The Consumer Can't Get Ahead

Debt levels are increasing for US consumers, and so are interest rates on their debt. With negligible income growth levels, the consumer-driven economy will stagnate.

The US economy is mostly consumer-driven. This represents ~72% of the economy. Any analysis of the US economy would be well-advised to ask the question, then: How is the consumer doing?

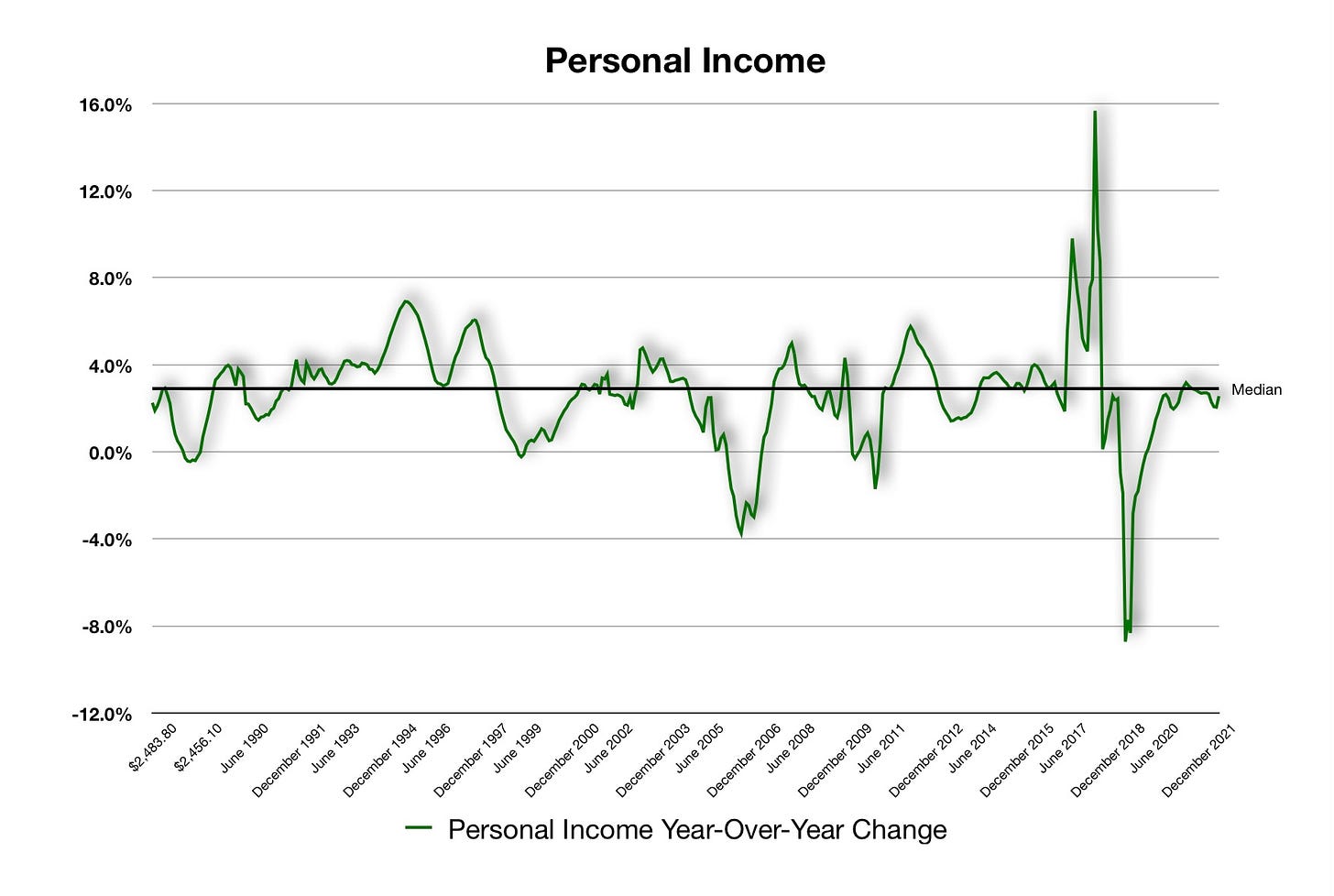

The Bureau of Economic Analysis reported the PCE price index last week. With inflation being a key focus, most overlook that the BEA simultaneously releases the Personal Incomes and Personal Expenditures data. While these numbers came in solid, they are a key indicator that needs to be watched.

