Slowing Economic Growth With Increasing Inflation - Stagflation?

Economic data is showing increasing price pressures despite the Federal Reserves interest rate increases - all with economic growth that is slowing - is this stagflation?

The primary economic reports that I focus on flowed in the past week. There are two key takeaways from the economic data that showed up:

Inflation is still on a overall decline, but continues to be pressured upward; and,

Economic activity is starting to slow somewhat.

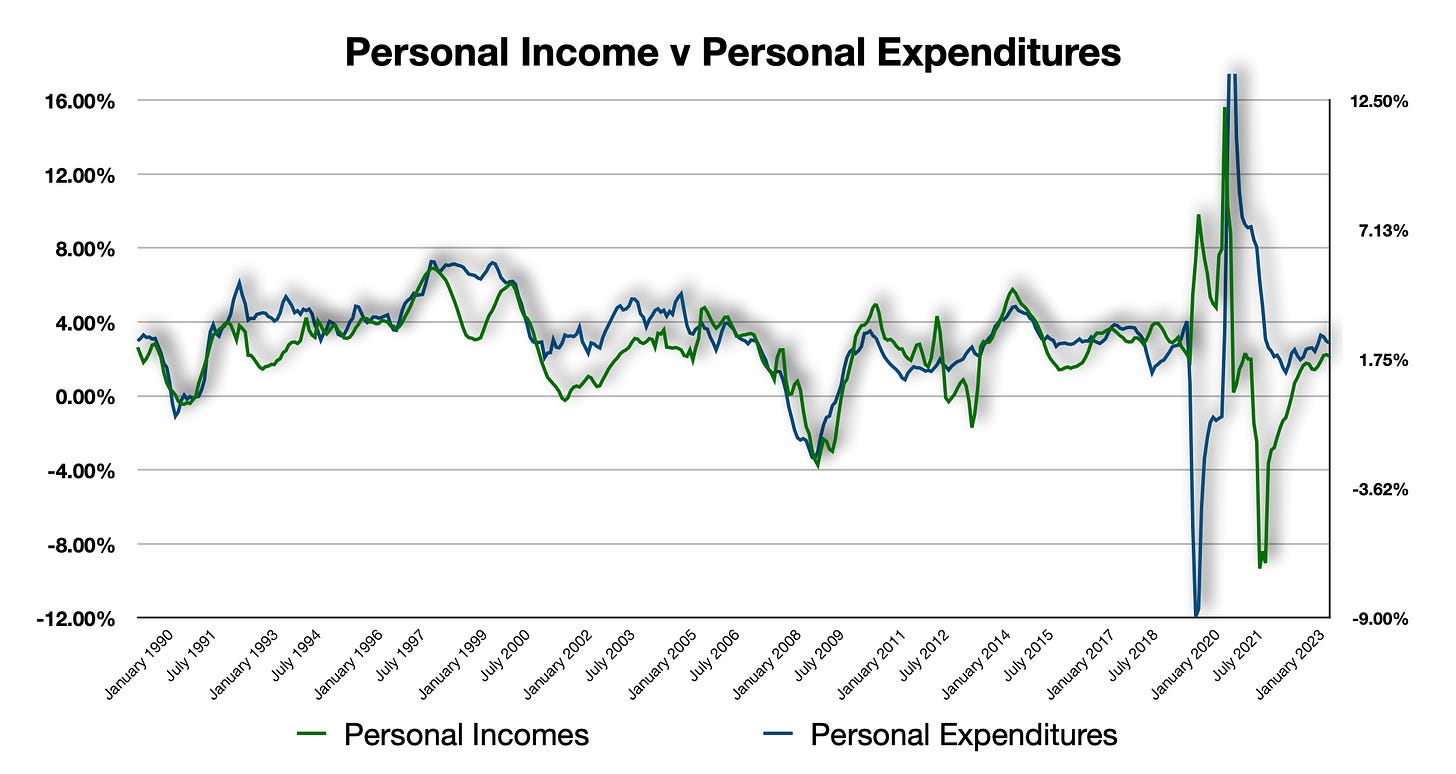

I have been pushing that this is what I see as well. The above chart is the first point at which I look toward for economic activity. And, the above chart is showing that the rate of growth is starting to move sideways, albeit modestly. Economic growth rates are driven by the consumer’s growth rate for incomes. Incomes translate to expenditures, which push both economic growth and price pressures.

And, the year-over-year rates of growth are the key to understanding what is next with economic activity.

