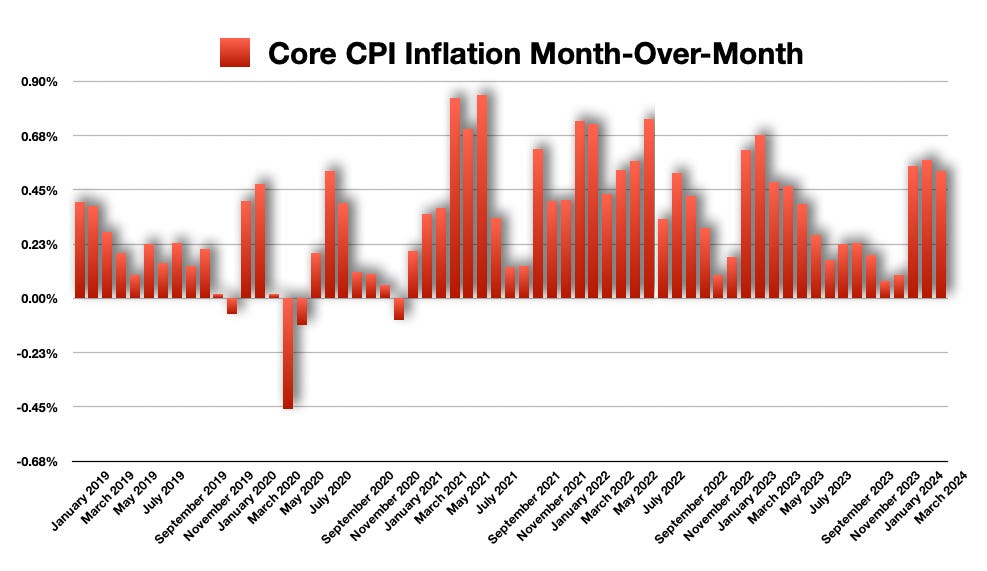

This week we get CPI data. Above, the chart on month-over-month gains for the core rate of inflation has been ultra-hot. This has led the market to believe that the Federal Reserve will need to continue to leave interest rates higher for longer, as their mantra has been for some time. The important thing to focus on is that inflation itself is not a cause, but an effect. With this in mind, looking at some other variables it is easy to see that continued inflation pressures are more likely to continue until what interest rate levels we are sitting at finally contain price pressures. Since inflation pressures have been so sticky for so long, and interest rate levels are going to remain high, employment levels will contract. As we are right now, employment is ultra high. Bringing unemployment up would, at the very least, bring economic growth to moderate levels. But, that also means stock market prices will have to adjust.

