M2 Money Supply Continues To New Highs

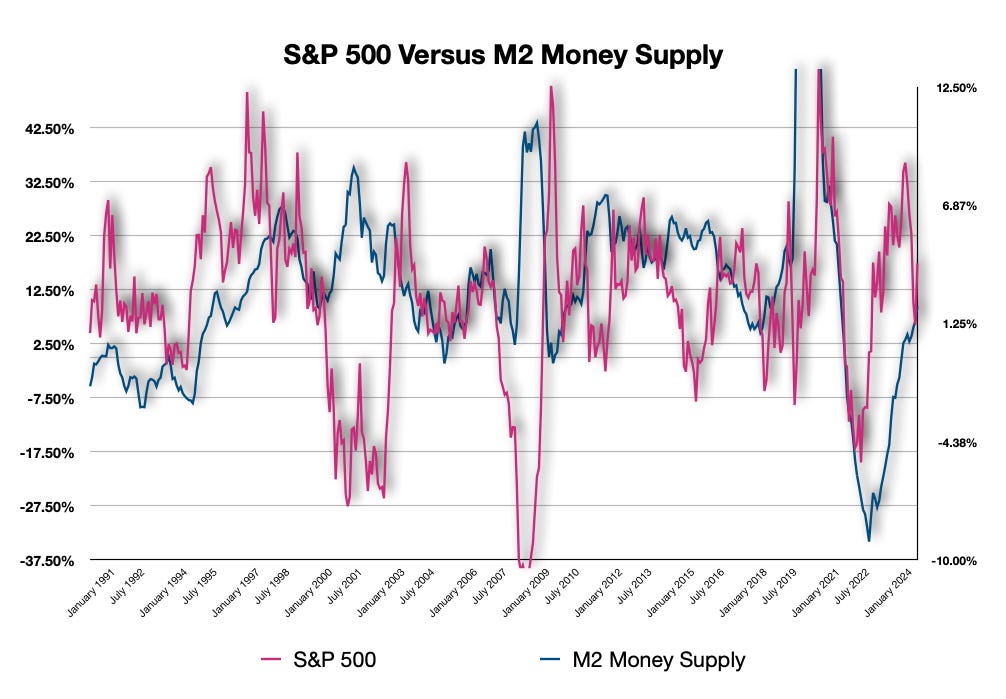

If you want to know what is happening with the economy, and by extension, the stock market, watch the growth rate of the money supply: It's still growing rapidly.

Money is the true fuel of the economy. The supply of money is a key economic indicator. If the money supply is expanding at an increasing rate, economic activity will follow.

The money supply is both a cause and an effect of economic growth. Keep in mind that money grows through fractional banking. As money is deposited into bank accounts, banks lend it out to businesses and consumers. This drives aggregate demand.

The Federal Reserve can push or pull this along. This has been clearly demonstrated with the four QE programs, where the Fed stepped in and pushed liquidity into the system. By buying assets from banks this pushes more funds into the system. At the same time, the Fed can step in and acquire large quantities of assets in the financial system, freeing up investors to buy other investments. Simultaneously, the Fed can step in and buy large quantities of debt assets, which would drive prices up and interest rates down.

The Fed had embarked on reducing its balance sheet. That reduction has bottomed, as you can see in the next chart.

Federal Reserve Balance Sheet

We were told that the Fed was reducing its balance sheet, albeit at a slower pace. That pace appears to now be zero, at least for this month.

The latest M2 Money Stock data shows an overall increase of $23.1B to $6,849.4B (Inflation-adjusted) from $6,826.3B.

With an abundance of money, in order to stimulate demand, interest rates would need to fall. However, there will also be an abundance of debt issuance from the Treasury, as the Federal government is running an unsustainably high deficit. This push & pull would mean that capital would need to be allocated to the debt, which would result in less availability for other assets.

