Non-Farm Payrolls Slows While Unemployment Moves Up

BLS released the non-farm payrolls showing smaller-than-expected increase while the unemployment rate increases slightly - What this means for the stock market & bond market

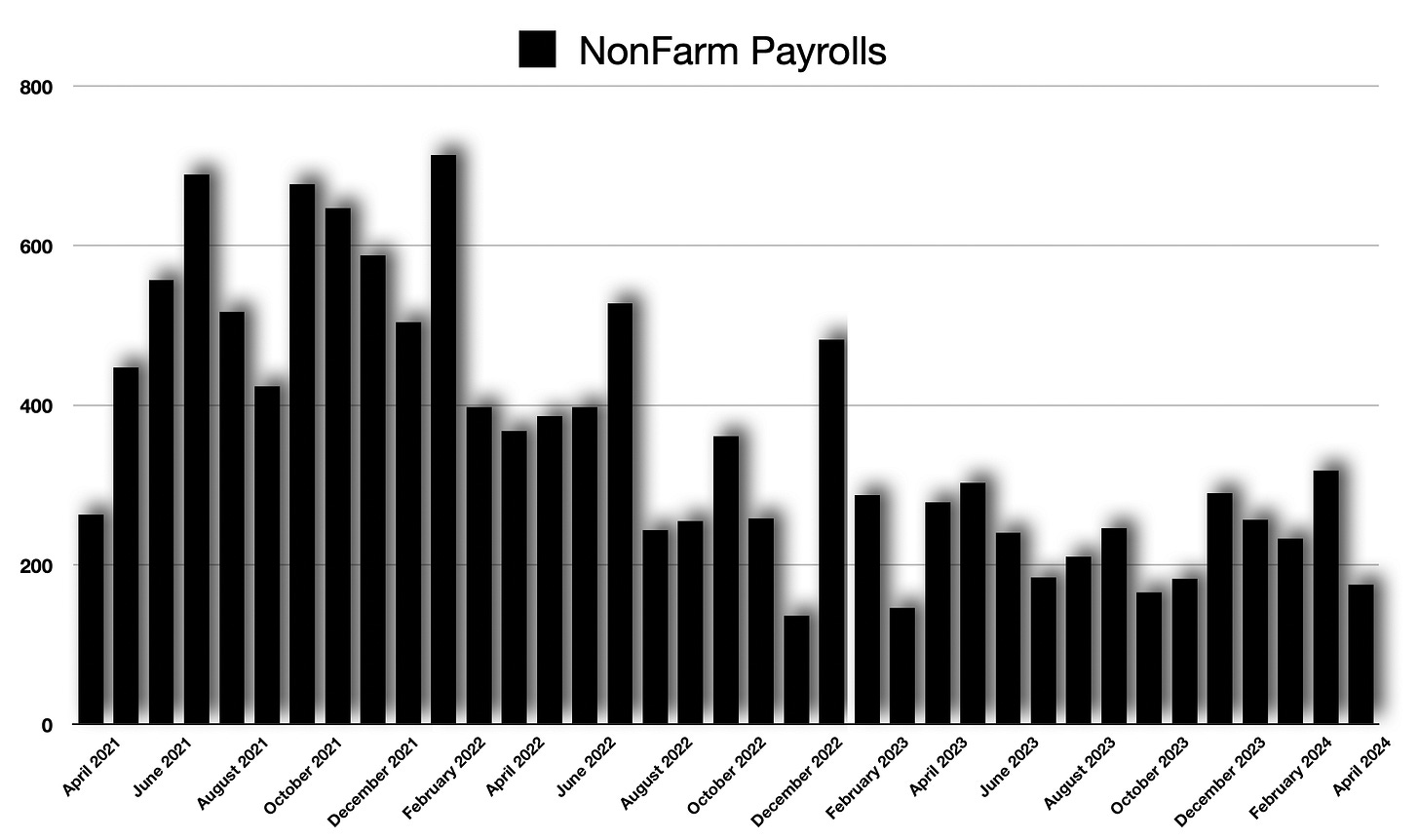

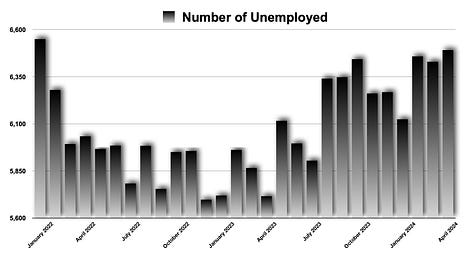

The Bureau of Labor Statistics released employment data. Non-farm payrolls came in with an increase of 175K - but, there were also slight downward revisions to previous numbers. The takeaway is that employment growth is waning. The numbers, as you can see in the chart above, show that employment growth has been softening. This is something that I have been keying in on as economic growth overall is beginning to slow. One of the important factors to this is that employment is a lagging indicator - driven by expenditure growth levels.