What is Driving Price Pressures

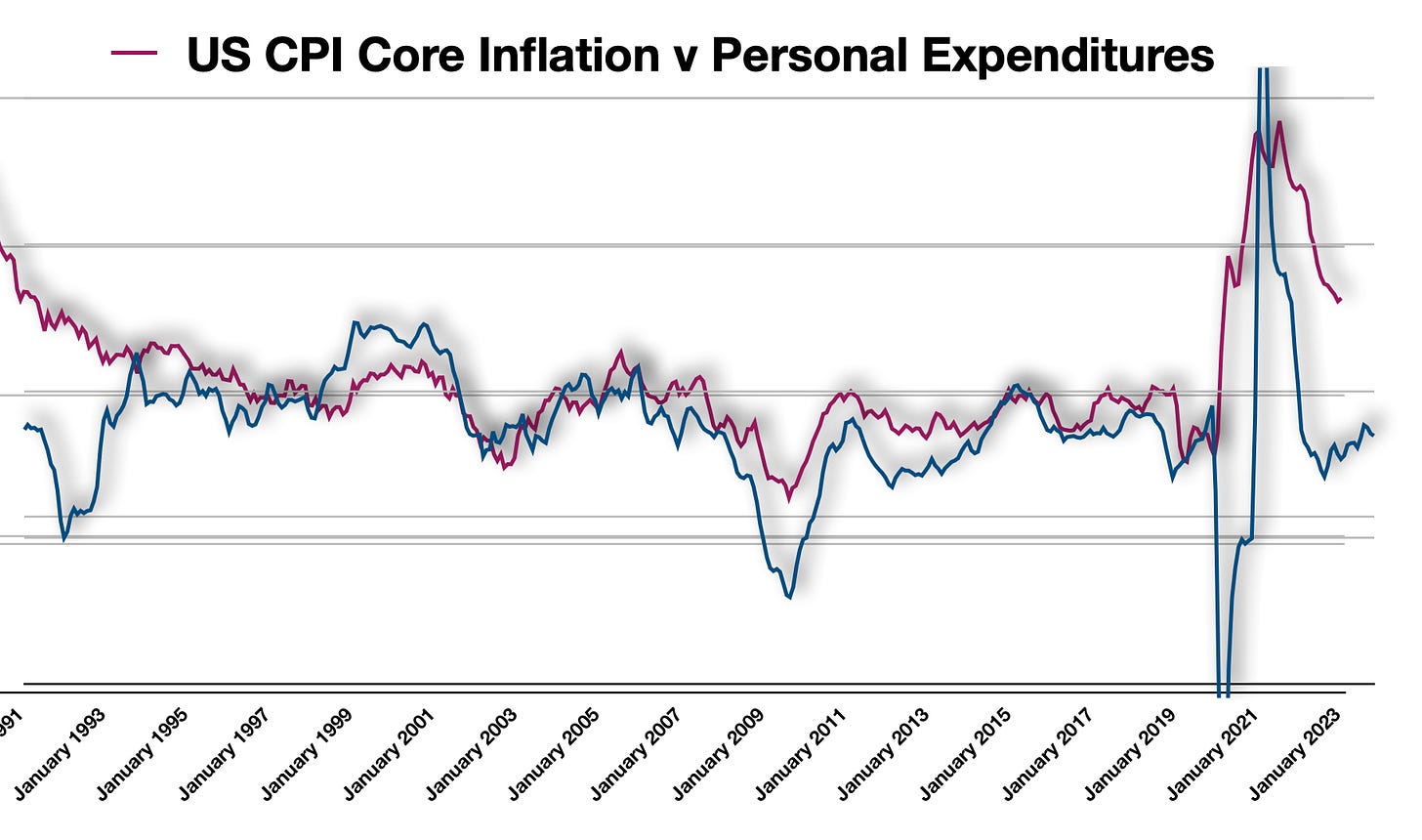

Price pressures are a factor of what consumers earn and then spend. While Government and business expenditures add to overall consumption levels of an economy, governments tend to have fairly flat-line growth. This tends not to spur economic growth without a surge in spending but, instead, just maintain some level of continuous economic level. Business merely respond to consumer demand.

Consumers, then, and their rate of growth of increase in employment and incomes are what will ultimately drive increases, or decreases, in economic growth. Following income gains is the best place to start for any economic analysis.

As more and more individuals are added to payrolls, aggregate increases in income will drive aggregate increases in expenditures.

In the above chart, you can see the tight correlation between expenditures and price pressures. Right now, the US unemployment level is sitting at 3.86%. This is a level that is well beyond ‘full employment’. Because of this, employment levels need to drop to more moderate levels in order to bring price pressures down to normal month-over-month gains.

The higher levels of interest rates are starting to have an affect on consumption levels, and this trend will likely continue. Lately, consumption levels have moved sideways - there have not been big increases. For me, this is key. If employment gains are moderating, then economic growth will do exactly the same. This will contain price pressures.

