No Recession Worries Needed - For Now

Unemployment data worried the markets with recession fears. New employment data cooled those worries and the stock market rebounded - here is what to watch.

The past week saw a tremendous swing in the stock market. First, on Sunday evening, the Bank of Japan raised interest rates in surprise, sending the Japanese yen upward versus its trade counterparts. This jolted the world’s stock markets. However, at the same time, economic indicators printed the week prior showed continued slowing in employment, making for big jitters going into the week.

But, employment data from the Department of Labor arrived again on Thursday printing initial jobless claims and continuing jobless claims. The print was not nearly as dire as market participants had anticipated. This drove the stock market higher.

The question is: what is the economic outlook and will we continue to see a jittery market, or was Friday’s move consistent and will buyers continue to show up?

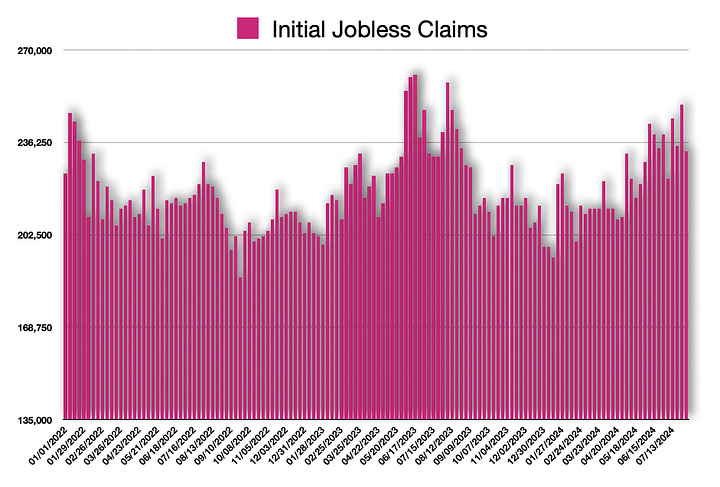

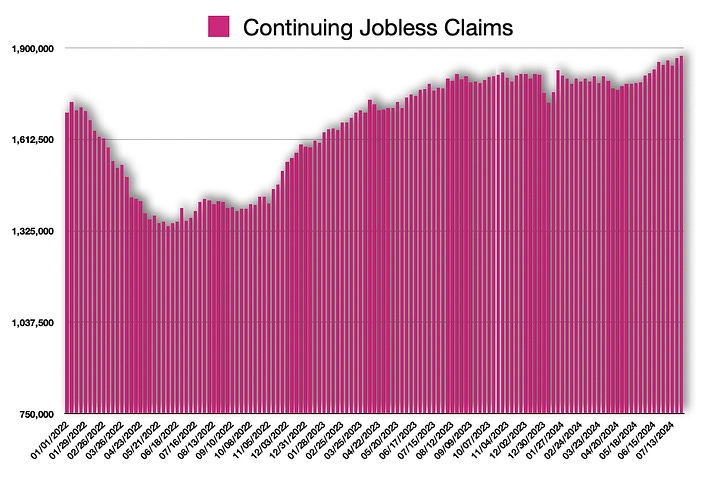

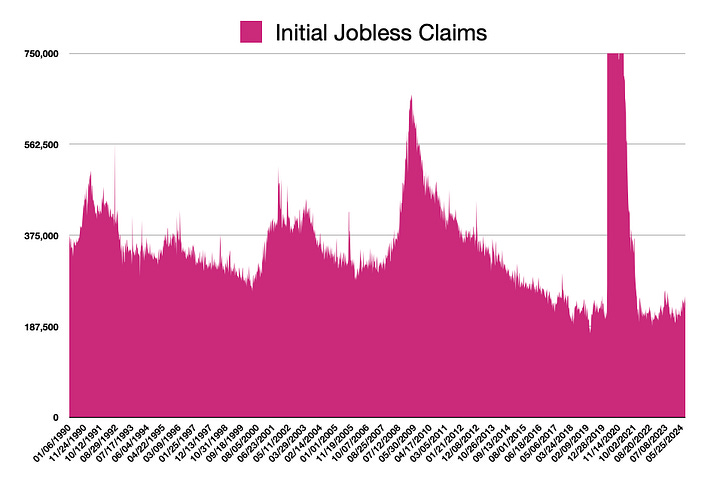

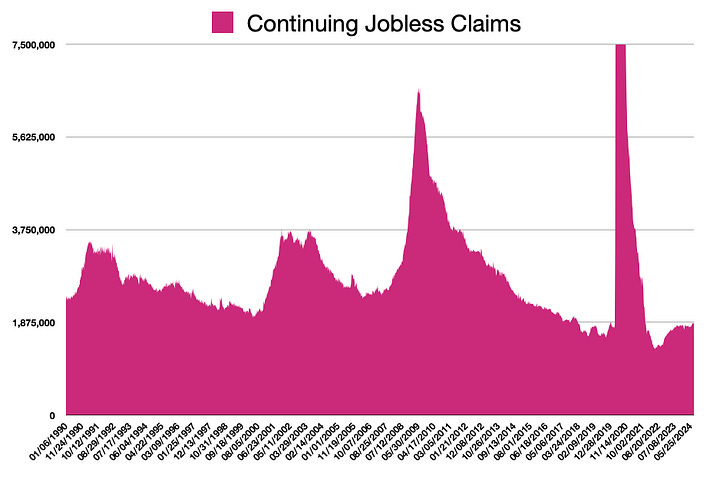

Jobless Claims

Over the past couple of years, both initial jobless claims and continuing jobless claims have edged higher. But, what is important to always point out is that the move higher is coming from all-time lows. So, if someone was merely looking at the charts above they could surmise that the economy is contracting rapidly and we are entering a recession with all of the job losses.

A Bigger Look at Jobless Claims

When you step back and look at a far bigger picture, the economy is nowhere near a recession from the perspective of jobs. However, jobs are a lagging indicator. For now, I do not see negative growth—the ingredient for a recession. What I do see is a moderation in the pace of growth. The US economy continues to expand. There is still job growth as we witnessed the previous Friday with non-farm payrolls printing 6-figure job growth. But, the unemployment rate is still climbing, albeit at a slow pace.

Regardless, a recession is far from imminent. I have not called for one just yet as we continue to see growth in the economy. Looking at the main driving factor for the economy allows for the ability to see what the economic potential is.

