Stock Market Sells - Is There A Crash On The Horizon?

The economy is running on full steam and inflation is sticky. Could the economy begin to slow with rising interest rates?

Last week, economic data came in that showed inflation is much more sticky than what the stock market participants have held on to as their thesis. I have consistently been stating inflation is not only too sticky, but that inflation is at a level which would likely drive the Federal Reserve to increase rates. I covered this last week when the latest CPI data hit. This week, stock market participants started off with their fingers on the sell button. While initially the stock market rose overnight and at the morning open, ultimately the bigger picture kicked in and the S&P 500 went red for the session.

Inflation is too high and the Federal Reserve will not have the luxury to lower rates. There is a slew of economic data coming out next week that should solidify that the US economy is still expanding and inflation remains sticky. Employment is robust and continues to add upward pressure to prices.

Given this, all signs point to the stock market standing on wobbly ground. This could be the start of a move back downward - and something that I have figured would occur about this time of year. Interest rates had trended higher like they have been back in October. But, in a reversal, the market started to price in interest rate declines. The stock market flipped right back downward.

Now, however, the market is starting to take away the potential of interest rate declines. With sticky inflation and an employment situation that is robust, there really is no reason for the Federal Reserve to lower rates at this point.

It may be that we just saw a high in the overall stock market and more selling will start to take place.

Retail Sales Comes Moves Upward

I begin my analysis asking the question what the consumer is up to and how their situation is playing out. If more and more individuals enter onto payrolls of companies, on a year-over-year change, the rate of growth of incomes increases. That aggregate income growth for consumers translates into expenditures - which ultimately translates into revenues for companies.

Above, you can see that personal incomes are heading higher. Consumption, and especially consumption on the retail level, is following suit. There is a very strong correlation between incomes and expenditures. and, retail sales is following along closely to personal incomes.

What Comes Next?

I have wondered about overall growth, however. And, I have also wondered about jobs and incomes, and how that all plays out.

Job Growth

The unemployment rate is sitting at ~3.75%. This is transitory employment, the rate of individuals in between jobs. Considering a classical standpoint, it used to be that full employment was 5.00% - the current rate is well beyond that. Having an employment rate that high would naturally pressure prices upward with too many individuals chasing limited, or scarce goods & services. This is part of the reason that price pressures are still sticky and the Federal Reserve has not gotten inflation down to its all-too-crucial 2.00% target rate - we are about 2.85% and starting to move back higher.

But, with unemployment remaining at such a low level, how much more growth could there be? The private sector will drive the economy growth rates far more so than government expenditures because those tend to be flat line and consistent. Hiring and firing adds more sway in either up or down to economic growth. Yet, there are not that many more Americans left to be added to the payrolls, so where does growth come from at this point?

But, this is a classical approach to the problem. One of the biggest issues with the recent inflation has more to do with housing and corporate profits. Still, employment levels are not helping with the problem - inflation is not heading toward its 2.00% target rate.

Interest Rates Trending Back Upward

Interest rates in the US have been trending higher. The last time interest rates moved up to these levels, back in October, the stock market was in a sharp decline. Interest rates turned back downward in November, and stocks flipped back to moving upward. The economy has certainly functioned at this level of interest rate previously. But, this does bring in problems - especially for banks.

The latest move may have the effect that the Federal Reserve is hoping for, a factor to put economic growth on pause, if but somewhat.