Employment

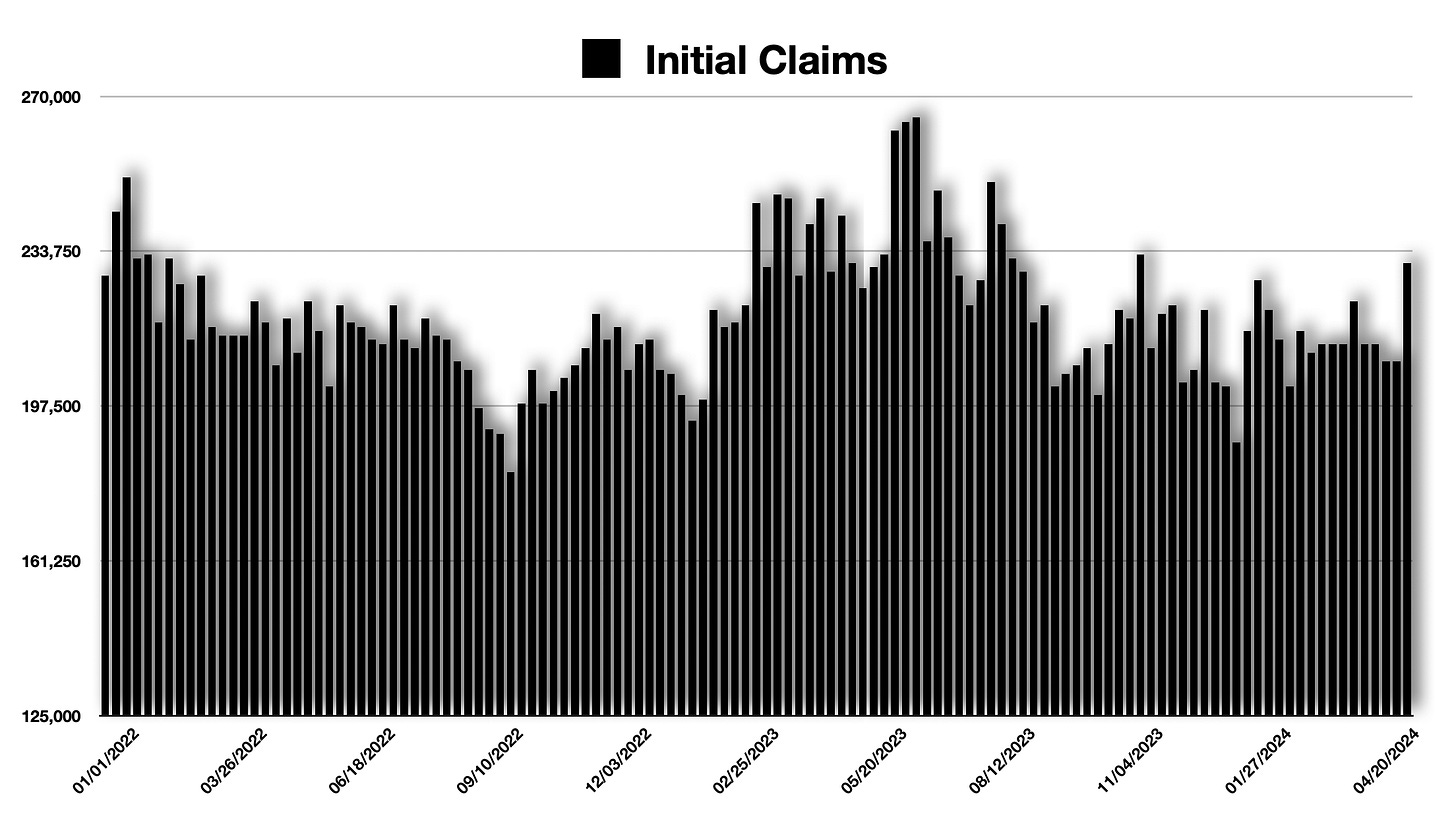

Last week, initial jobless claims came in with a small pop upward. This is modest and hardly a cause of celebration. And, it could easily be a 1-off that is erased as early as this week - one data point is not a trend nor an entirety of an economy.