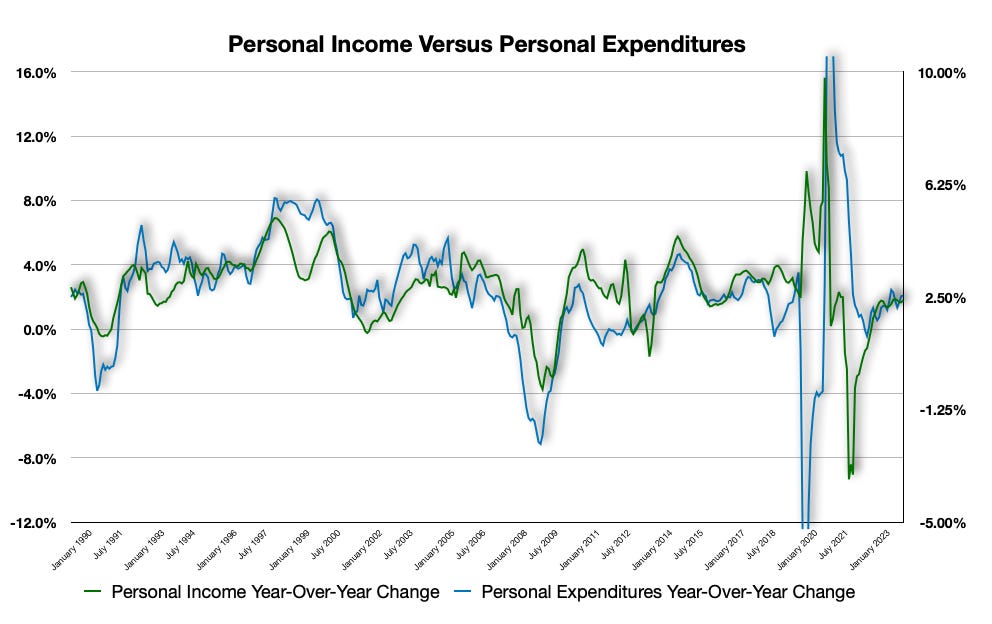

Income & Expenditure Growth

The US economy is primarily a consumer-led economy accounting for well over 70% of economic activity. The growth in incomes, whether increasing or decreasing, drives expenditures. Those expenditures turn into revenues for companies, which drives stock prices. Following this trail enables a stock trader to continually understand what is next in the stock market.

For now, income growth is middle-ground, and expenditures are tightly correlated with incomes. The current growth rate is coming off of big swings driven by income acceleration from stimulus checks from COVID. The US economy reached record employment levels. Now, that is moderating.

If the economy slows somewhat to a GDP growth rate of about 2.5%, this is a normalization of economic growth. But, this would not get to the measuring stick of a recession—there would still be positive economic growth.

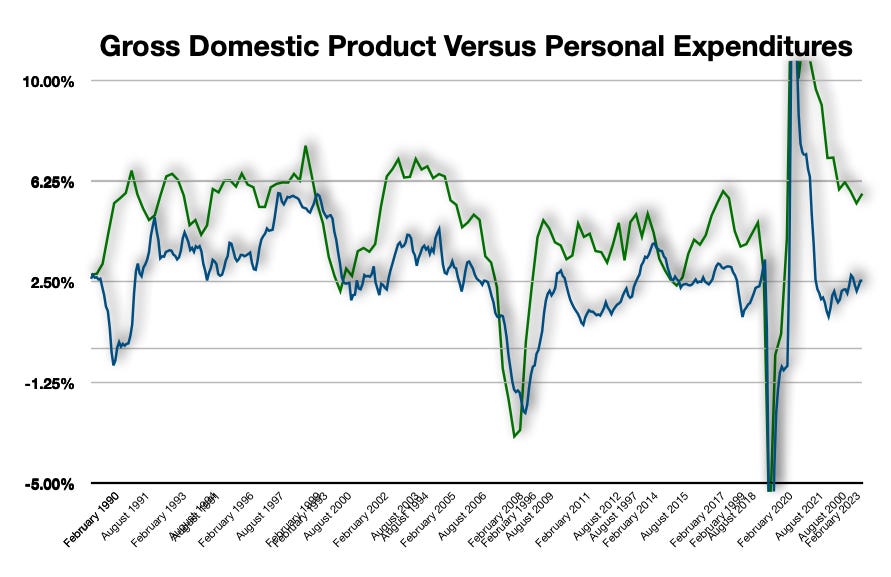

Gross Domestic Product

This chart above, Gross Domestic Product versus Personal Expenditures, sums everything up. GDP is the measurement of economic activity within a country. And, personal expenditures is the driver. Other factors account for economic activity within a country such as government expenditures and business expenditures. However, government expenditures are more flatline in growth rates because government expenditures tend to be fairly consistent. Business growth is a response to the demand curve which is driven by the consumer. Because of this, I focus heavily on the consumer and their respective state.

With a decline in employment, expenditures will slow overall. But, this does not mean expenditure growth will go to negative. I do think, however, that expenditure growth will drop and get close to zero.

The Stock Market

The stock market reacted badly from deleveraging via the FX market on the heels of employment data that was softer than expected. But, the economy is a long way away from proof of a recession. During this, interest rates re likely to remain a bit lofty, but continue to move lower in the eyes of softer inflation. The Consumer Price Index arrives on Wednesday and likely will continue to show a decline in price pressures.

My belief remains that US Treasury yields will continue to soften, but do so a slow pace. During this, stocks may be volatile as revaluations occur. I am not sure we see the highs again, but the stock market has a very short-term memory. Instead, it is possible that we see continued volatility. Eventually, however, I do expect that the stock market will wobble. But, that is many months from now.