I have said this many times: There simply is not much growth left to push employment further. This is a key factor in what I believe will be occurring in the economy, and this will play out in the stock market and bond market.

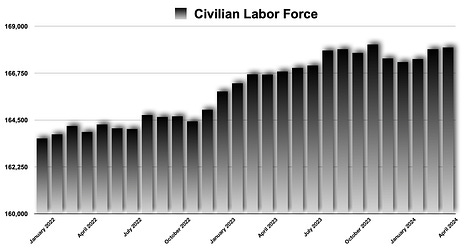

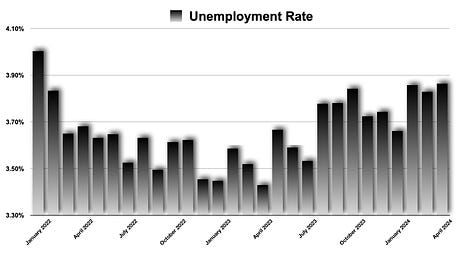

Simultaneously, the unemployment rate ticked upward ever so slightly from 3.829% to 3.864% - a shift of ~0.055%. The underlying theme is the same here: employment is running at full speed.

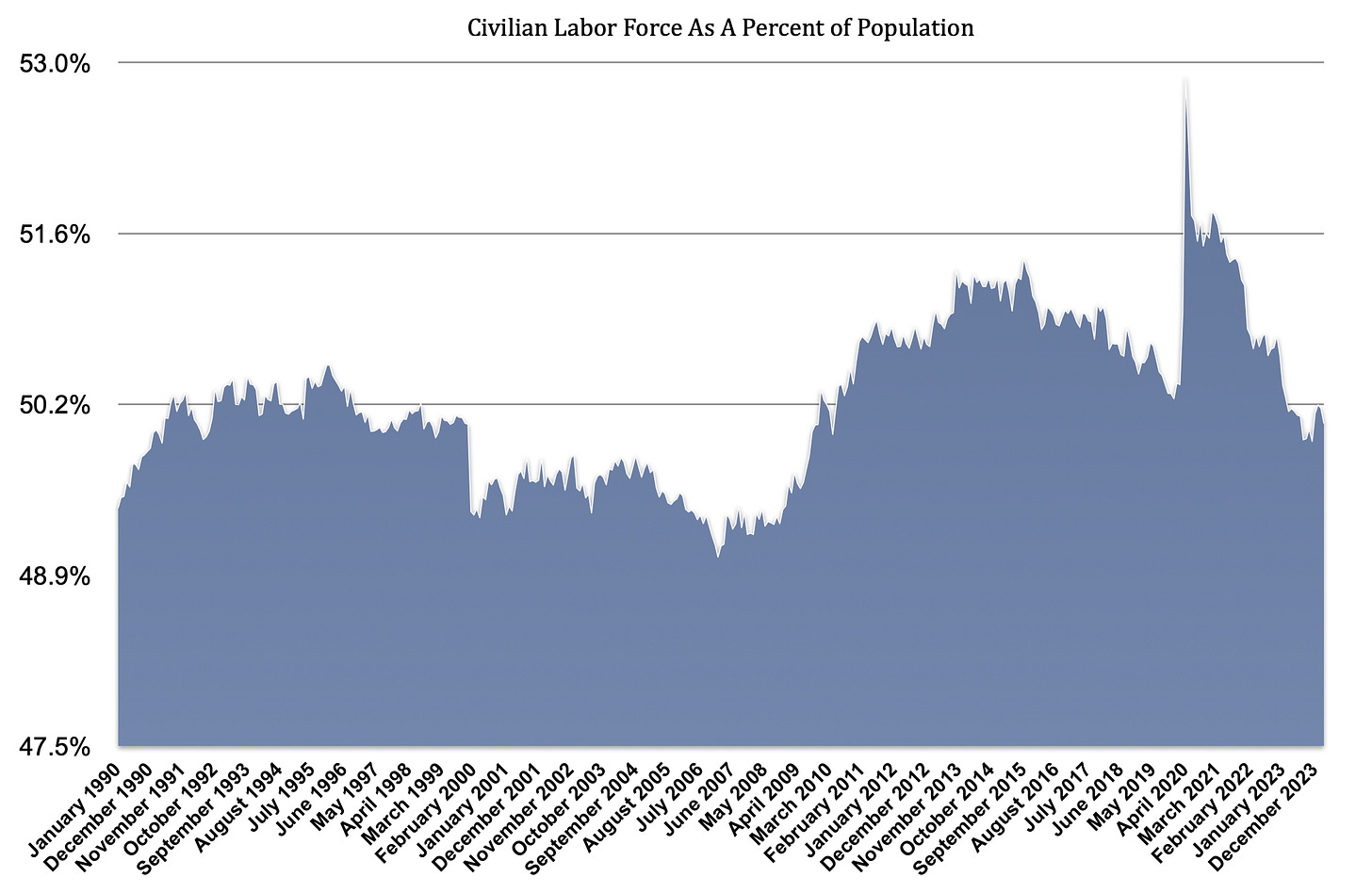

As a percentage of the total population, the Civilian Labor Force is fairly neutral with regard to how many individuals within the US population the Bureau of Labor Statistics feels wants a job. The fact that unemployment is low has not necessarily drawn in new individuals into the labor force despite price pressures forcing families to shift lifestyles in order to make ends meet. I felt this was an interesting chart to put together. I would have assumed that the on a percentage basis, and considering the low unemployment level, the civilian labor force would have been higher. It is not: It is moving lower.

