Inflation: The Fork In The Road

Asking AI on economic and stock market analysis, the jobs reports did nothing to sway. Next will be the inflation report, which this could be a big market shifter.

Last week we received employment numbers, which came in a bit on the soft side. There were gains in employment, but they were less than anticipated. In fact, the year 2025 was the worst year for job growth since the pandemic.

While job growth is poor, there was not much there for the Federal Reserve to bite into to lower interest rates faster. In the future, expectations are for one decrease in interest rates in 2026, and maybe there is enough room for two cuts. The latest jobs data does not push that needle too much further, however.

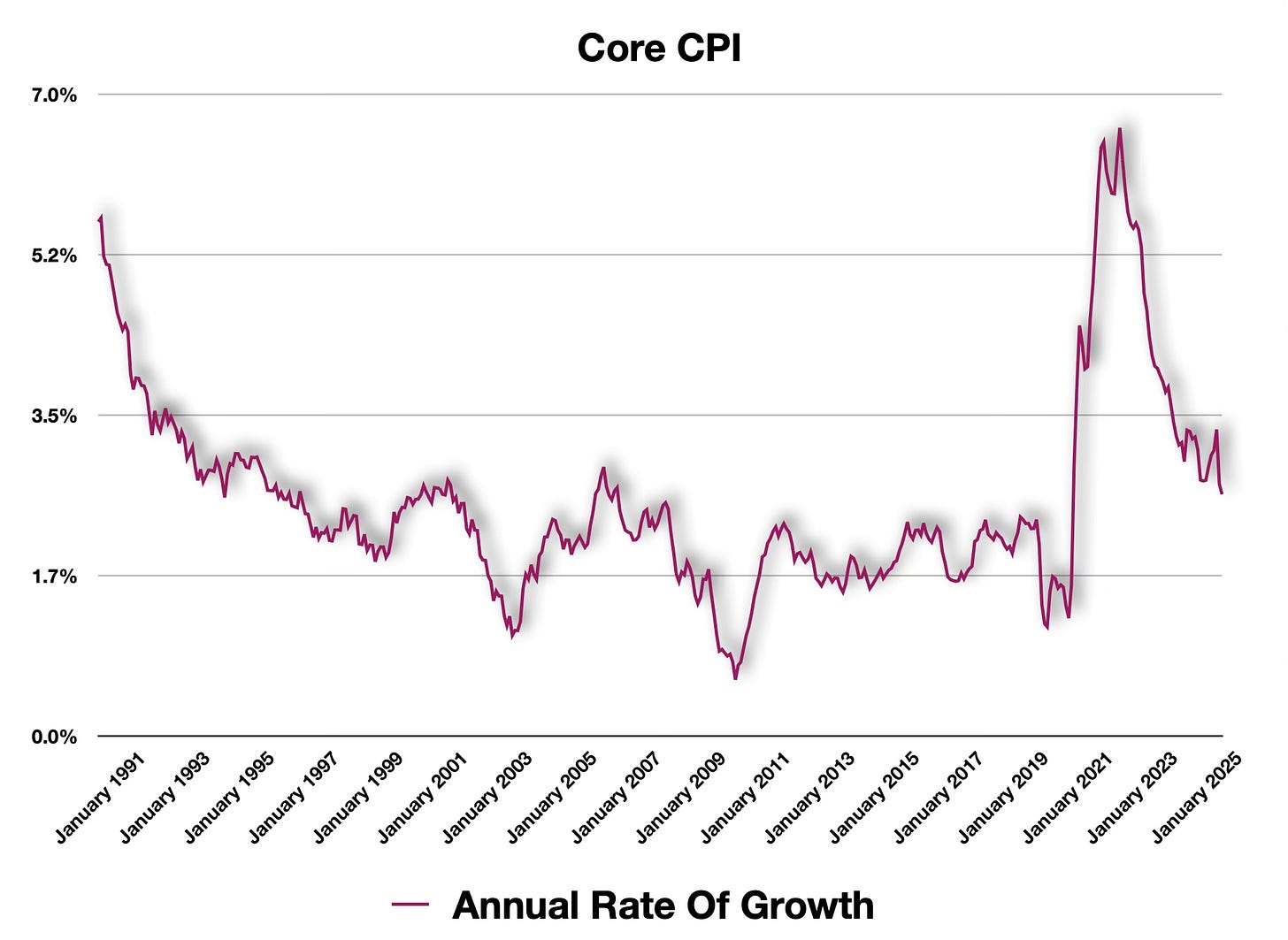

This week, inflation hits with CPI on Tuesday and then PPI on Wednesday. While job growth has slowed, inflation has not necessarily painted a picture that shows positive moves toward the all-too-critical 2.00% annual growth rate.

