The Consumer Is Fine... For Now!

The economy continues to be propelled by growth with the money supply and consumer expenditures. For now... the tariffs have yet to materialize.

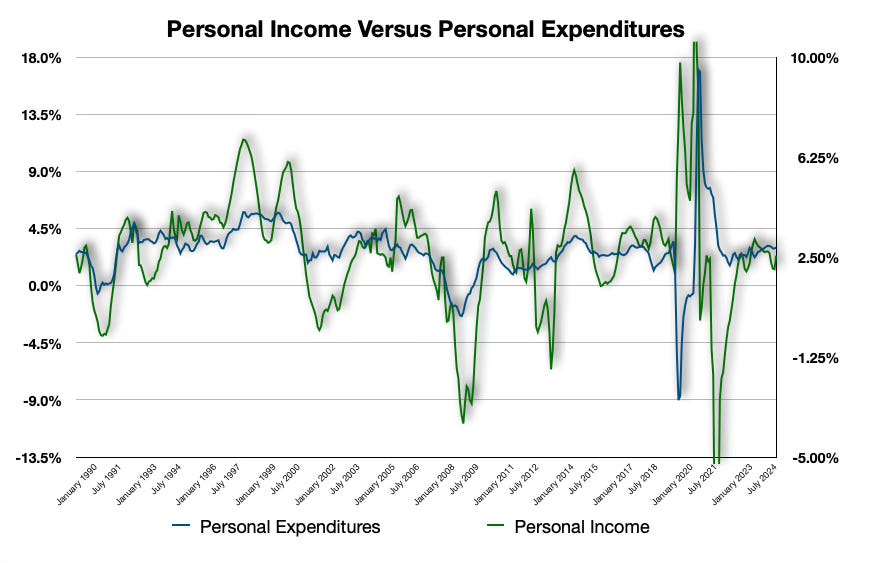

Consumers are earning at a solid pace, and spending equally. As you can see from above, both incomes and expenditures, on a year-over-year basis, are just slightly below median. All else equal, consumption and expenditures would continue to propel the economy forward.

But, what we have not seen are the effects on the economy of the tariffs hitting.

I do not expect a wall of inflation to hit. Looking backward at the past few months, everything leading up to the tariffs being announced, companies purchased nearly double their inventory levels within a very short period before Trump became president, and then enacting tariffs.

All of those inventories are not going to be worked off for some time. In fact, we may not really see the tariffs hit until the fall of this year, going into the Christmas season.

That long, slow progression will likely mute the effects of price increases. Simultaneously, it may be that the courts rule against the tariffs altogether, thereby mitigating the potential price increases.

Core Inflation

For now, inflation data remains muted. The latest print was just above 2.50% annually. Given the level of economic pace and the current level of interest rates, all else equal, the Federal Reserve would likely hit its target for core inflation before year’s end.

But, and as I mentioned, price pressures are likely to rise somewhat from the tariffs. However, employment may decline somewhat, and this could balance out the push-and-pull of the tariffs.

The Tariffs?

I have said many times that the tariffs are more likely than not, unconstitutional. Two courts have just ruled saying the same. Because of the inventory buildup by suppliers, the tariffs may have a muted effect overall on the economy for some time, and then the tariffs may simply go away.

That is both good news and bad news.

The Republican Party is pushing through a bill that is entirely dependent upon the tariffs to fund the policies.

The tariffs would be a constant ball-and-chain on the economy and eventually, the consumer would feel its effects. That would deteriorate the economy.

But, if you take away the tariffs, the economy would remain resilient. However, you would then have a massive hole from the lack of the tariffs and the tax revenue they would have created for the new budget going through Congress.

Two positives may occur:

The tariffs are ruled unconstitutional; and,

The Senate pushes through a version of the bill that depends less on tariffs existing, since, after all, they are nearly dead on arrival.

I won’t be holding my breath. But, I will wait and see.

What are your thoughts?

If that so we are going to see the positive trend last until the end of that inventory

AYRWF

First of the big cannabis companies to fail. This was inevitable without regulatory reform. The government wants oligarchs.

Basically filing bankruptcy, headed for single digit pennies today 😮