What Credit Card Companies Tells About The Economy

Amex, Visa, MC are good bellwethers for the economy - Here's what they are telling us

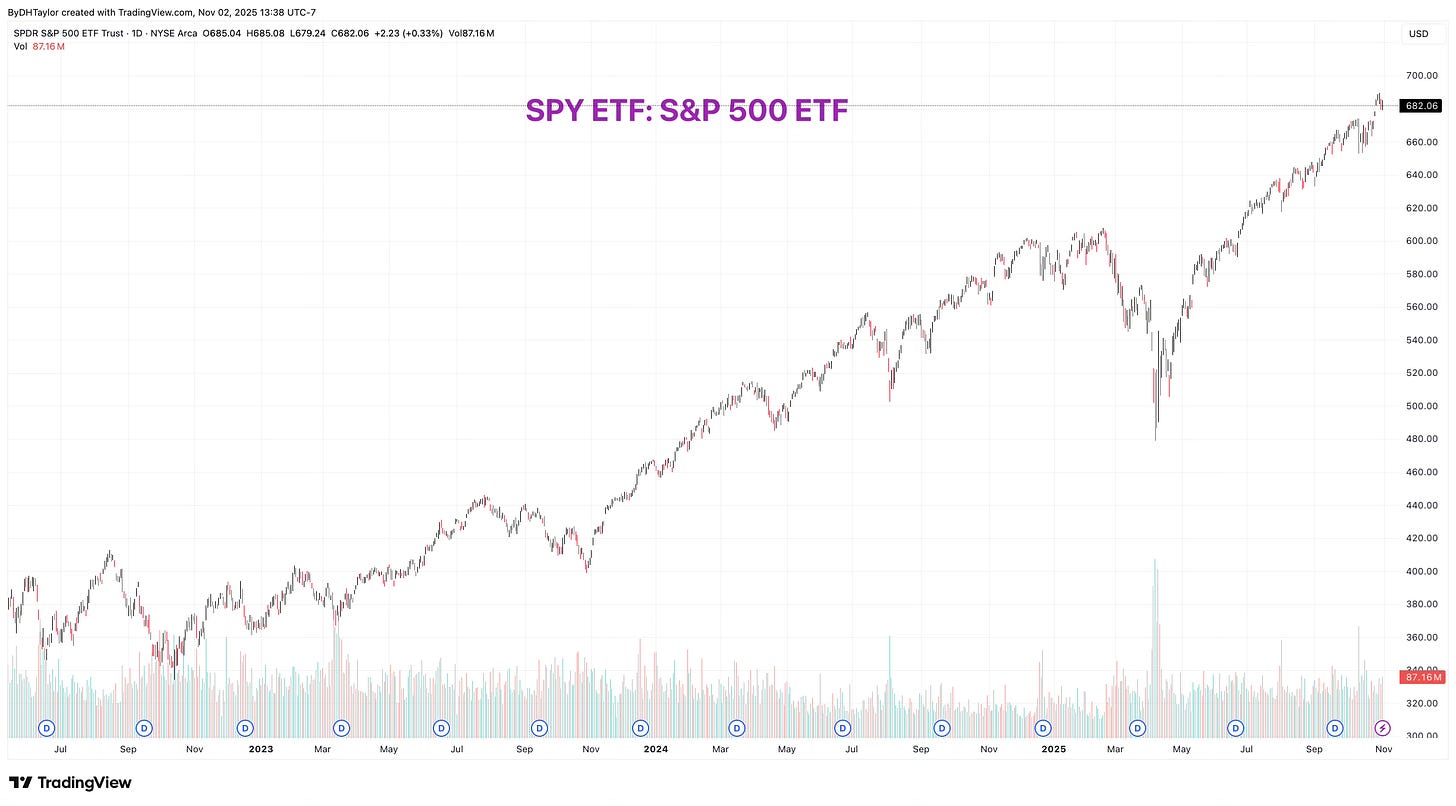

The S&P 500 has surged to yet another all-time high the past week. It is important to note that the S&P 500 is not the economy, but a barometer of the stocks traded on the stock exchange.

Some stocks are driving the stock market more than others—the infamous Magnificent 7?

And, as the AI trade continues to expand, this is driving many stocks further higher.

But what about the economy itself? Many say the economy feels like it is about to collapse on itself. And yet, the stock market keeps making new highs.

Without government data, relying upon creative strategies gives us a clue as to where the economy is, and where it could be going.

One of the first questions is if the stock market is over priced.

The Forward P/E

The forward P/E ratio is high at 23.45 from a normalized level, but is not near any levels that previously indicated a coming recession. This could be some of the Magnificent 7 showing up in the numbers to keep the P/E ratio in overall perspective.

While the Magnificent 7 and the AI trade continue to surge higher, other aspects of the economy are showing weakening signs. Consumers themselves, are not confident in where the economy is.