Personal incomes came in with a year-over-year growth rate of 2.147% and expenditures hit with 2.419% year-over-year rate of growth. Both of these numbers are slightly below median growth rates.

These charts are the key charts I look toward to see what I think is likely to occur with the rate of growth of economic activity. As personal incomes either increase or decrease on a year-over-year basis, so too do expenditures. As more and more individuals are added to or removed from payrolls, the respective increase or decrease in aggregate income adds or subtracts from aggregate expenditures.

The above shows that the growth rate of personal incomes is starting to moderate and move sideways. This will continue to move economic activity along further as expenditures follow suit. But, the rate of growth is no longer increasing at an increasingly higher rate. Economic activity will follow suit.

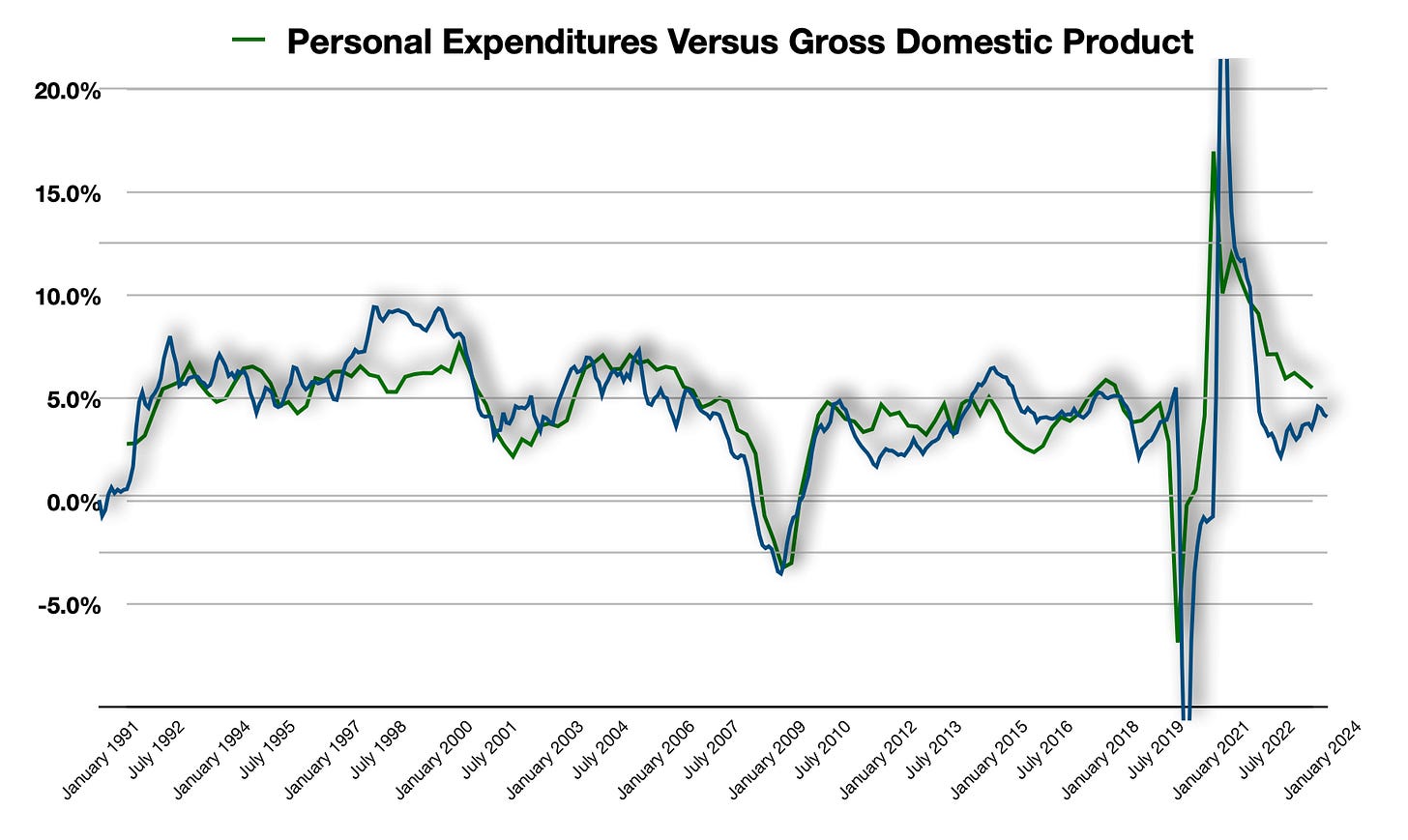

The overall picture spells out what is likely to occur with GDP in the coming quarters.