Economic Growth Is Slowing

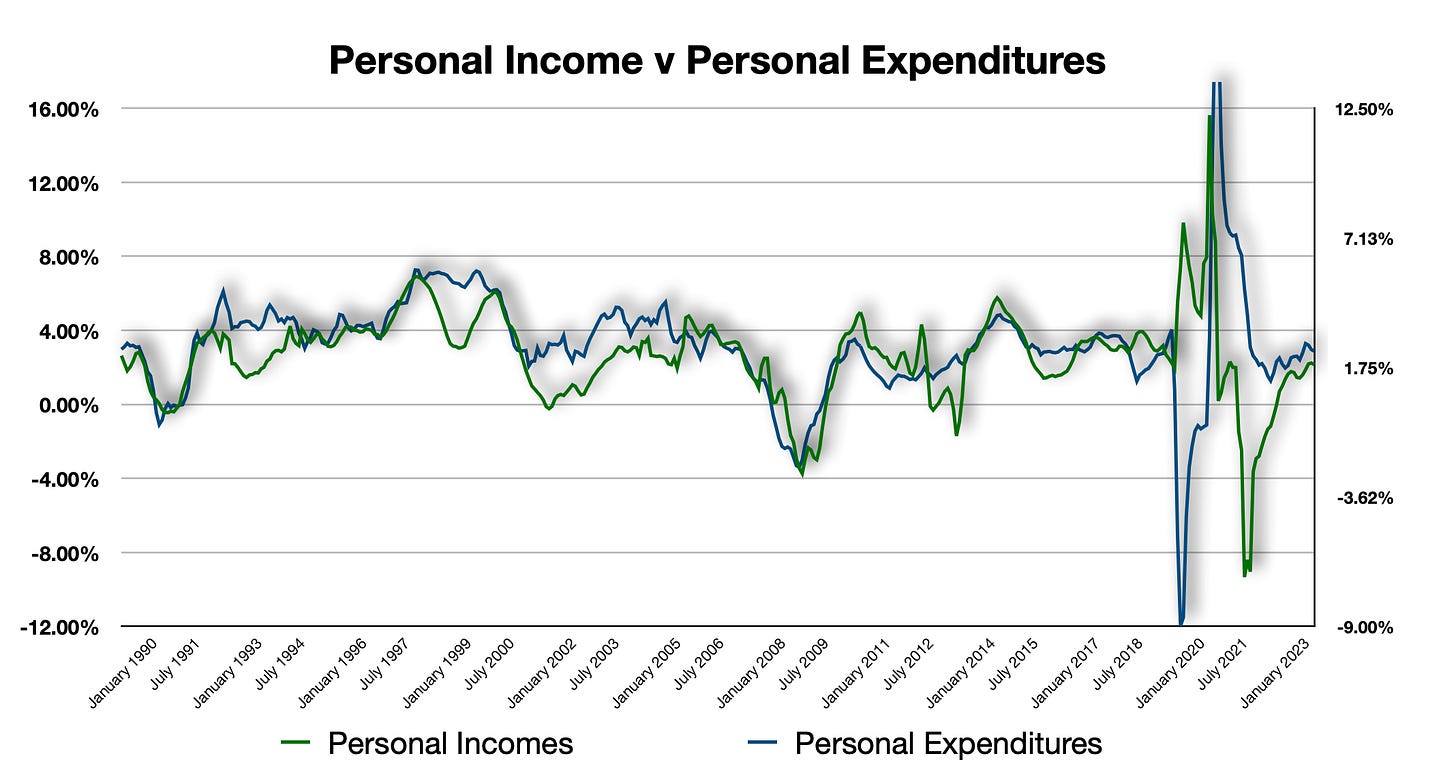

Labor Growth is driven by personal expenditures. Businesses respond to the consumption of consumers. Labor is a lagging indicator and the two most important factors to focus on are that there simply is not anything that would push individuals off of their couches - the proverbial stay-at-home-girlfriends we hear about on TikTok, that could drive employment gains further.

At the same time, income growth has leveled out recently. The stimulus checks are all cashed and spent, and the Biden Inflation Reduction Act has pushed the economy as significantly as it can for now - any further gains are going to be incremental.

Likewise, higher interest rates are limiting the finite incomes available to families. Income growth will continue at its median level and expenditures will follow, but the higher interest rates will have a limiting effect.

Bond Yields Respond to Employment Data

The Federal Reserve just met on Wednesday and left key short-term interest rates were they are. Since that time, the US 10 Year Treasury Yield, a key metric laying between the 2-Year & longer term interest rates as well as the benchmark investment rate, has slowly slid lower, but not by much.

The Federal Reserve likely will be forced to wait on making moves in interest rates until just after the US Presidential Election on November 5th - The Fed will not want to appear to sway the election one way or another. The Fed pushed interest rates upward throughout 2022 & 2023 and has paused since the summer of 2023. This would mean that the Fed will force higher interest rates on to consumers for ~15 months until they can make a move lower. As of right now, employment is strong enough that this is not an issue. And, consumption is still ample to keep the economy perpetuating, but not much in the way of new growth.

The Fed has signaled that there is likely no rationale to move interest rates upward anymore. Inflation pressures are still present, but six months from now those price pressures will have abated enough that the Fed will be able to slacken policy restrictions.

I do not see interest rates going higher and any moves upward in yield would merit me stepping in to buy bonds - the inverse relationship between price and yield.

The Stock Market And Employment Data