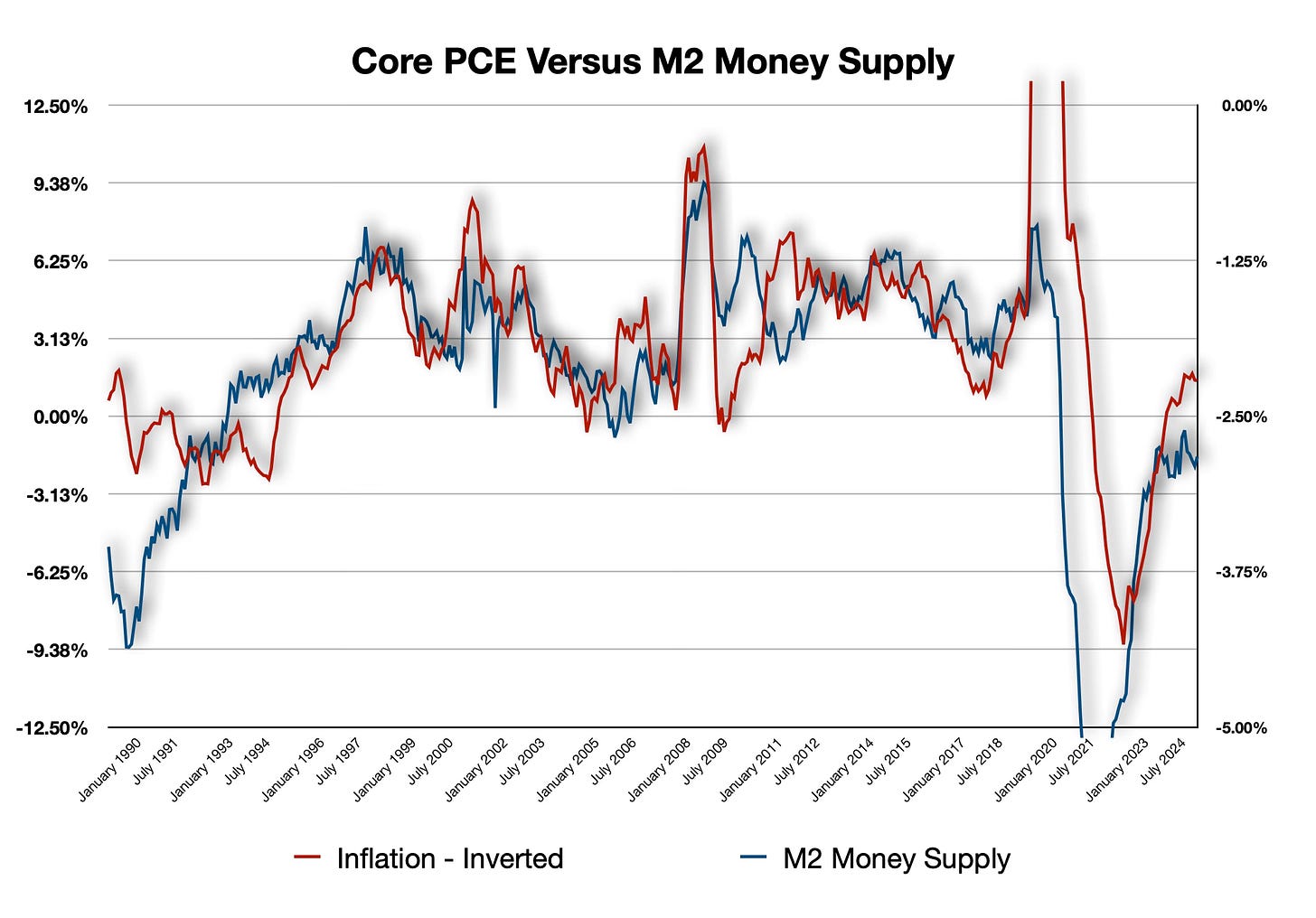

The chart above shows how strongly correlated the year-over-year growth rates are for the money supply and inflation—effectively, they move in tandem. Inflation is a purely monetary phenomenon. If the money supply growth rate is increasing rapidly, there is more money to purchase goods and services, which drives up prices, ceteris paribus.

