Seismic Week For Economy & Market

A virtual Olympics of economic data, events, and geopolitical events just occurred this past week: Here is what is next, and what to expect.

The market, which had been working on a model that the effects of the tariffs had not made their way into the economy, sold off heavily on Thursday and Friday when non-farm payroll data from previous months were revised downward heavily.

New job creation in the United States is far lower than thought. Friday’s non-farm payroll showed an increase of a mere 73K new jobs—I believe this number will be revised downward in future updates. The 73K was below the consensus of the ~110K expectations.

The real damage began with the downward revisions of May and June that cumulatively totaled 258,000 fewer jobs created than originally reported.

The market had sold off on Wednesday due to the Federal Reserve having stood its ground on interest rate decreases because it believed the job market was very resilient. The newly revised data throws that entire framework into the garbage.

While the stock market had rallied on Wednesday night because of strong financial reports from companies, Thursday’s activity brought the market right back down. Then, Friday’s activity saw the market fall an additional 2.00%.

Where do we go from here?

On the one hand, the Federal Reserve had made its decision about interest rates based on poor data. Therefore, the Fed will have to look anew at the reality of the economy. The Fed will have ample ammunition to lower interest rates now. The market will anticipate this.

On the other hand, the stock market had been rallying because of the lack of effect on the job market. This week, three Fed governors will speak, and likely they will revise their position on interest rates.

But there should be some caution here: Inflation is gaining, and will continue to increase. This may be a permanent feature from this point forward. The economy may print slower job growth with growing inflation, a.k.a., stagflation.

Employment

The big surprise, as mentioned, was the severe drop in non-farm payrolls in the previous two months. My thinking is that this month’s data, July’s data, gets revised downward later as well. In the meantime, this triggers the Fed’s ability to lower interest rates.

For now, we wait to see how the stock market performs, knowing that the economy is cooling as much as it is because of the tariffs.

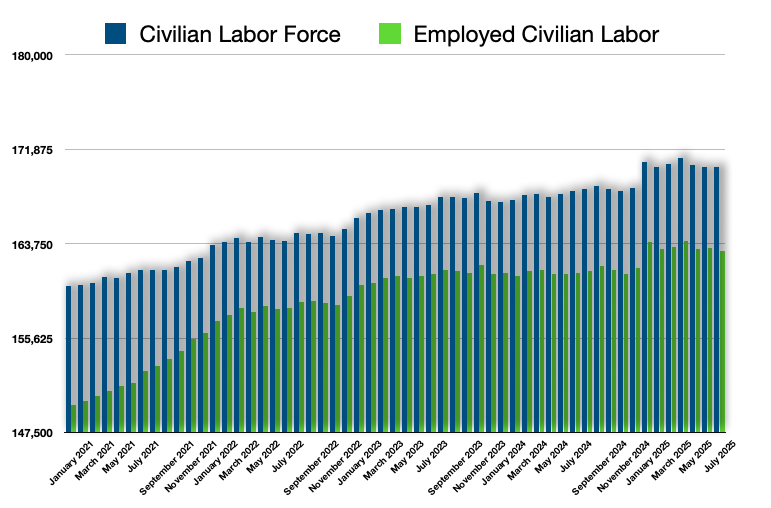

With regard to the civilian labor force and those employed, the country is running at a 4.2% unemployment rate, which is near historically low levels.

The thing to point out is that there is net positive job growth. However, it is slower job growth than what was seen prior to the tariffs.