Along with the trend lower in interest rates since the Fed meeting and now employment data, the stock market has been inching higher. Interest rates are not going to move upward anymore and this relief will mean consumers can get back to business and do what they do best: Spend money.

But, the stock market has not been sailing higher and higher. Instead, the move higher in the stock market has been modest.

While the relief in higher interest rates will mean consumers will see less pressure paying down debts, there will be damage to the overall economy achieving this.

Consumers are already spending less - as noted by McDonalds, PepsiCo, & Starbucks who have collectively seen declines in foot traffic and revenues. Companies are going to shift to the lower expenditure levels and declining revenues by laying off employees. This will mean lower revenues as the unemployment level increases. While there is likely not a snowflake turning into an avalanche scenario at this stage, slower growth rates are very likely to be what we see next. That means we would see lower stock prices. This is why the stock market has on the one hand trended slightly upward, on the other hand, it has been contained.

My Take

I am going to be watching for what happens next with personal incomes & expenditures, and the lagging indicators such as employment numbers and CPI data. I fully expect that a labor force that is pushed to its limits will start to soften as the consumer continues to pay higher interest rates on accumulated debts. Companies that are seeing misses in revenues will start to take action to protect a bottom line that is being affected at the top line. This will translate into aggregate incomes declining, and lower expenditures across the board.

While I do not necessarily see a recession at this stage, a perfect soft landing may not happen, either. In the meantime, I have been accumulating TLT stock this past week and will continue to do so as interest rate levels continually move lower. The stock market may move up today, but I expect that to be short lived and the reality of slower growth rates means stock investors, savvy investors, will take profits. The broader stock market is off its highs, and I think that high level is gone for a while until interest rates get to a far more accommodative level, consumers finish retrenching, and economic expansion gets back under way.

This may take some time - the Fed will not lower interest rates until early November. I just wonder how much damage will be done while the Fed sits on its hands.