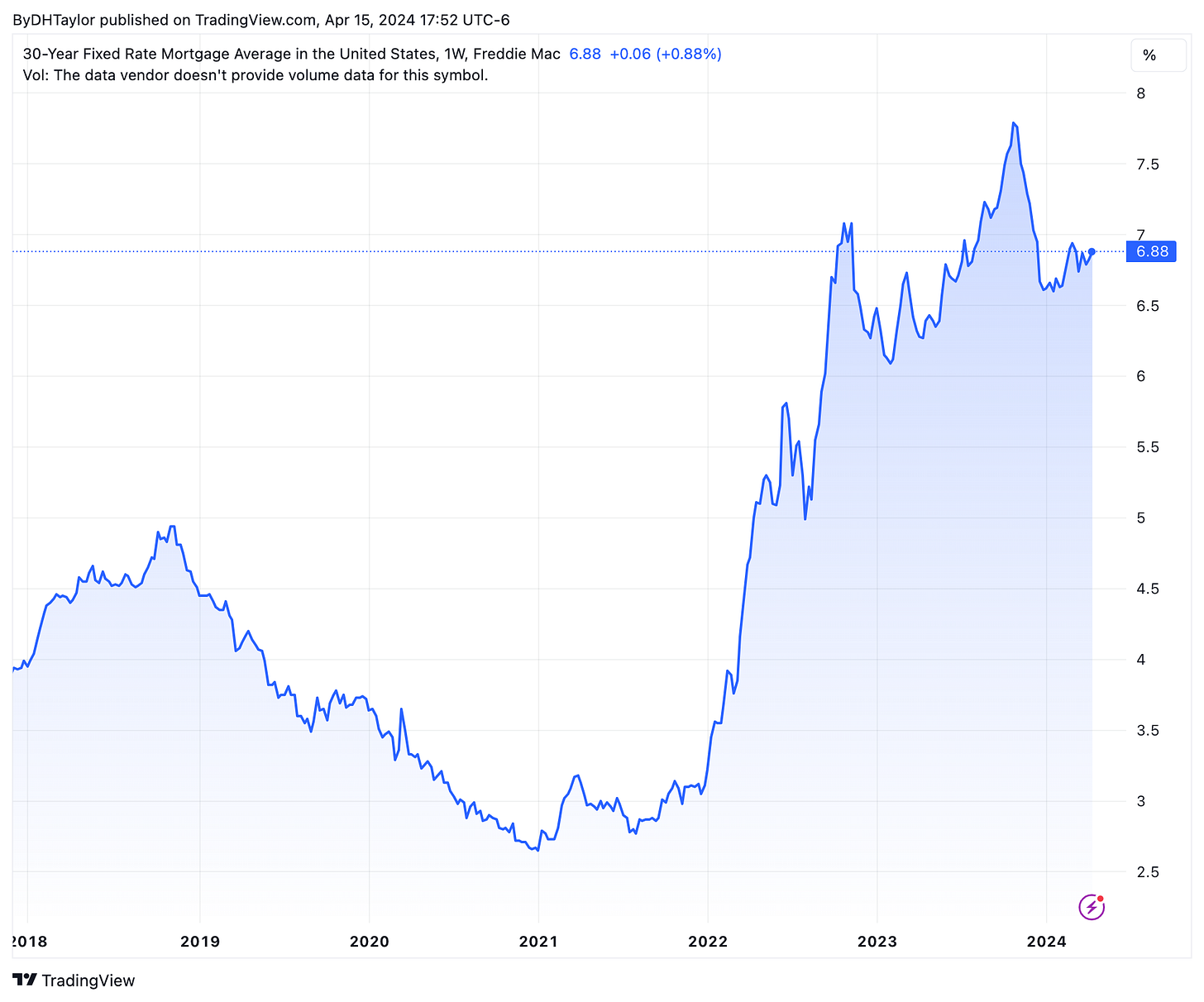

Housing Remains Imbalanced

A big part of the cause of the big spike upward in inflation was owed to housing - something that is skewed heavily with limited supply and lots of demand. But, mortgage rates have been trickling back upward and this is keeping many would-be buyers on the sidelines. That would help to contain some upward price pressures, but that portion of the picture is convoluted and structurally imbalanced. There is a lot of demand but limited supply. And, if mortgage rates remain elevated, supply will remains below equilibrium as builders cannot find buyers at elevated prices - or, buyers simply wait until mortgage rates decline.

