Leading Index - Lagging The Story

Leading Indicators rattled the market on Thursday, but this indicator is largely a lagging indicator. Here is what to expect in the stock market

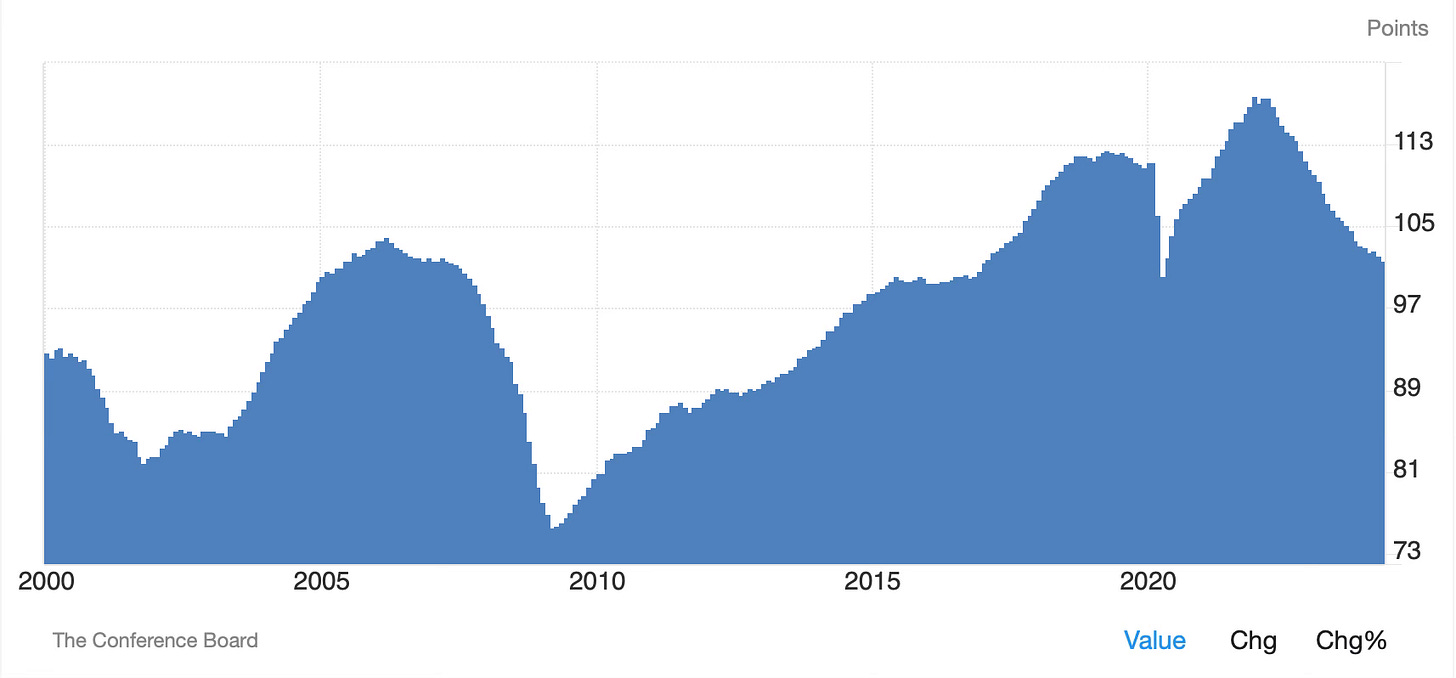

On Thursday, the US Leading Index from the Conference Board was published and the number continues to soften. This indicator shows consumers’ thinking on the future of their situation and how they believe they will fare economically. Mostly, the Leading Index follows along in a similar emotion as income and expenditures. If personal income is increasing due to more and more individuals being hired, the Leading Index follows suit, and vice-versa for declining new hires.

Given that, personal incomes have been narrowly trending just below the median for the past few decades suggesting that growth will be moderate, not robust. On Friday, the Bureau of Economic Analysis will print June’s Personal Incomes, Personal Expenditures, and the PCE Price Index showing us what is the current main focus: Inflation.

The Leading Index moved the markets. But, it did not move the needle. We already knew the information would be sluggishly moving lower and lower since income growth is not moving higher. Given that, this week’s BEA report could shed new light on the future direction of the economy, as well as the continued direction of the Leading Index.