Selling the Spike - The VIX & UVXY Stock

There was a recent spike higher in the VIX - the volatility index. Here, I show why I am selling the VIX short going into non-farm payrolls

Last Thursday, the Bureau of Economic Analysis released personal incomes, personal expenditures, and the all-too-crucial Personal Consumption Expenditure (PCE) Deflator Index. However, the stock market was largely already on 3-day holiday mode - the stock market barely winced at the PCE Deflator Index’s elevated levels. The number was elevated enough that expectations for a drop in inflation to the target rate are off, and the Fed may be in a position to wait longer to lower rates.

However, the market waited until Monday to make a decision regarding inflation. And, for two days straight, the stock market sold off:

Above, you can see that the past two days, the S&P 500 sold off from ~5,280 to 5,200. During that time, the VIX spiked higher (the first cart above). This happens when uncertainty moves in: The price of put stock options increase as investors race to buy an increasing level of puts. This pushes the put/call ratio upward as more puts are bought and the price for the individual puts higher. This is what drives the VIX higher.

Video Analysis

Danger: Data Ahead

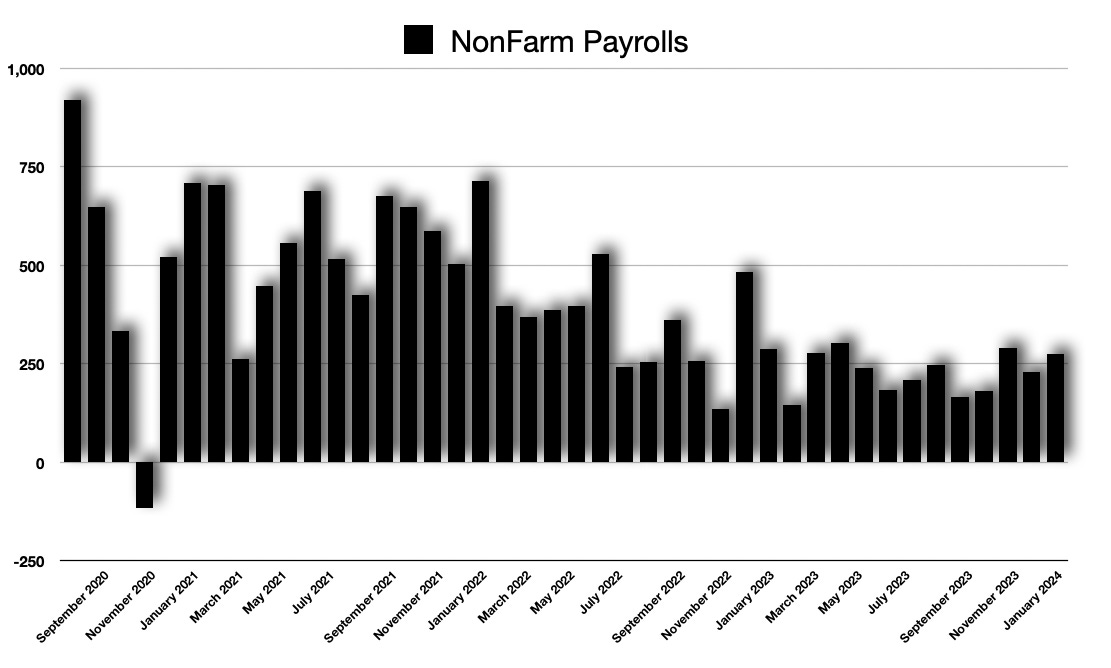

On Friday, we also get non-farm payrolls. This, is yet another data point that the stock market is awaiting and another reason the VIX is elevated - the market expects employment data to come in robust: I do not, however.

The economy is running rich, but not overheating. And, unemployment is sitting at 3.7%. It used to be that 5.00% was considered full employment. So, at 3.7%, this is well beyond the level that would have been considered full employment.

Ask yourself: how much more employment can this economy add? Further, what would be the catalyst event for pushing employment gains further?

At some point, there is simply not any more additions to employment rolls that the economy can undertake. Given this, and looking at the non-farm payrolls chart above, I think the number of non-farm payrolls is going to be on the lighter side. I do not see any real measurable gains coming in that would make the market nervous about interest rates: I am leaning toward the under on the 200K non-farm payrolls additions for this month.

