The Fed Meeting & Economic Data

This week the Federal Reserve meets to decide interest rates on the same day we get inflation data and after stronger-than-expected jobs data - what will the stock market do?

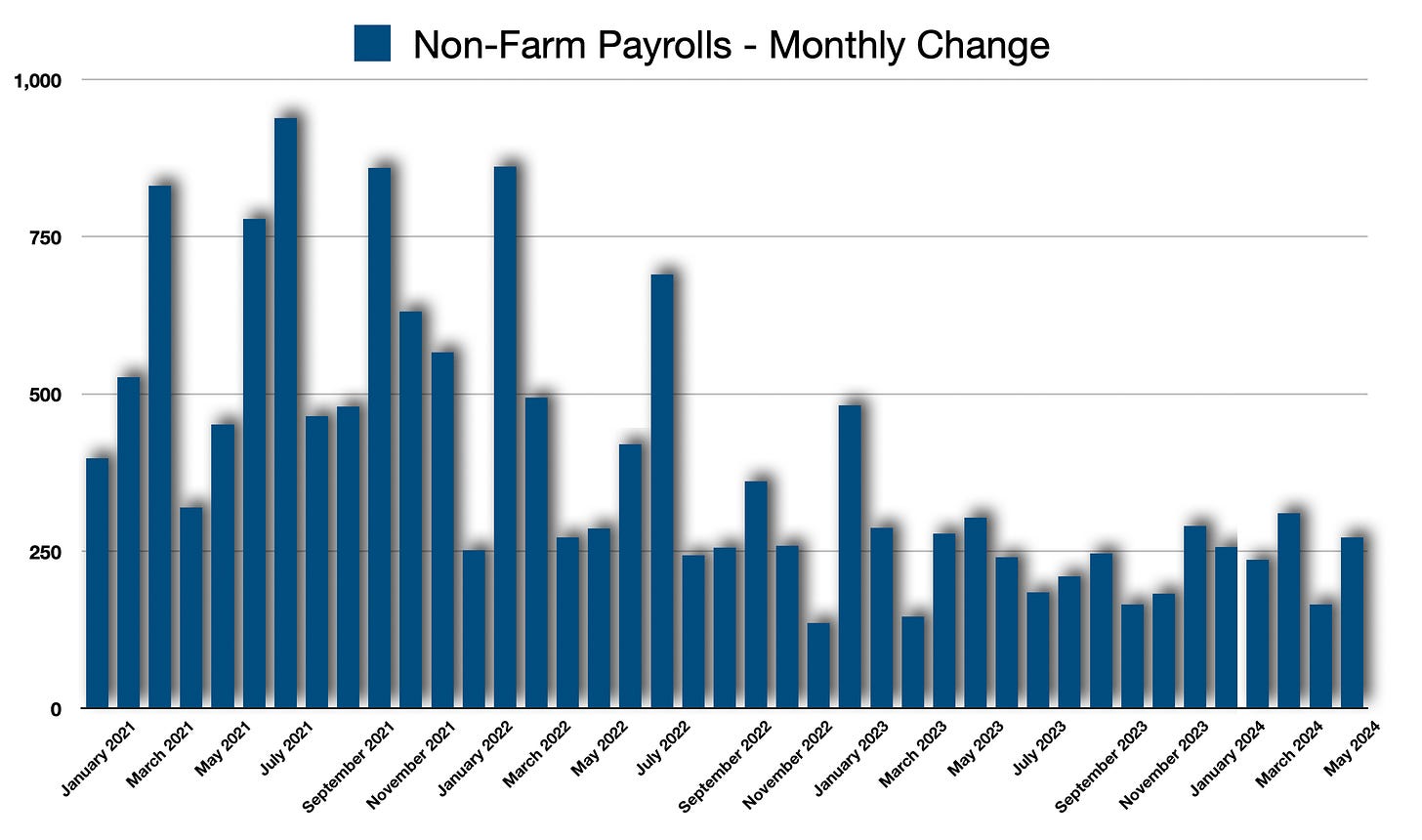

On Friday, the Bureau of Labor Statistics printed non-farm payrolls and a solid 272K jobs added. The employment situation consistently defies analyst projections. The bottom line is that the economy continues to push along at full force. However, at the same time the unemployment rate moved upward slight - from 3.86% to 3.96%. This is transitional employment - those shifting jobs for whatever reason. There is not a lot of slack in this number despite the increase in unemployment.

The question becomes: What happens next with the economy and how will the Federal Reserve react to this information?

The main focus for the Federal Reserve is inflation. Interestingly, on Wednesday we get more information on the inflation front as well as there being a Fed meeting that concludes on Wednesday. We should have a lot of answers about what happens next with the economy, and how the Fed will react.

Keep reading with a 7-day free trial

Subscribe to D. H. Taylor Analysis to keep reading this post and get 7 days of free access to the full post archives.