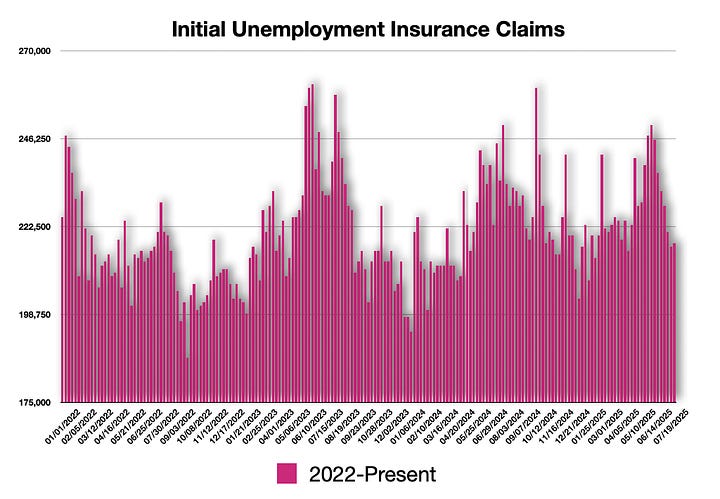

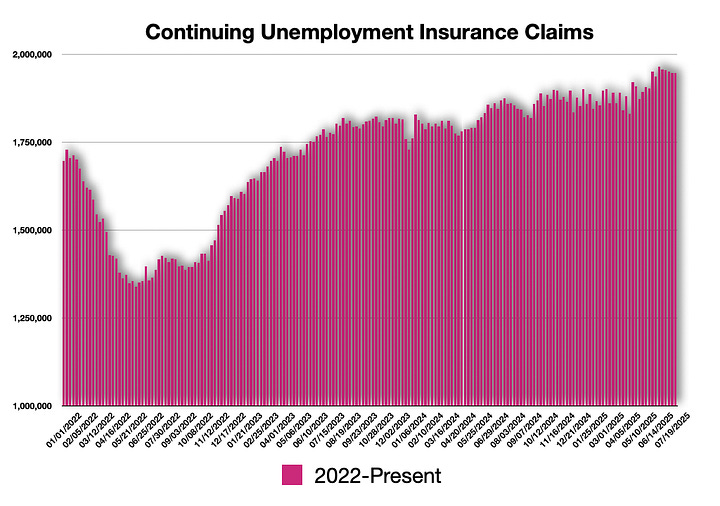

Initial Claims

Initial claims and continuing claims are reported every Thursday morning. This is a number I look to every Thursday. This number relies upon individuals filing a claim to the government.

I have mentioned this previously many times: I’m not the world’s biggest fan of non-farm payrolls as an indicator. The data relies upon randomized phone calls. The revisions reiterate why I am not a big fan of this data point.

The only key takeaway for the jobs data is that the unemployment rate remains very low, but job growth is low.

Next, we ask what is happening with inflation.