Put Call Ratio

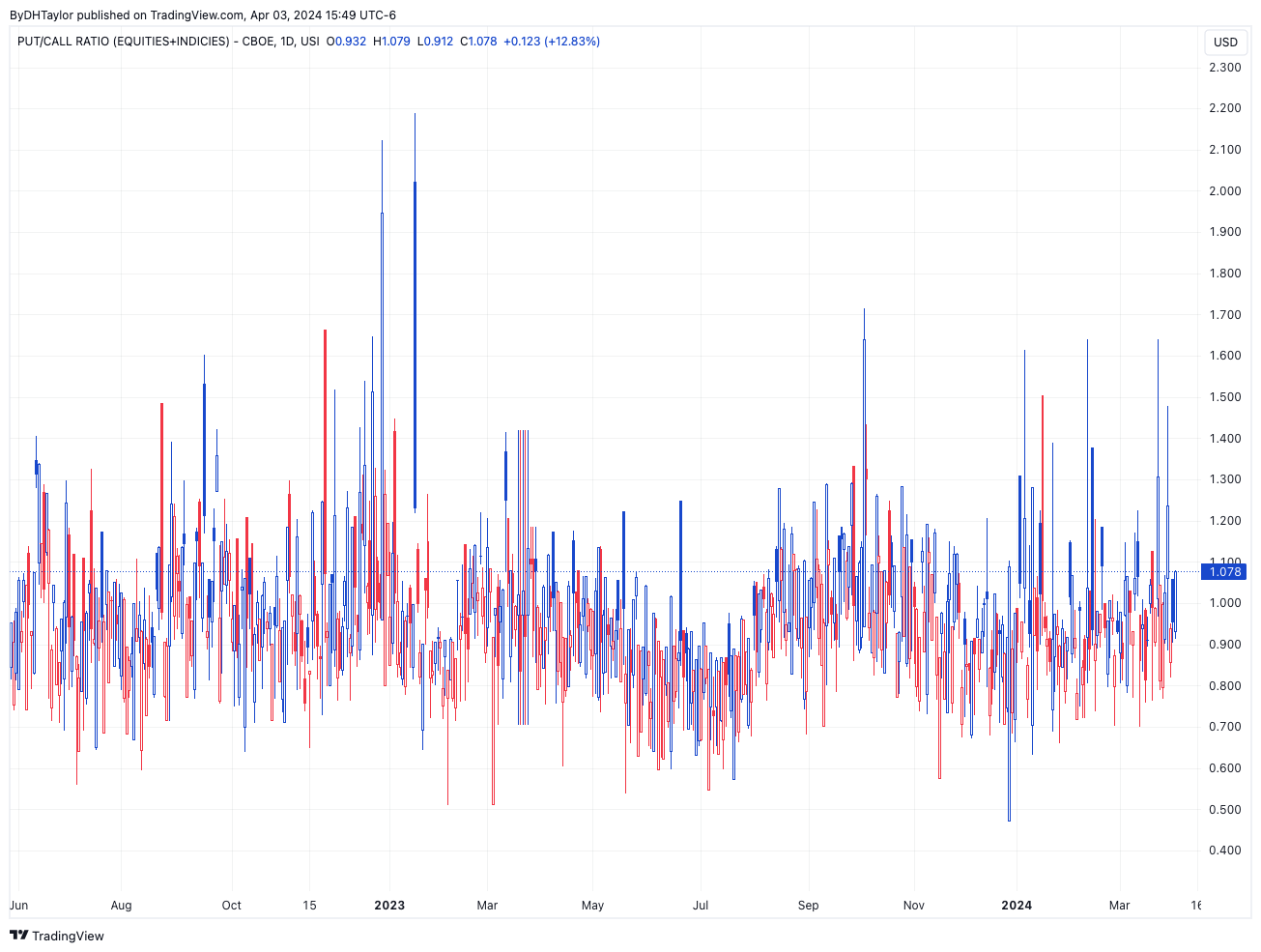

Above is the put call ratio that shows the total number of puts open interest versus the total number of calls. The median is 0.950, meaning: for every 1 call outstanding in the trading realm, there are only 0.950 puts - a smaller amount.

There is also math involved: If the value of puts moves upward to a number higher than the calls, this drives the VIX upward in value.

For instance, if there are 0.950 puts for every 1 call, and the value of calls and puts are both trading at about 10.00, then the VIX would have a certain value. But, if there are more puts being bought and open interest on puts increases, and the value of those puts goes to, say, 12.50 versus the 10.00 mentioned earlier, this drives the value of the VIX upward.

UVXY and The VIX

My general thesis is that those that bought a bunch of protection on any potential spike upward in non-farm payrolls after the inflation data will likely get out quickly if non-farm payrolls does not come in too robust. This would mean many of the options purchased would be removed, thereby subtracting the total number of puts being added to the overall index. Simultaneously, the value of these puts would decline, further pushing the VIX downward.

The above chart is UVXY stock - one of the tradable VIX ETFs. I am already in from yesterday’s spike higher with the selling from the S&P 500. I sold calls out-of-the-money and am looking for delta & theta erosion. I am already profitable after today’s mellow trading. But, I do have a bit of theta on this trade and am hoping for more erosion - leading to more profits for me.

I do not expect the stock market to sell off on Friday because of any big spike in the data we see. Because of that, I expect that the VIX will settle down somewhat - and, by extension UVXY stock.