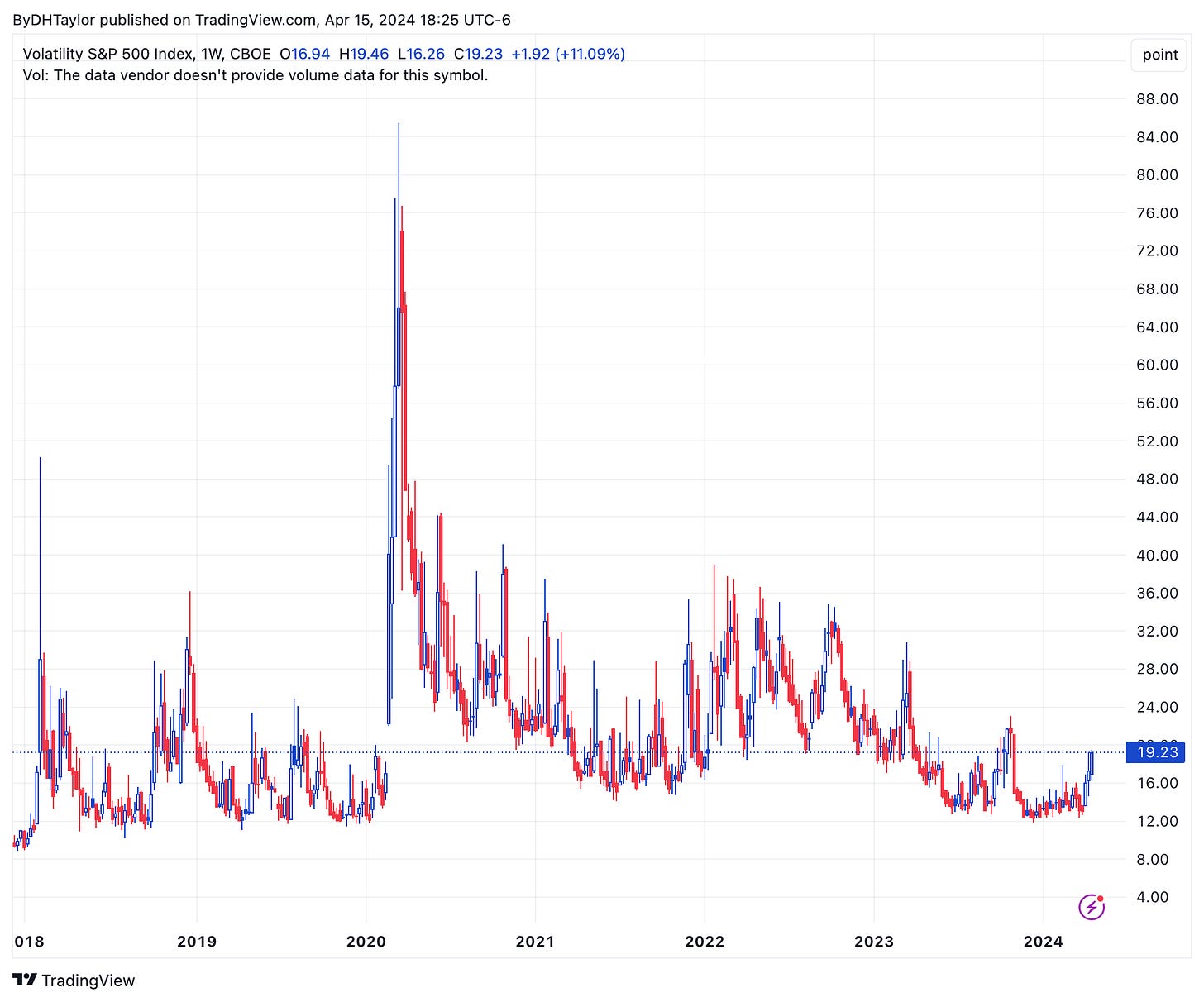

The Stock Market Is Getting Nervous

The VIX, or the Volatility Index, is starting to show signs of life and pop upward off the low levels it’s been sitting at for some time. If the stock market were to continue with sporadic moves downward, more investors would likely move in to buy protection for their positions. Otherwise, those buyers could opt to simply get out of their positions, further fueling nervousness.

My Take?

I have been consistent for some time that the economy would continue to expand through the spring of this year, and the stock market would likely move mostly sideways through the summer. Then, I expected the stock market to begin to move lower as the reality of higher interest rates means lower growth levels. The economy is already operating at levels beyond full employment and that is adding to sticky inflation.

On the other front, the housing market is likely to cool off if mortgage rates start to trend back upward and affordability moves downward. This neither adds to nor subtracts from the problem because supply is the real issue at this point. Still, this could help to ease upward price pressures.

Along with all of this, income growth rates have been pushing upward and consumption is following. This will add to upward price pressures, but at the same time, the increases in growth rates are starting to wane somewhat.

I believe the Federal Reserve has no ability to lower interest rates. They may catch a break if employment growth rates start to flatline simply because the economy is already at full employment. This could be the X-factor that keeps the Fed staying put at the current levels.

Regardless, if interest rates remain lofty, the stock market needs to adjust as downside risks far outweigh upside potential. I have been looking to protect any long positions and get ready for potential moves lower.

Next week we get Durable Goods, Q1 GDP - first look, and Personal Incomes & PCE Price Index. Next week will be a nerve-wracking week for economic data and stock market move potential. My thoughts are that the future data will continue to show upward price pressures.

That all could bring in more moves upward in interest rates, and stocks will respond.

Open Up our Energy Independence and EVERYTHING WILL BE CHEAPER----The day Joe Biden did that--All things moved, shipped & flown--WENT UP UP UP --The "FED" Can Not adjust for THAT!! Joe Biden created the highest inflation in 40 years, threatened to raise over $4.7 TRILLION in taxes, and now he’s got his eye on America’s retirement accounts +++ Closing 4 Oil Processors keeps the SUPPLY TIGHT And difficult to RAISE PRODUCTION! >>>FJB!