Money Supply

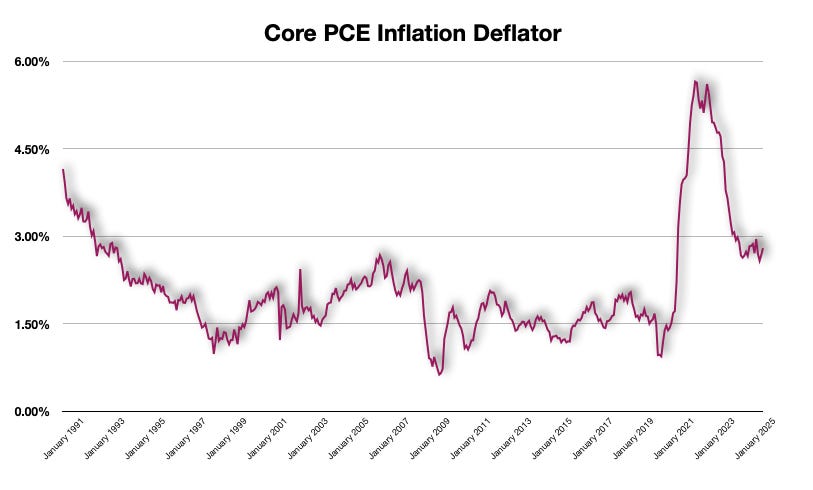

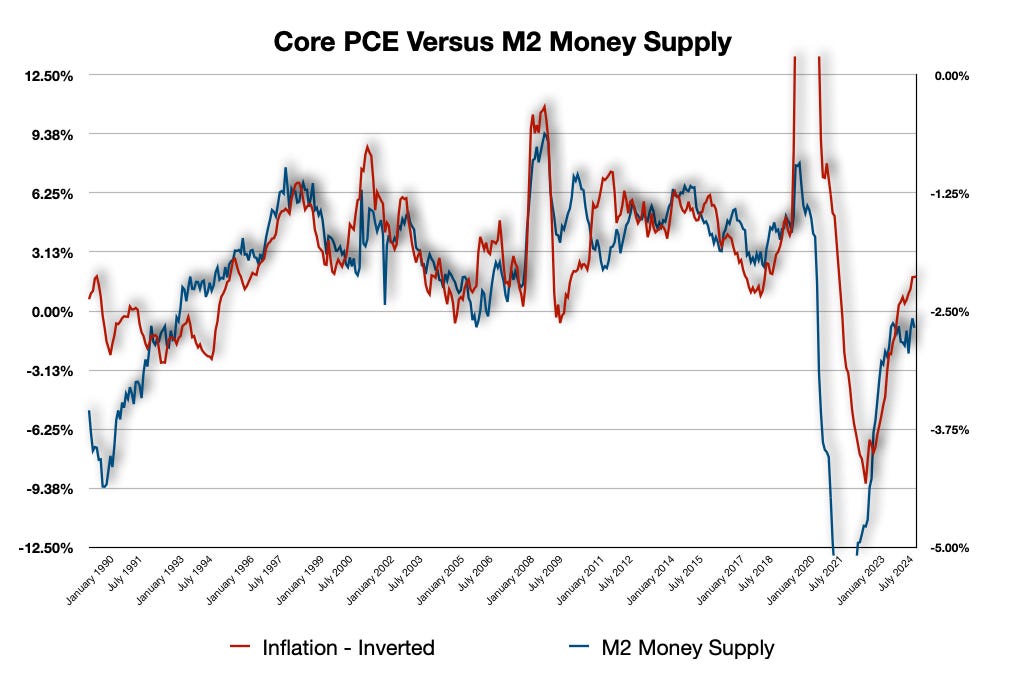

Inflation is a purely monetary phenomenon. If the money supply is growing at a faster rate, inflation follows suit. The latest data on M2 shows an ever-increasing money supply. Inflation will continue to follow. Comparing inflation numbers to the growth rate of the money supply, you can clearly see the correlation and what will follow next.

Inflation

On Thursday, we also got PCE inflation along with personal income and personal consumption. Inflation numbers remain elevated. The arbitrarily-chosen 2.00% year-over-year target rate appears out of reach. When you factor in the pace of growth of the M2 money supply and the fact that the Federal Reserve will likely loosen policy, I expect inflation to pick up quickly.

I look to this chart frequently to show the correlation between the pace of growth of the money supply and inflation:

With the debt-to-GDP ratio about to balloon even further out of control, there is simply no way monetary policy can contain inflation. The federal government would have to reduce the budget significantly while also increasing taxes. The current administration just did the complete opposite.

Effectively, the government is going to have to print away the debt. That means significantly higher price pressures are coming; the M2 money supply growth rate shows this will occur.