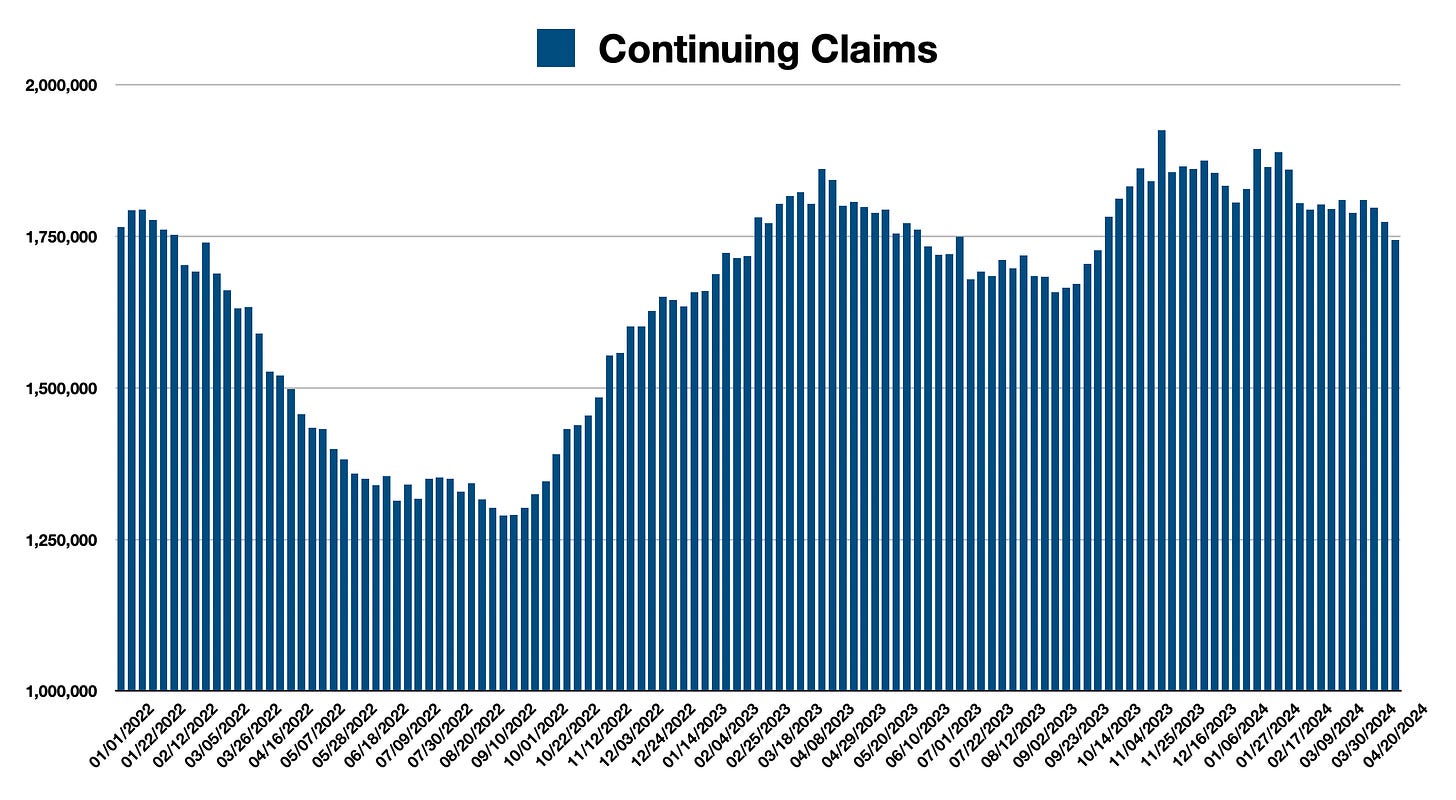

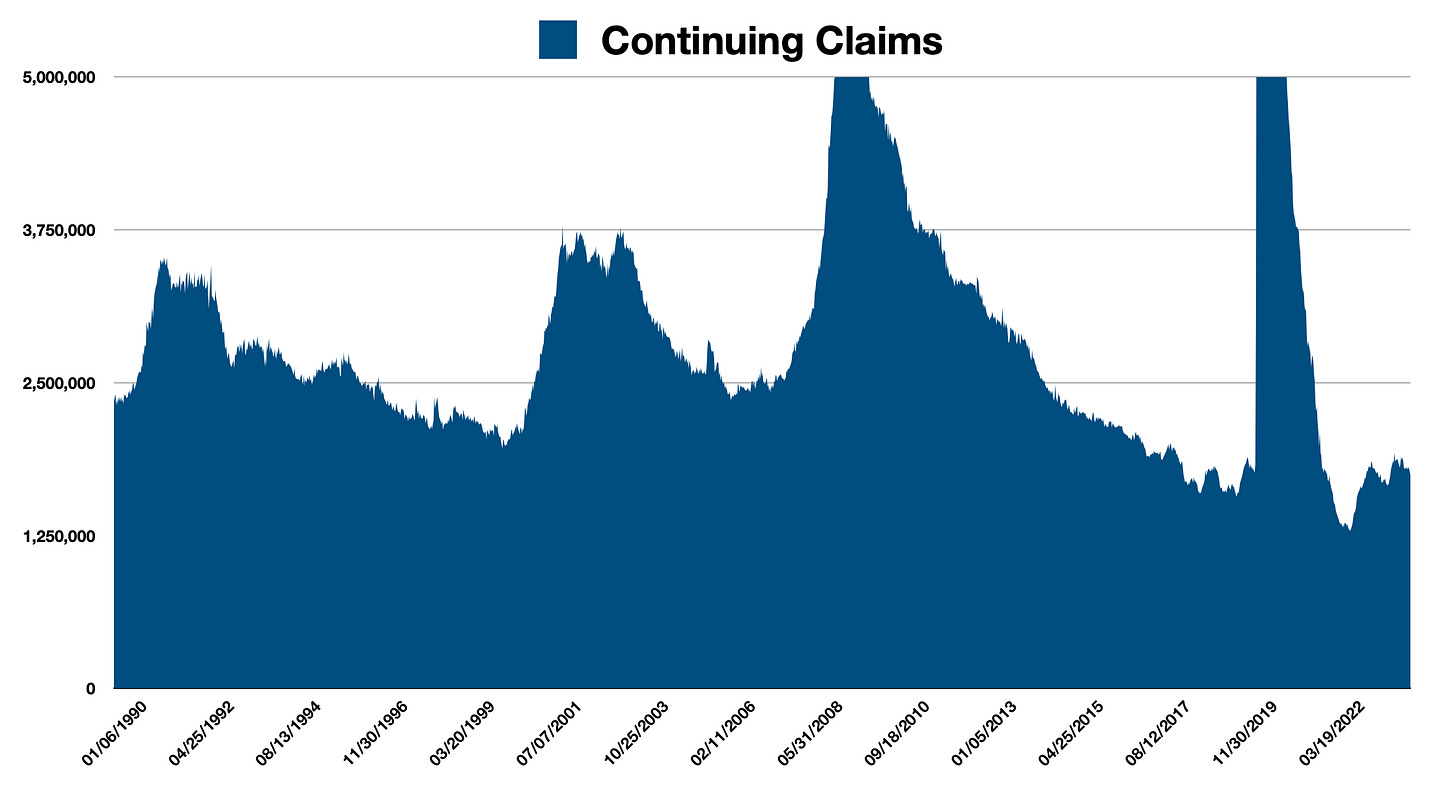

Looking at this chart above, the US Continuing Jobless Claims, shows that although there was a small pop higher in initial jobless claims, continuing claims are still far from moving upward.

This chart above is a bigger look at US Continuing Jobless Claims. The US economy is running at full steam and ti will be a while before we see an upward trend in continuing claims that show a decline in economic growth that will contain price pressures.

Remember: Price pressures are an effect, not a cause. In order for price pressures to be contained, economic growth needs to flatline at the least. Employment levels are a cause of price pressures in the sense that if too many individuals are employed, current economic capacity cannot necessarily keep up with demand, and therefore price pressures will continually be pushing upward.

What is Happening With the Bond Market

The ‘cure’ for price pressures is to moderate economic growth. If the economy is pushing at full capacity, there is not enough ‘slack’ in the economy to allow for price pressures to moderate. Lowering the number of individuals that are employed will all for some slack.

Interest rates have been at relatively higher levels for about 12 months now. Since unemployment is sitting at 3.86%, there really is not enough excess to add more jobs. Therefore, job growth and economic consumption have been moderating the past several months. This is the start of decreasing price pressures. But, it is only a start and there are other factors that are contributing to inflation other than normal economic growth - housing being one of the biggest.

I expect that the above chart has hit its highs, and this is the one move I am playing for: I am longhand will be buying more and more of TLT stock, the bond price ETF. As interest rates moderate lower, TLT stock will move upward in a longterm move.