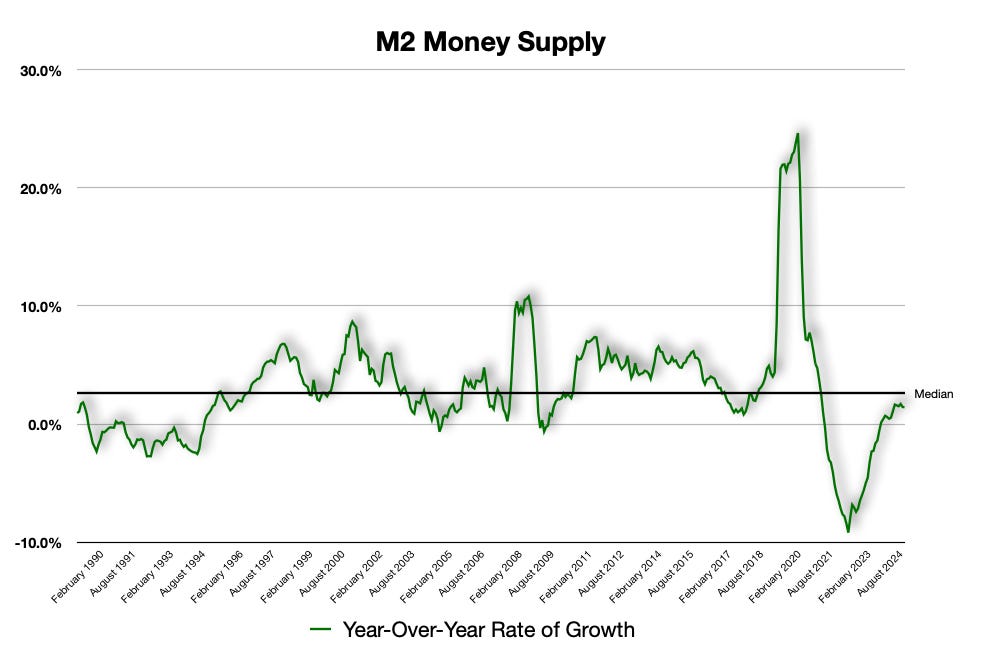

But it is the money supply that is showing signs that the growth rate is slowing, and this is one of the first stops that I always check when trying to determine what will happen next with the economy.

The Money Supply - Rate of Growth

My analysis always begins with the money supply and the consumer. These two aspects go hand in hand with each other. In fractional banking, if the money supply is growing, firms are taking on loans to expand their business. Those loans create money within the economy, expanding the money supply. The rate of growth, the year-over-year change, is where to see at what rate loans are being made, expanding or contracting the money supply. With an expanding M2, firms will take on new employees, which drives consumer incomes and consumption.

We are not getting consumer income nor expenditure data from the government because of the shutdown. Therefore, another place to look is consumer confidence.

Consumer Confidence is Falling

While consumers may be getting hired at a pace because of businesses expanding their operations, the other place to look is consumer confidence. If consumers are feeling less favorable about their future, or the overall economy, this also drives consumer expenditures. In an economy that is over 70% consumption by the consumer, with falling confidence, consumers are more likely to entrench and diminish spending.

Confidence is an indicator that is heavily tied to consumption. Many things are weighing on the consumer right now to include tariffs and the shutdown. Non-essential Federal workers have been furloughed as well as SNAP benefits being suspended, and this is playing out in the news every day.

If confidence continues at this lower level, this weight will begin showing up in economic data—when it starts being released again.

With lower consumption rates, this would translate into lower revenue growth levels for companies. On the one hand, many companies have continued to invest and expand with their AI investments. On the other hand, those companies that are not involved in the AI trade are seeing slowing in revenue growth and have begun laying off employees.

All of this will start to show up in the consumer economy, and credit cards are a solid barometer that show what is happening with consumers.

Credit Card Companies

The three major credit cards; Visa, Mastercard, and American Express, all released their earnings this past week, and all three had solid releases with increasing revenue and profits. Yet, the direction of each stock has gone differently that expected.

American Express

American Express saw solid growth this quarter with increases in revenue and profits. Amex had a lot of solid things to say about growth and international growth, and this is why AXP stock has surged as much as it did.

Given the situation of the shutdown and consumer sentiment here in the US, Amex differs in where they think the consumer will be over the following year. Amex believes that the consumer will keep on rolling forward, but the typical Amex card holder may not be affected by the shutdown nor tariffs as much.

AXP stock is trading currently at $361.00. With a projected EPS of $17.44, and an average of 23.44 on the forward P/E, this puts AXP stock above $400.00. If American Express customers pull through, and international carries the company, there’s a 10% gain to that could be coming for AXP stock.

However, I wonder if the company will actually hit their numbers. If the shutdown continues, as I expect it will, this will have negative impacts on the economy. Plus, the Federal Reserve may not lower interest rates too much more over the coming months. It may be that the forward P/E ratio moves lower, and that could cap AXP stock.