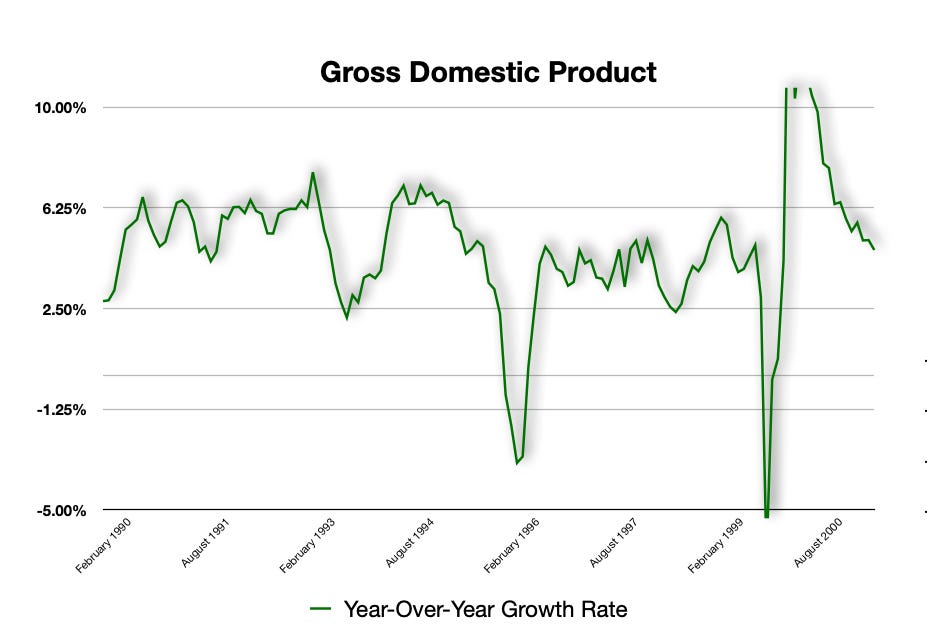

GDP Growth

The economy reported strong growth in GDP. But don’t take the headline number at face value. When they factor in GDP growth, they subtract imports from the total number. Imports are declining. This gives a slightly false sense of security that the economy actually grew. The fact is, the United States imported less, which left the total number higher.

If employment growth declines, the economy will still see continued increases in overall economic growth. However, I believe this growth rate will narrow closer to zero growth.

