Is The Economy Faltering, And With That The Stock Market?

The Fed is moving, and here is the one key economic indicator to watch for that will also push the stock market

The economy is starting to slow from the effects of the tariffs. Tariffs are a tax, and incomes are a finite resource; consumers only have so much that they can spend on disposable items. If a government taxes that finite income, something has to give. In this case, it is the economy, which will slow.

Fortunately, the issue of the tariffs themselves are heading to the US Supreme Court. I have never doubted that the tariffs would be ruled unconstitutional, but the process will take time to work its way through the process.

In the meantime, the Federal Reserve has lowered interest rates. While that will alleviate some of the burden of the tariffs, by no means a long-term solution.

Once the tariffs are removed, consumers will see relief at the register. However, there will be a gaping hole in the Federal Government’s finances, which is reliant upon the revenue generated by the tariffs.

The question is: What happens next with the economy given the current economic landscape, and its future?

For me, the two biggest indicators are about to hit this week and next:

M2 Money Supply; and,

Personal Incomes & Personal Consumption

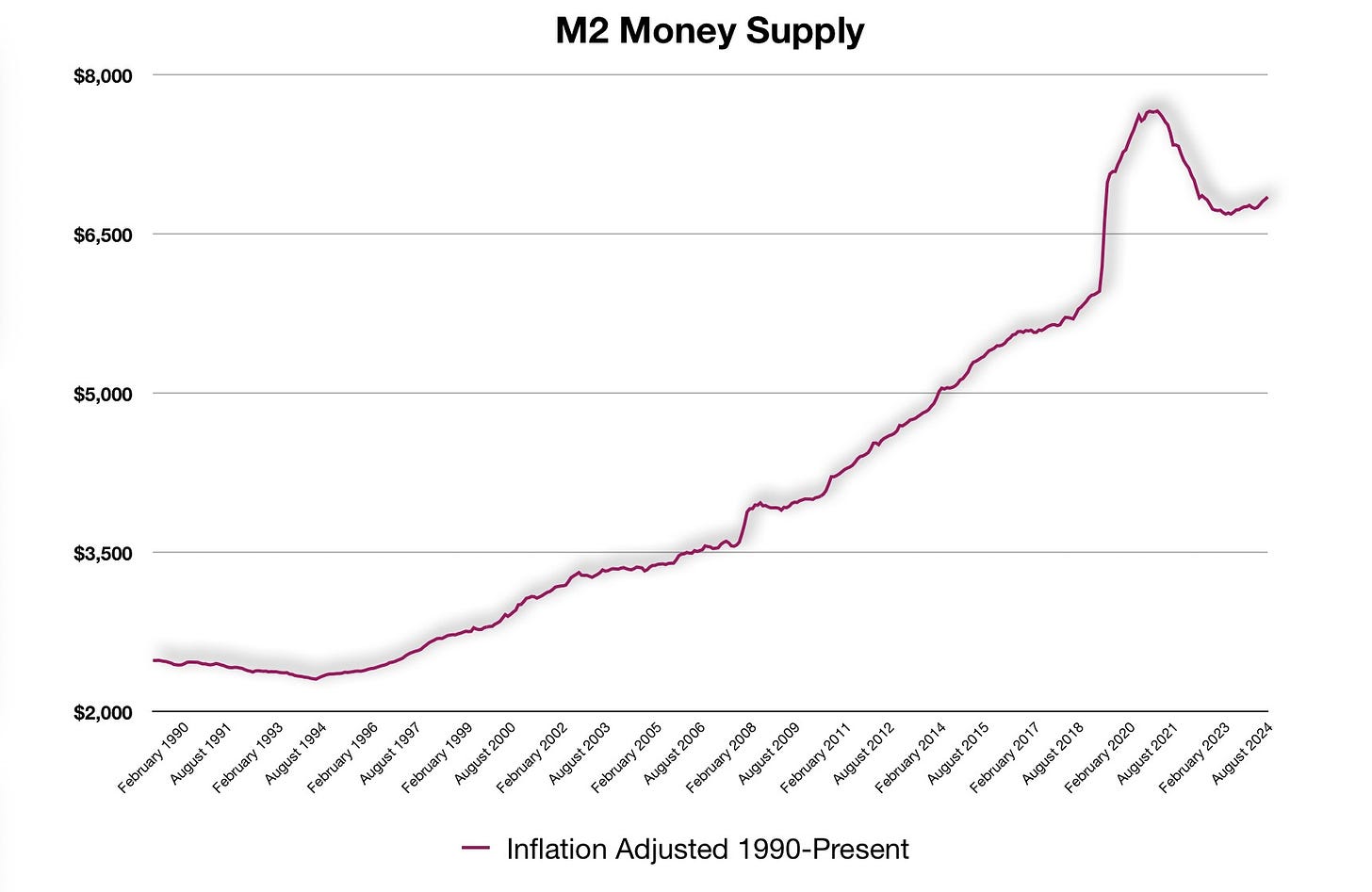

The Money Supply

This image above is the overall M2 money supply. Watching this shows what will happen next with the economy. If the money supply is continually expanding, as it currently is, the economy will follow suit.