I fully expect that while inflation levels will continue to be modesty higher, ultimately inflation will decline to more moderate levels. Once this starts, the US 10 Year Treasury yield will be allowed to come down.

But, I still think we see higher inflation numbers this week.

What to Expect With The Stock Market

The stock market is acting like a two-handed economist. On the one hand, there are signs that the higher interest rate levels have had some effect on the economy and economic growth will dissipate. This will bring employment levels lower and price levels will follow downward.

The other handed economist would see that since there are signs of slowing economic growth and moderation, interest rates are going to trend lower and therefore stock prices can continue to rise. Unfortunately, the stock market has things dead wrong in that regard.

The stock market was completely wrong coming in to this year to think that the Fed was going to lower interest rates up to six times this year. The economy would have needed to have an incredible level of stimulus in order for the Fed to lower interest rates six times. The economy would have been laid out on its back for that scenario to take place.

I believe that the Fed will leave interest rates where they are to finally get inflation where they want: On a clear target of 2.00% year-over-year growth. This would mean that economic expansion will have been contained and likely there would be very little economic growth. At that point, the Fed would have to respond appropriately.

But, during that period, if economic activity has been largely contained, and unemployment rises in response, there is no way market valuations are appropriate. The stock market is being far too exuberant in its enthusiasm at this point.

My strategy remains the same: Keep an eye toward the bigger picture and get ready for a big move upward in bond prices, and a big move downward with stocks. For this week, I see inflation pressures printing high, the stock market selling, then stepping right back in and embracing lower interest rates - the stock market will move right back up again. Eventually, it won’t.