Personal Expenditures Versus GDP

GDP was reported on Thursday with a slowing rate. No surprise there, all one would have to do is check in with the rate of growth in expenditures to see that since the rate of growth in both incomes and expenditures is not increasing, neither will the rate of growth in GPD.

One thing to note is that this ‘slowing’ rate is 5.486% change from a year ago. This slowing rate is still a high rate of growth.

There is an incredibly strong correlation between personal expenditures and Gross Domestic Product. GDP, of course, measures total economic output for the US with a few additions and subtractions. Basically, all economic activity within a country’s borders is calculated and measured with GDP.

The analysis on what will occur next with GDP growth is going to continue to move lower until it meets up with the overall growth rate of expenditures. The economic data - and the economy itself - is somewhat skewed via the stimulus checks and their affects on the economy.

Price pressures are the next extension from consumption.

Personal Expenditures Versus PCE

Price pressures are the next extension from incomes & expenditures. There is a very strong correlation between personal incomes and both expenditures & GDP. But, the correlation begins to break down more significantly with the PCE Price Index. While there is still an overall correlation, there are disconnects.

A lot of the disconnect with incomes and the PCE has to do with housing and other variables. The most recent price pressure increase was driven by both housing demand as well as corporate profits. Price measures are going to move lower. But, the pace lower is not fast enough to achieve the Fed’s target rate, and that is the key.

That being said, maybe the Fed does not have to do anything?

The Key GDP & PCE Takeaways

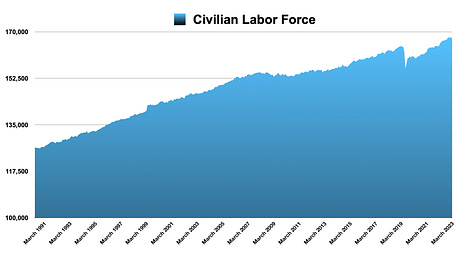

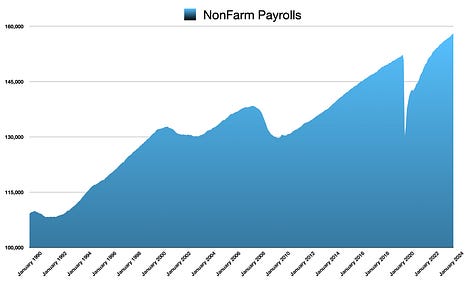

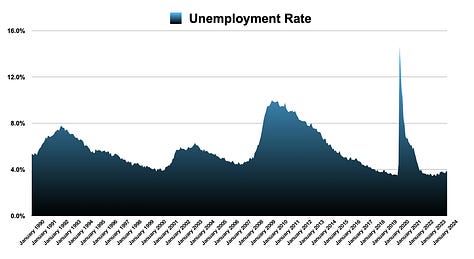

We get non-farm payrolls on Friday and also have a Fed 2-day meeting wrapping up this week as well. Looking at the bigger picture shows that we are likely to continue to get softer and softer numbers out of payrolls. This may make the stock market plop somewhat. That easing in payrolls data is a given - labor is a lagging indicator.

If there is a waning increase in personal incomes, expenditures follow. Since employment is a lagging indicator, and the rate of growth in incomes and expenditures is leveling out - not increasing rapidly, I fully expect non-farm payrolls will not move upward significantly. There simply is not many more individuals left in the US that do not have jobs to be added, nor a catalyst for adding more and more jobs.

Because of that, price pressures will likely abate. It is possible that this is what the Fed needs in order to hit its target of 2.00% PCE year-over-year growth. With a declining rate of incomes & expenditures, this will likely create a declining rate of growth of payrolls that shows up this Friday.

For now, the inflation data is not moving low enough fast enough. At the same time, the Fed will have to sit on its hands right in front of a presidential election that they do not want to appear to be swaying one way or another. That, alone - sitting on their hands - could be enough that in time the rate of growth of price pressures starts to move back lower.

However, this will also mean a lower rate of growth in revenues & profits for companies. Stock prices will need to adjust lower, especially, the borderline companies.

Eventually, the Fed will be able to lower interest rates. In the meantime, however, I expect that equities are going to need to move lower and adjust for lower growth rates.

I am still taking the stance of buying bonds as they will increase in price once interest rates start to move lower. And, I would be a buyer of equities when that begins.