If consumers are increasing their rate of growth of consumption, this will push companies to expand further in order to increase their respective position in the economy. Businesses typically take on expansionary projects by borrowing from banks. In a fractional banking system, with an increasing amount of money being borrowed by businesses, this expands the money supply.

With a business borrowing money to expand projects, they would then need to hire more employees. The pace of hiring would stimulate a consumer-led economy further. New hires would push the rate of growth of personal incomes and consumption higher.

Given that, the tariffs are having an adverse affect on consumption, and by extension, hiring. The employment situation is slowing. As consumers stall their pace of consumption, this is affecting businesses decisions, and hirings are faltering.

Because of this, the Federal Reserve has lowered overnight borrowing costs.

Money Supply Growth Rates

Looking at the overall picture of the money supply tells us some information, but for me, the growth rate tells the bigger story. In the image above, the year-over-year growth rate continues to climb higher, but has started to slow its pace of increase.

What is important to understand is that the money supply, as an indicator, is both cause and effect, and also a push and pull for the economy. While it is important to watch this indicator, it is just as important to understand what drives the growth of money, and what the growth of money supply drives.

Understanding this enables one to see the bigger picture that it is not just one indicator, but many. Looking above at the growth rate of the M2 money supply, it is slowing as a result of businesses not expanding in the economy. This means slower hiring, which has been seen in the employment data.

Because of slowdown in hiring, we will see a slowdown in the gains in personal incomes, and by extension, consumption.

Income growth is driven by two factors:

Increase in number of individuals added to payrolls; and/or,

Increases in individual incomes already employed.

Taking the pace of growth of the money supply allows one to compare these numbers to income growth and consumption growth, and then other indirect indicators.

Comparing M2 To Income

Comparing charts to each other is a crucial step in analyzing the economy to better understand what is next. In this chart, both the rate of growth of the money supply and personal incomes are compared. The correlation is very strong.

Each of these is both a cause and effect, and there are reactions because of increases of one to the other. If consumers are seeing increases in both employment and incomes, the pace will drive consumption, which will drive revenues at businesses.

That, in turn, drives, businesses, which are seeing higher revenue growth. With a faster pace of revenue growth, businesses will take on more risk and expand, which will, in turn, push employment, and the cycle continues.

With this, the money supply grows and expands.

Fro now, we are seeing the stalling in hiring, and by extension, personal incomes and consumption will follow. This will start to show up in the money supply.