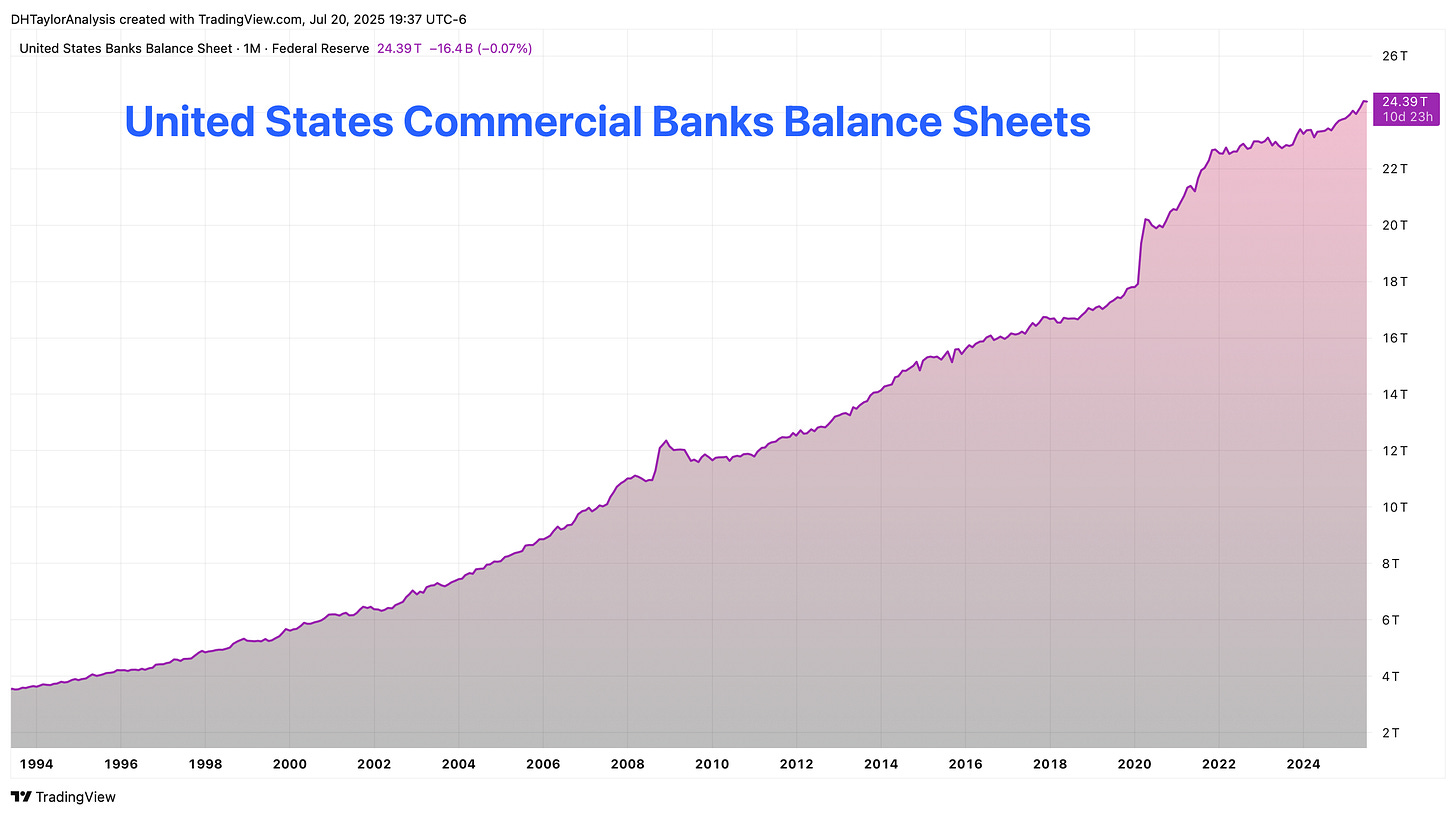

Commercial Bank Balance Sheet

The Fed, as it turns out, is not preparing to raise interest rates by reducing the balance sheet, which would begin to build pressure on the reserves for banks held at the Fed. Instead, the moves of no longer reducing the balance sheet could amount to an announcement that the Fed will be lowering interest rates. At the very least, the Fed is not reducing liquidity in any way.

If the Fed does not take any measures to reduce the pace of the money supply expansion, inflation is likely to jump significantly.