Above is the level of debt that the US consumer is sitting on with revolving credit, a.k.a., credit cards.

There is a lot of debt.

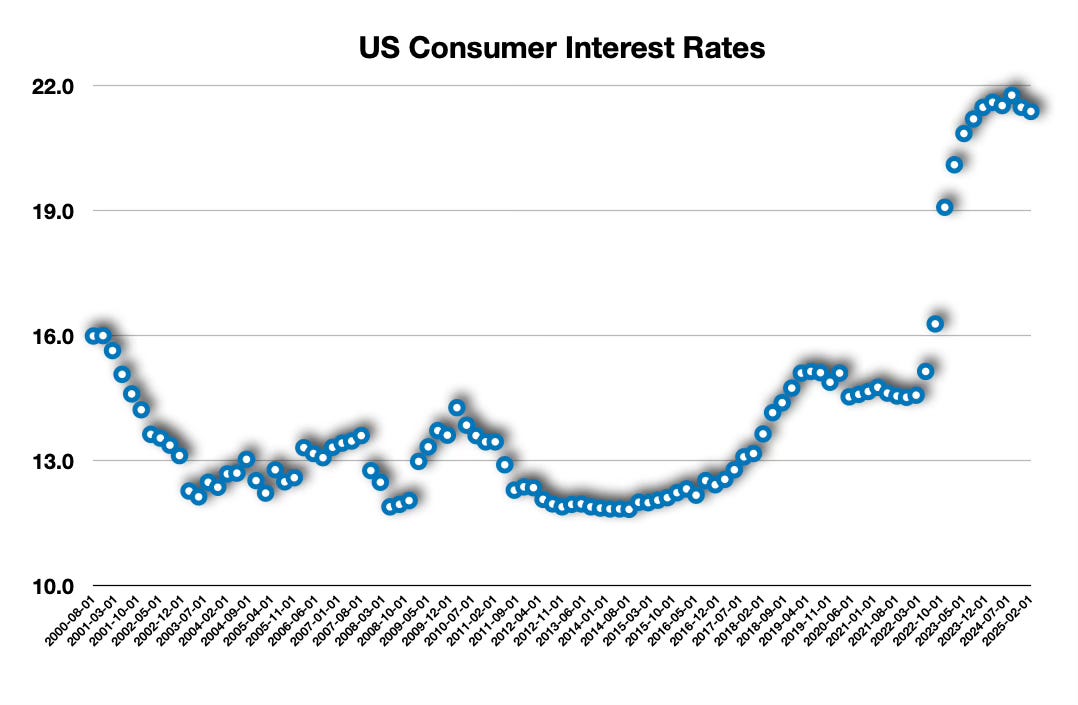

More importantly, is the interest rate levels that consumers are being charged for carrying that debt.

Interest rates have moved higher because of inflation. And, while aggregate incomes had jumped because of the stimulus checks, debt levels and the interest that consumers have paid on that debt have outpaced that growth.