I asked AI to analyze the latest employment numbers, as well to look into my position to see what it believes (last week’s post). AI feels that employment will not push the needle for the Fed, that the wait-and-see approach to employment is still warranted. In the meantime, the real “fork in the road”, as AI put it, will be inflation.

Both releases are hitting this week for CPI and PPI, which are solid indicators for the PCE at the end of the month. Notably, data is missing because of the government shutdown, so the actual inflation data may feel a bit askew. For that, looking to the money supply data is the best way to determine the overall trajectory for inflation, given the chart above.

The Odd Thing About Tariffs & Deflation

Price pressures have been falling—even the money supply growth rate is falling, as can be seen above. While there has been a drop, the latest numbers are printing about 2.65%—still above the 2.00% level.

There is an odd outcome from tariffs that is not immediately obvious: Tariffs can be deflationary. Tariffs are a tax. Anything that will be consumed is now being taxed at a much higher rate. This diminishes the purchasing power of the consumer because incomes are finite and have not increased measurably over the past year, certainly not relative to price increases, where the word “affordability” is now a key driver for the Trump administration.

Tariffs actually create deflation. Since less is being consumed, prices begin to drop. The catch is: Employment begins to drop. We are seeing employment dropping, and from that, revenues and profits for companies will fall short. So, on the one hand, while more is being spent on taxation, prices will eventually drop and employment will continue.

My expectations for this week’s inflation data is that we see more of the same, that inflation is moving toward the coveted 2.00% level, but the pace may be slow. I do not believe we see anything that would necessarily push the needle for the Federal Reserve on inflation, much the same as employment.

My Current Position

My current position is a pseudo-short position on SPY ETF. I am short a 1-month vertical call spread versus long a 1-month vertical put spread. I sold the call spread for $0.43 points, and bought the put spread for $0.28; I have a $0.15 credit. Both of the positions are about $10 out-of-the-money giving me some cushion.

If the market moves mostly sideways, or goes up slightly, then expires, I earn the $0.15 at expiration—if I keep the position that long. If the market moves down, the calls will decrease in value, while the puts increase in value, and I will exit the trade. The downside is a sustained move upward.

According to AI, this is a patient trade, and the rewards are for sitting and waiting this out. AI believes the overall trade will work because it does not see sustained moves higher. I agree, and that is why I put the position on.

However, I want to know more about AI and stocks involved in that genre.