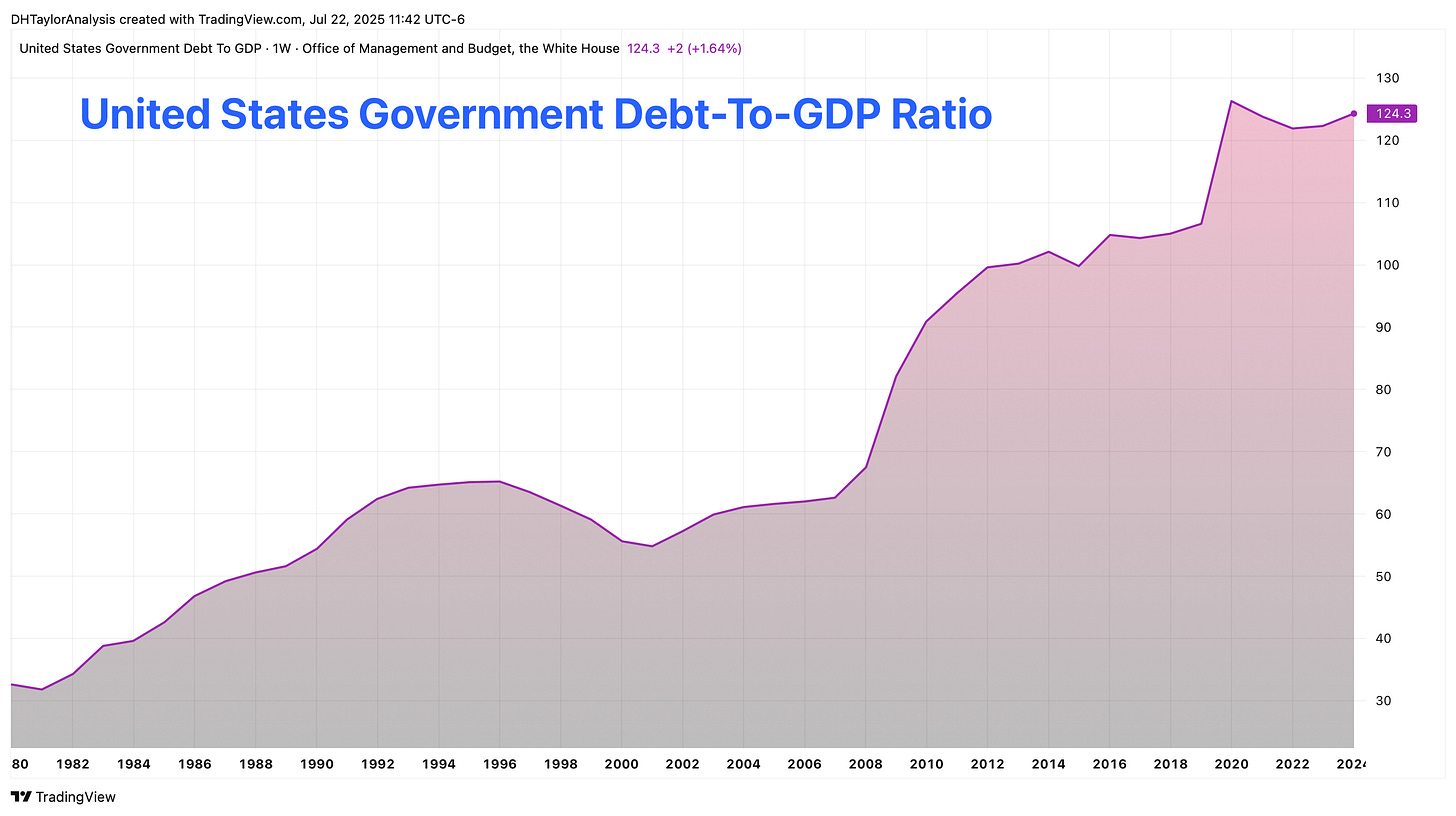

United States Debt-To-GDP Ratio

Above is the chart on the Federal Debt-To-GDP ratio. This is something that needs to be watched. Tax revenue is getting to the point where debt needs to be taken on just to service the debt.

The new budget is expected to add significantly increased debt. This would pull funds away from investments in the private sector to pay for Federal debt.

Money Supply & Economic Activity

There is a fairly strong correlation between the rate of growth in the M2 money supply and the rate of growth of the S&P 500. As the pace of money grows in the economy, all of that money floods into the economy, which ultimately turns into profits that show up in the stock market. Therefore, if you really want to know what is going to happen to the stock market, understanding how the money supply drives the economy is one of the big keys.

Money is increasing at an increasing pace. This will lead to more jobs through firms. More jobs, of course, means more consumer demand.

Money & Inflation

The downside to an increasing money supply is the correlation to price increases. Inflation is a monetary effect. There is more and more money. Prices will increase, and you can follow this pace by comparing the M2 money supply versus the PCE price index.

What Is The Fed Planning?

If the Fed allows the money supply to continue to expand, what they will be doing is essentially printing away the debt. If the money supply continues to grow at a rapid pace, this dilutes past debt. However, that means there will be future inflation.

The Fed, ultimately, is stuck between the proverbial rock and a hard place.

There is continued pressure on the Fed to lower interest rates to spur the economy's growth at a faster pace. Lower interest rates would create inflation in an environment where inflation is already growing.

