No Tariffs—Now What?

The tariffs were a bulwark of the Big Beautiful Bill. Now that the tariffs are ruled unconstitutional, what happens next with the budget and economy?

An international trade court in Washington, D.C., just ruled that Trump overstepped his constitutional authority when he imposed his sweeping tariffs against all countries, including the uninhabited one, covered in ice, and ruled by penguins.

The tariffs had one real purpose: Raise taxes on US consumers to afford the tax cuts for corporations and higher-income earners in what is being called: The Big Beautiful Bill. Without the tariffs, there will be a $350 billion - $425 billion annual hole that needs to be filled. Either that, or the Big Beautiful Bill needs to be far smaller and much less attractive to a certain key demographic.

Otherwise, the bond market will tell the US government what it thinks.

Where to Now?

As I am sitting down writing this piece, the stock market is well off its highs.

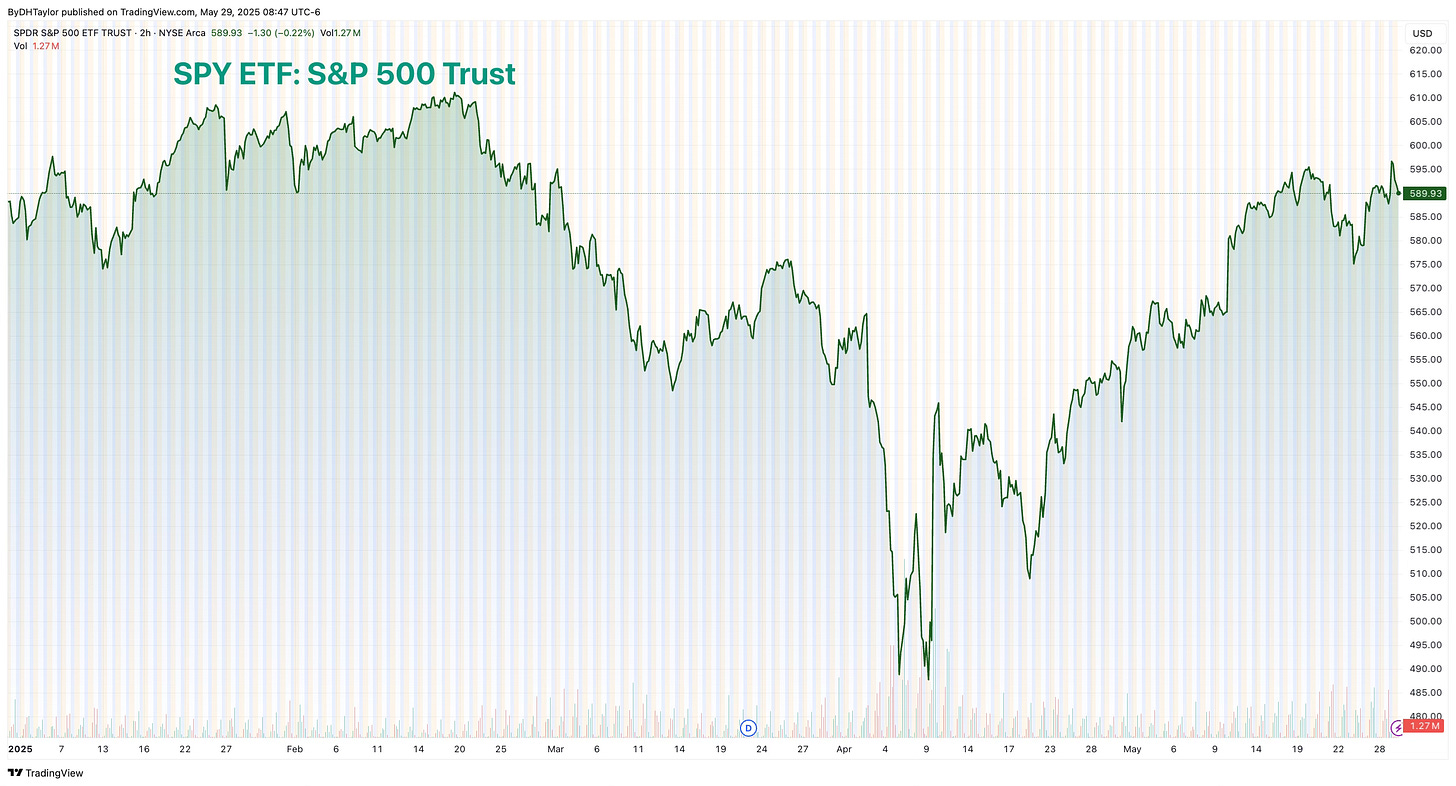

This is a 3-minute chart on SPY ETF, the S&P 500 Trust ETF. You can see the initial reaction to the court decision in the market as the stock market rallied in overnight trading.

However, since its opening this morning, SPY ETF has pushed lower. This is the opposite of what you would expect.

Removing the tariffs is a key element that would bring confidence back to the economy, and this should have been celebrated robustly in the stock market.

The selling tells a different story, of course.

The US Treasury market is seeing a big drop in bond yields. Initially, the 10-year Treasury yield spiked higher on the news, but has since moved significantly lower. Again, this is the opposite of what you would expect.

What Gives?

First, we have not heard the end of the story on the tariffs, I believe. To begin with, there will be an appeal. That will take about 2.5 years, at its earliest. At this point, the courts would be in no hurry.

However, there is an additional avenue that the president can utilize to impose sweeping tariffs under another law. This additional law is more targeted and effective.

The 1974 Trade Act gives the executive the ability to hit a country with tariffs. But, they may only be in place for 150 days.

There was an excellent breakdown of yesterday’s ruling on tariffs out of VOX, of which this paragraph is an excellent summary of what is likely to be used next:

The court’s second significant holding arises out of Trump’s claim that the tariffs are needed to address the nation’s trade deficit — the fact that Americans buy more goods from foreign nations than we export. But, as the trade court explains, there is a separate federal law — Section 122 of the Trade Act of 1974 — which governs the president’s power to impose tariffs in response to trade deficits.

Trump cannot use the current law, which he is quoted as stating as the rationale for tariffs. But he can still impose tariffs; so much for that victory.

So, on the one hand, the tariffs are gone. On the other hand, this is temporary at best. The administration is still very likely to impose sweeping tariffs because the Big Beautiful Bill needs to fill a hole.

What is Next?

Tariffs need to happen because of the Big Beautiful Bill. Otherwise, the economic problems of the Big Ugly Hole from the tax cuts will be enormous. Expect tariffs to happen another way. Expect these tariffs to be implemented rapidly through that other avenue.

Because of the tariffs, economic contraction will still occur—it will just happen under a different authority.

Because of this, the stock market has already contained its excitement. And, for that matter, so has the bond market.