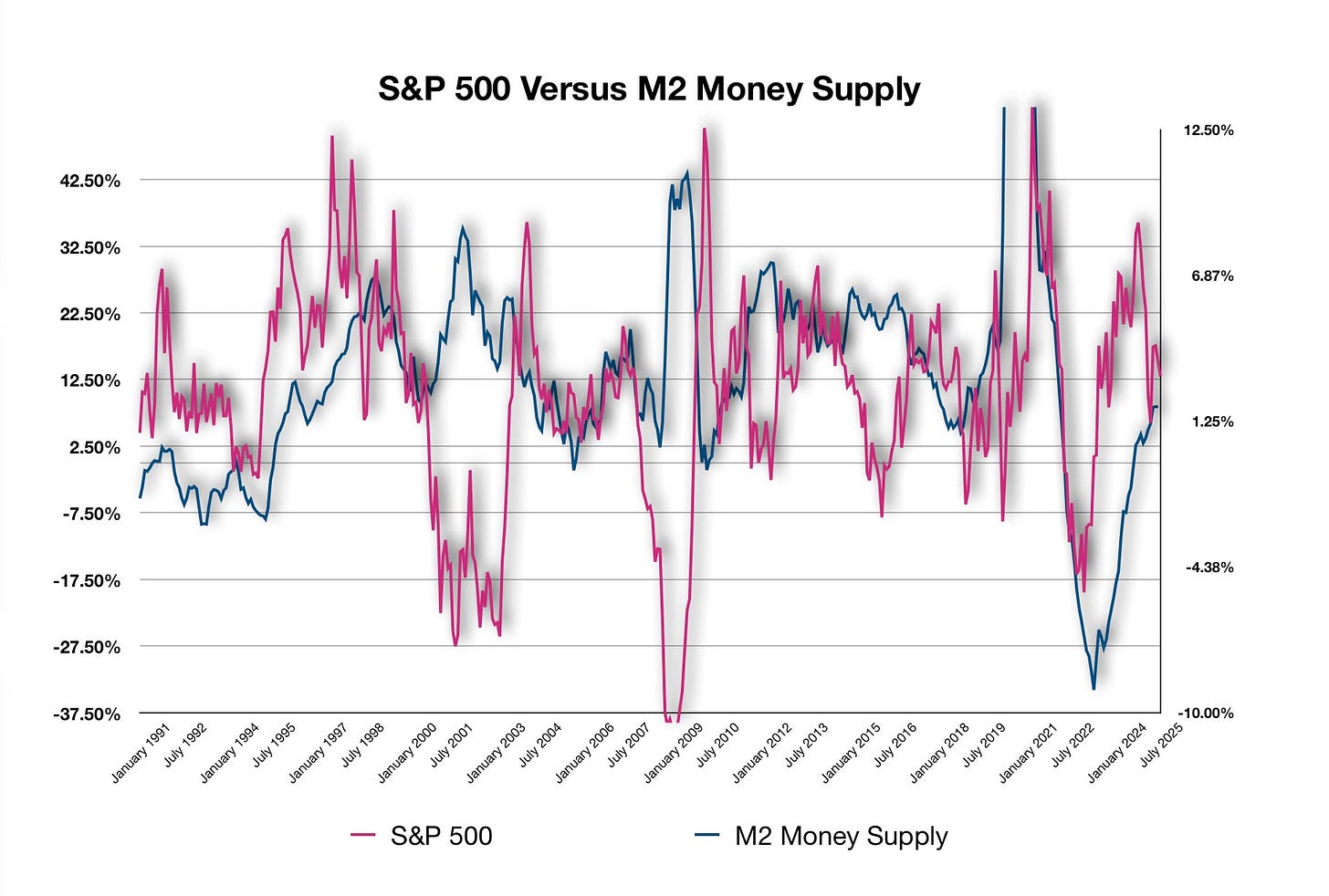

Money Supply Growth Versus Equity Markets

Through all of this, if there is an increase in the rate of growth in the money supply by cause and effect of an increase in the rate of growth in personal incomes & consumption, revenues for companies will increase. If revenues start to slow, so will profits, and P/E ratios will be affected: The stock market will sell off.

The opposite is just as true, of course, and this is where I continue to watch for evidence that the economy is faltering, and from that the stock market.

The Federal Reserve Lowers Interest Rates

The Federal Reserve has lowered its target rate on overnight funds. There is likely a lot more room for this. The tariffs are going to deprive the economy of a lot of potential. Interest rates will help.

About the time that the economy could be entering into a recession, should that occur, the US Supreme Court will very likely strike down all of the tariffs as unconstitutional. The relief in prices will allow the economy to expand.

The United States is the only country on planet earth that is imposing sanctions on itself. Prices of goods sold out of China will be the same for all other countries, and very quickly there will be relief in prices across the board.

But that will only be some relief. Once the tariffs are ruled unconstitutional, the government will have to pay back to importers everything that was paid by them… but not the consumers that bought from them.

That will mean a very large bill will be due and payable by the United States federal government. In addition, there will then be a massive hole in the budget, and both of these are going to drive interest rates significantly higher.

US 10 Year Treasury Yield

It is very important to keep in mind that the Federal Reserve is currently targeting only short-term interest rates. Longer-term interest rates are driven by overall market perceptions, and likely to remain lofty. Then, once the tariffs are removed, and the bill is due, the federal government will have to raise additional funds to finance the debt. This will continue to pressure the longer end of the yield curve upward.

I continue to maintain an overall bearish outlook on bonds with my long-term TBT ETF holding, and this continues to remain stable. I have been selling options against this position to continually bring in premium as these options expire worthless, and I have been doing this since April.

The 10-year yield has not really budged. Eventually, I expect it to move higher.

SPY ETF

There are caveats to all of this: The stock market is not the economy, and a few stocks are responsible for a disproportionate amount of the overall stock market.

I have been playing the long end of the equity market. That has worked out. But as a caution: The options market is pricing in that there will be a move downward. Puts are a premium over calls, which says market participants feel a move downward is more likely than upward.

It may be that these participants are hedging their current long positions, or placing new bets on the short side. Whatever the rationale, there are ample indicators that state the market is overpriced, and likely to correct.

If the money supply starts to falter in its growth because of businesses no longer moving to expand operations and take on risk, this, to me, would be a clear indication that the market is likely to start a move downward.

While most continue to watch the more headline-making, lagging indicators, for me, the money supply growth and the personal income and expenditure growth rates are far more capable of showing what is next in the economy, and by extension, the stock market.