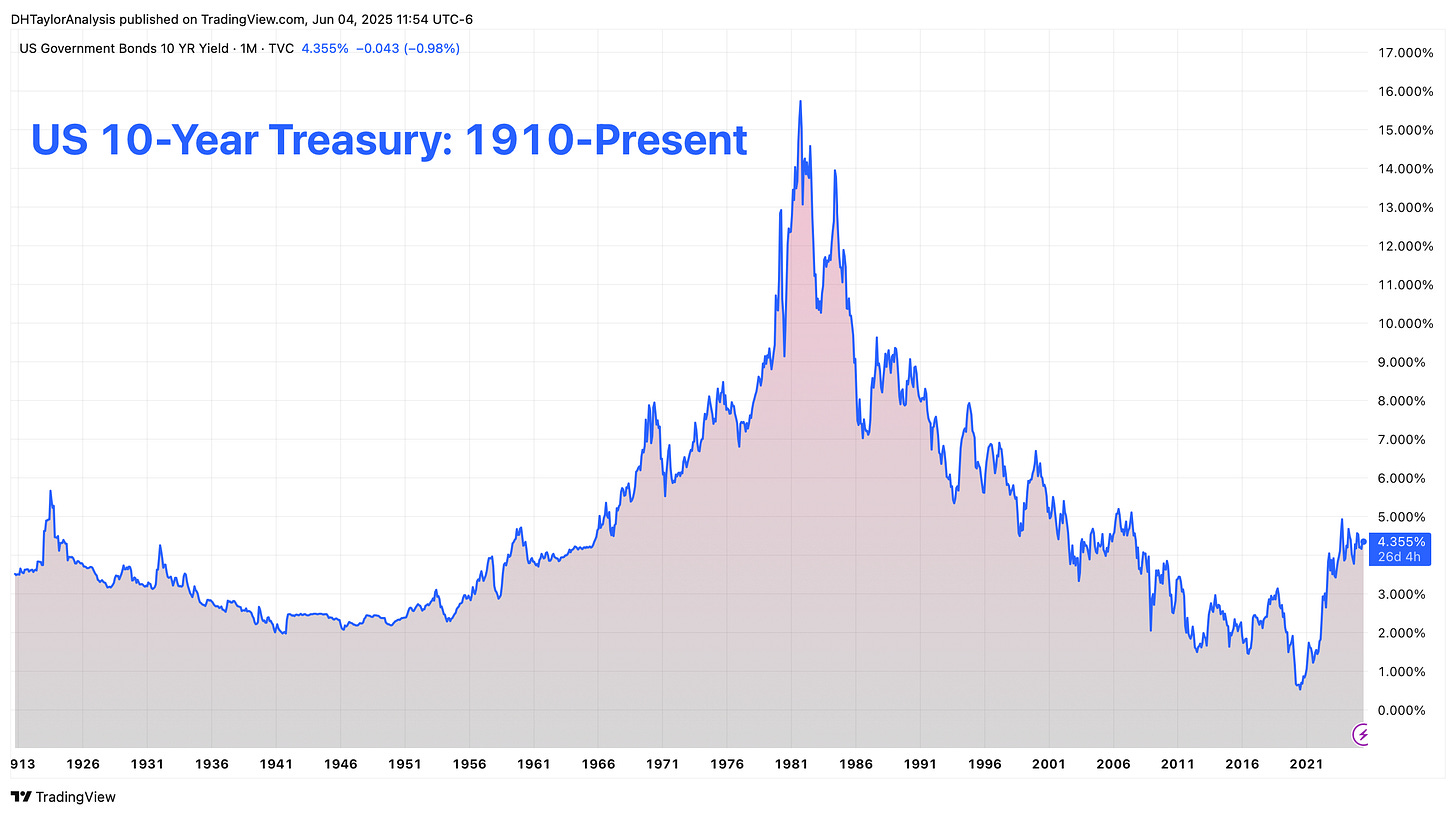

Interest Rates Will Go Higher

The above is the US 10-Year Treasury yield from the early 1900s to the present. There was a period from the early 1950s to the early 1980s when interest rates moved steadily upward. Since that time, interest rates have steadily and consistently moved lower. The bottom was the period when the Federal Reserve had actively pushed interest rates to ultra-low levels to stimulate economic growth.

The Federal Reserve, in effect, turned on the printing presses and created inflation. While the economy was finally recovering from the economic fallout of the Great Recession, COVID hit. Then, the Federal Reserve turned on the printing presses even more.

We are at the point where it is time to pay the economic costs of inflation.

We have just left America’s golden era. There was access to ultra-inexpensive capital. This was not the norm, as you can see from the interest rate levels over the past 100+ years. But it was a privilege.

The Economic Costs Ahead

The tariffs are here, but will go away. They are a cost to the consumers. By taxing consumers, the economy will see a shaving of about 1% of economic growth. It is a small amount, but it is on top of many other minor constraints. This will affect employment prospects as well as aggregate income. The US dollar is also sliding lower, and this too will affect overall economic standing.

Then, there are the interest rates that will inevitably increase from the debt being carried by consumers. Interest rates are driven by the United States Treasury yields, which are trending higher.

Each little act is not necessarily a big game-changer in itself. Instead, however, you need to look at the compounding effects of every act, all inclusively.

The US economy may very well continue to grow and expand. But the pace will be slower. Given that the tariffs will go away, the stock market could easily move higher. But the economic costs for all of the paper that had been printed via the Federal Reserve, along with the lack of fiscal restraint from the Federal budget, will translate into higher interest rates. This will burden the US consumer, who will not be able to get ahead of these costs.