US Dollar Index

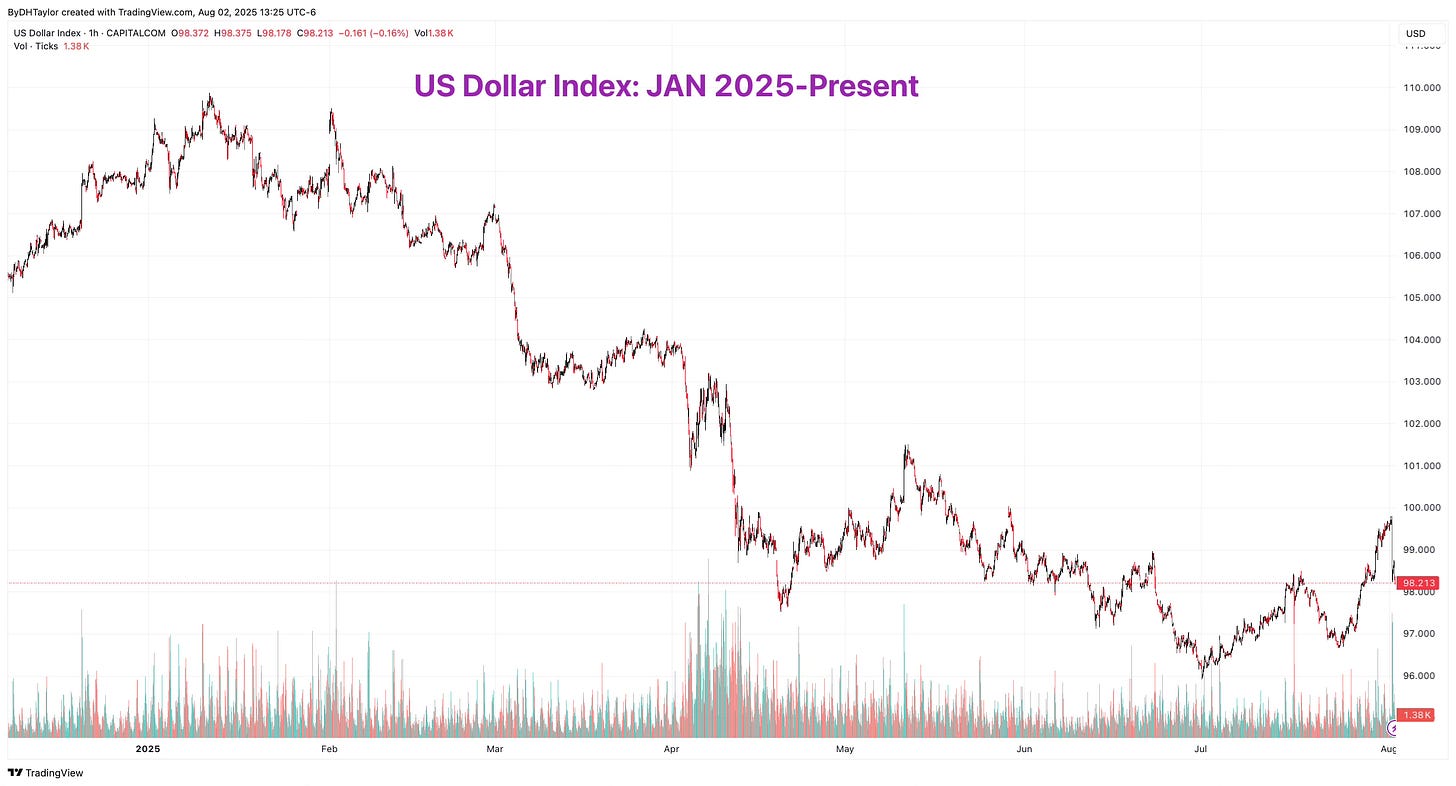

If you want to increase the budget while decreasing tax intake, the end result will be to trash the dollar. The latest move in the dollar shows that with the Federal Reserve now more likely to shift short-term interest rates downward, the Dollar index sold off. The reason is the differential between the United States and its counterparts. If the differential narrows, as it will, there is no incentive to be in dollars.

This chart above shows the more dramatic, longer-term move in the dollar since the beginning of this year. The current policies will depreciate the dollar over time. With slower economic growth, the Federal Reserve will lower interest rates.

But these moves are only going to be with the short-term interest rates. Longer rates, such as the US 10-Year Treasury yield, will move somewhat lower to start, but there will be limitations to the decline in interest rates. The reason? The deficit wall is coming from slower economic growth driven by the tariffs.

Interest Rates - How I Am Playing This Move

Friday’s move was pronounced on the US 10-year yield. But the overall picture remains contained, as this next chart shows on the 10-year since 2020:

Short-term interest rates have a lot of room to move downward now that there is proof of the tariffs affecting the economy. But the avalanche of debt will contain the longer end of the yield curve. So, while the shorter-term interest rates moved downward sharply on Friday, and are likely to continue to move downward, I expect the Golden Era of interest rates is over; from here, the world will see higher long-term interest rates.

I remain in my TBT ETF trade, the inverse Treasury Bond holding I have. I expect that interest rates will continue to rise over the longer term.

In the meantime, I continue to bring in premium by selling short options against my positions. The recent move higher in TLT ETF, the chart above, is nothing more to me than an opportunity to step in and sell calls against this. I am looking for a short-term vertical call spread to sell where I can risk approximately $1.00 in total, while bringing in about $0.12-$0.15 on the trade, then continually sell that position strategy for many weeks to come. I am hoping to earn about $2.25 in total over the course of the following few months with this strategy alone.

Buy Gold - How I Am Playing Inflation

Inflation is coming. The price of gold will be heading higher. If the Fed lowers interest rates, something I highly anticipate and will likely tip its hand this week, the stock market may very well rally again from this brief selloff. But it will be gold that moves the highest as the metal aligns itself with purchasing power.

I have increasingly been moving into gold because of the money supply. The Fed largely stopped the decline with its balance sheet; they are allowing the money supply to increase. Gold will follow suit, and it will do so rapidly. Over time, I expect the price of gold to move much higher.

There are a few instruments that I have been buying into. GLD ETF is an excellent way to add gold to a portfolio, but I am also moving into gold derivatives with crypto via PAXG.

Can you elaborate on: "I am also moving into gold derivatives with crypto via PAXG."