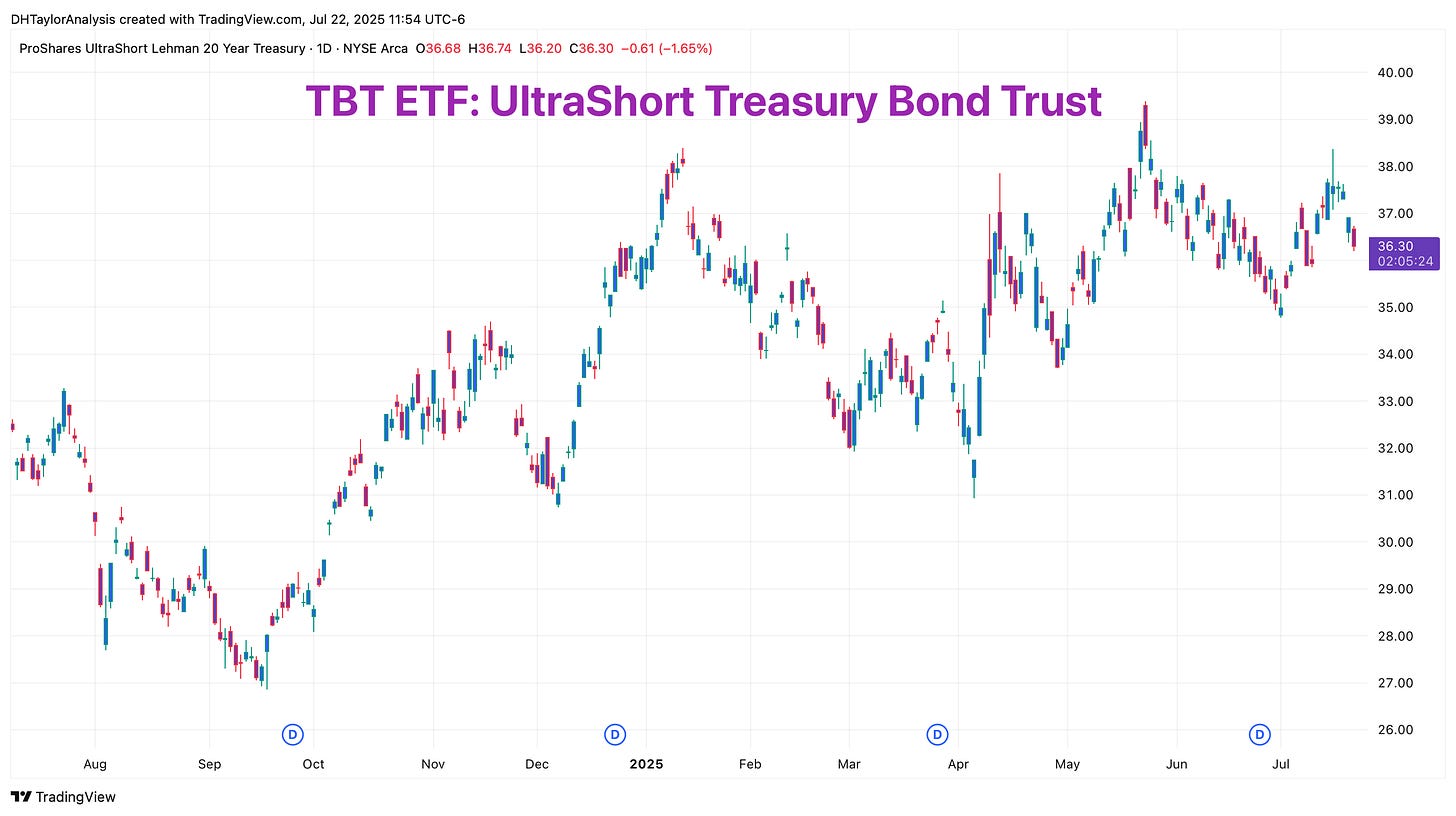

Simultaneously, the debt level will pressure long-term interest rates. I still expect higher long-term interest rates, but that will be a long, slow process.

My Trades

I have been long TBT ETF for some time, and well above my entry price level. Over the past few weeks and months, I have been continually selling options to generate premium. This lowers my overall ‘entry’ point when the options expire worthless. This is a long-term outlook. Eventually, I expect TBT ETF to move much higher. This move may take many months, if not up to 1.5 years, to finally really happen.

I expect the effects of the tariffs to show up in inflation data over the next several months. When that does happen, the markets will start to react. If the Fed does lower interest rates soon, this will only make inflation data more problematic in the future.

In the meantime, the stock market will probably continue higher. More and more money in the system means more and more profits for companies. I’m not certain that is necessarily a good thing. But I will make my money as it happens.