The AI Trade

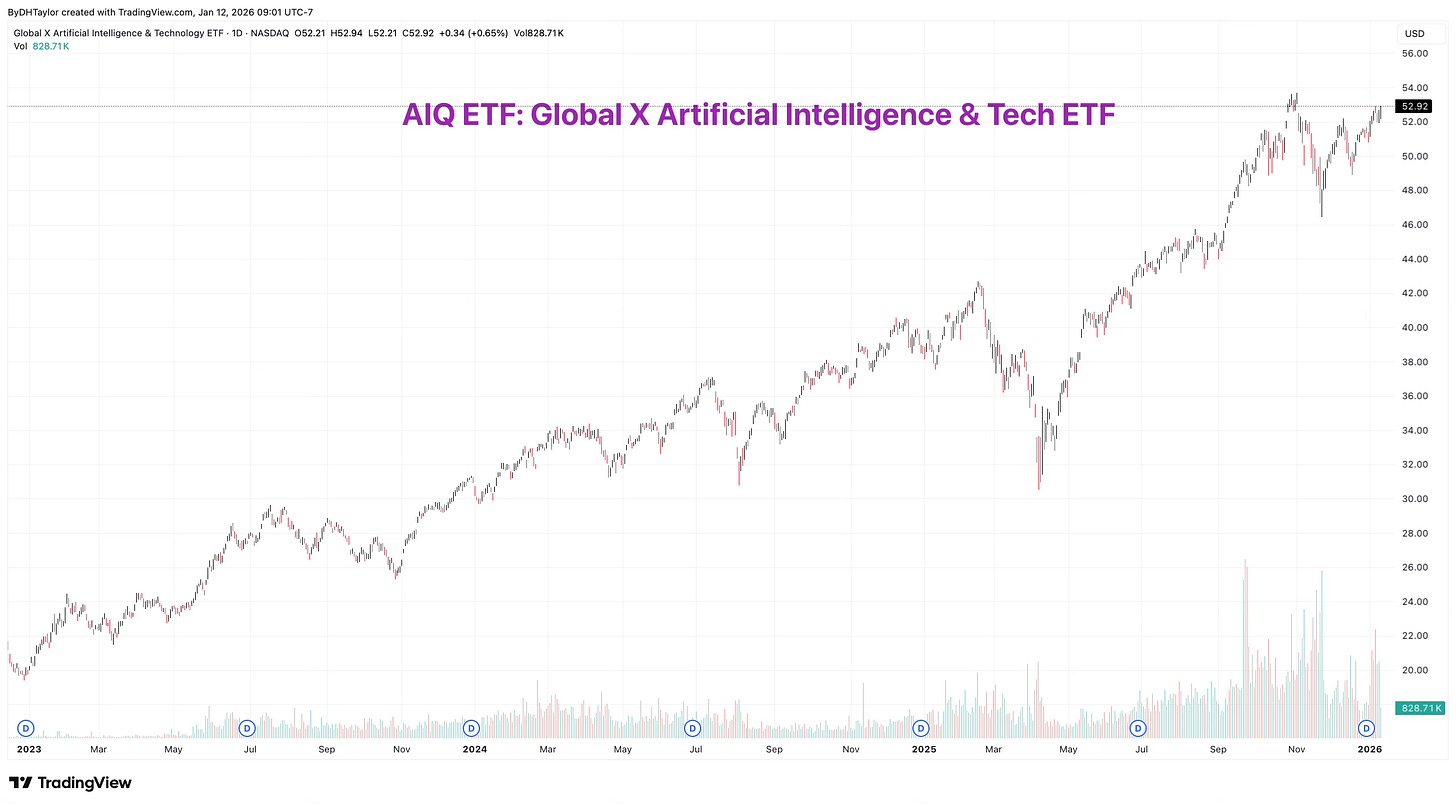

What happens next in the stock market may be determined by what happens with the AI trade. Above is AIQ ETF, which is the go-to AI trade ETF as it encompasses the most predominant AI stocks. Since 2023, AIQ has been on a tear, and is up near its all-time highs reflecting how some of the individual stocks are trading in the sector.

But what happens next?

This is the big question everyone is focusing on, inducing myself. There is a tremendous amount of spend going on within the industry, and this has driven all of these stocks to their current all-time high levels. However, the market is starting to wonder what the payoff will be, and when it will materialize.

Take the leader: Nvidia. They are backlogged. NVDA stock is appropriately priced given the 12-month forward P/E ratio. But if you look beyond that, Nvidia stock may be overpriced as the rate of growth is expected to taper beyond 2027-2029. Then there is the poaching that is starting to happen with some companies opting for Alphabet’s TPUs versus Nvidia’s GPUs, and that poaching will drive more increases for GOOG stock at the expense of NVDA stock.

Then you have companies like Oracle where the market is wondering if the company can recoup their investments, and the latest stock moves have shown the concerns of investors.

My take on this is that we may see a pullback on AI stocks because of the lack of profits and the over-valuation on some of these stocks—I will be asking this of AI in next week’s post.

A Potential Bond Position

The final thing to consider in this is the tariffs themselves, and the Supreme Court’s pending decision. Expectations are that the SCOTUS will strike down the tariffs as unconstitutional. What happens then?

Interest rates are likely to move higher because of this, and because of other effects from that.

First, the consumer would be relieved of its tax on consumption. That would reinvigorate that segment of the economy, which actually would relieve the Fed of the pressure campaign to lower interest rates. Employment would likely restart, and toward H2 2026, employment gains are likely to materialize in the data.

But how does the government pay for the hole in the budget that the tariffs were designed to fill?

The current budget deficit is expected to hit ~$1.825 trillion. The lack of the tariffs should have a hole of about $400 billion, pushing the deficit to ~$2.25T, a 10% increase higher than expected. Investors will be able to demand more interest for their investment from the United States, and absent any real concrete moves from the Federal Reserve, this would drive the 10-year yield up to about 4.50%-4.75%. From there, it could be all downhill. As the debt increases, the amount being paid continually consumes the budget itself.

I am awaiting the Supreme Court decision as we all are. I am going to start moving back into TLT ETF on the short side (I am still long my TBT ETF, the Treasury inverse ETF). I am not anticipating a big move down in TLT ETF, but instead. continuous pressure that would keep a lid on any moves up.