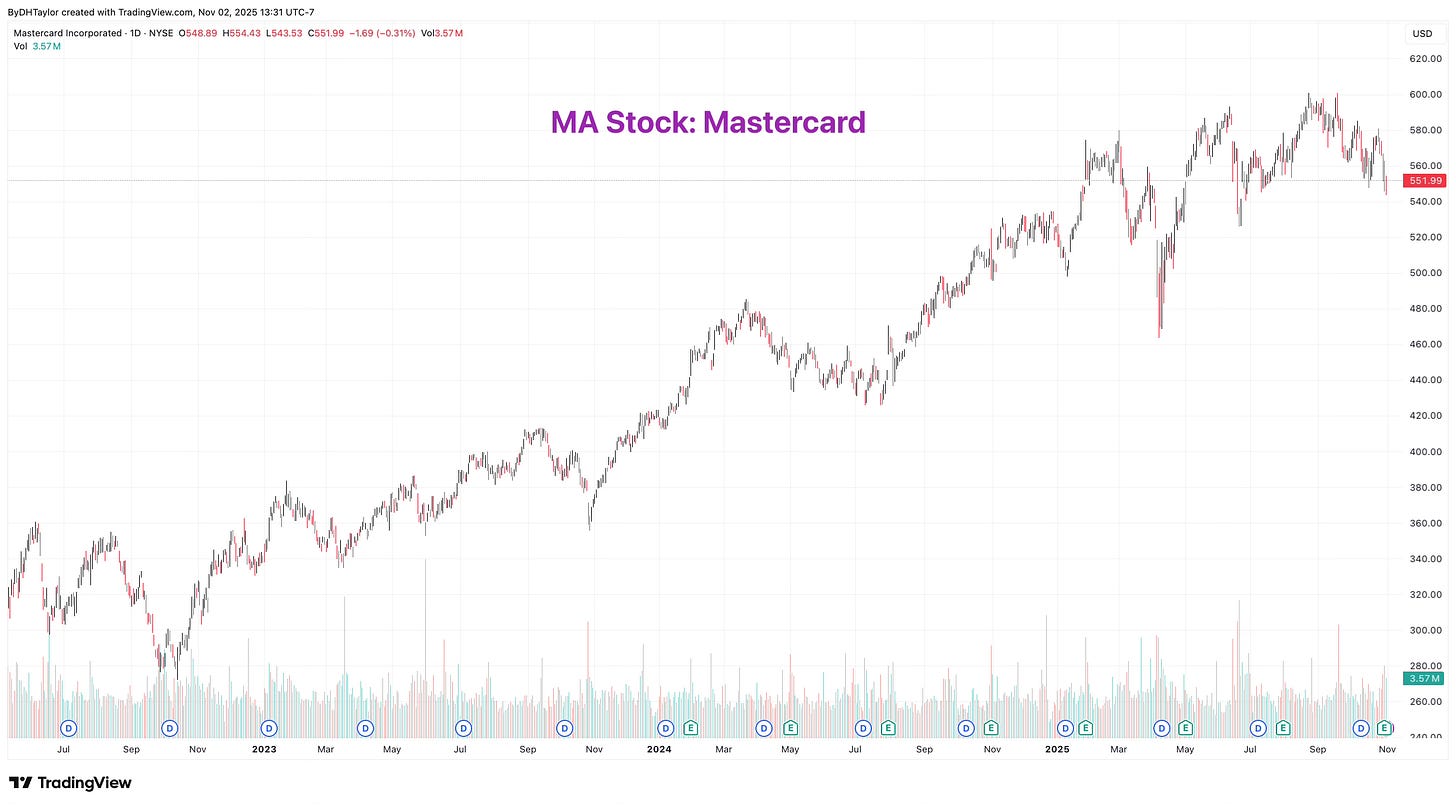

Mastercard

Just like Amex, Mastercard saw solid revenue growth and earnings growth. And, just like Amex, Mastercard sees continued increases through this year.

But looking at MA stock moves over the past few days, it does not look like the stock market believes Mastercard.

The projected EPS for Mastercard in 2026 is $19.12. With an average forward P/E of 23.44, this would put MA stock at $450.00—it is currently trading at $510.00. This may be why MA stock has started to slide lately.

Although there has been solid double-digit growth in revenue, the stock market is adjusting its expectations with MA stock, and this will mean the stock should slide further.

Factoring in the consumer’s sentiment and a money supply that is not increasing its growth rate, this may explain what is happening with the stock.

Visa

Just as the other two companies, Visa has seen strong growth in revenue and profits. However, just like Mastercard, the revenue growth and subsequent profits are falling short.

Visa is expected to haul in $12.79 through 2026. But the economy could falter with the consumer tightening its grip on their wallets. The same factors that are affecting the economy, will play out to affect Visa as well. With the average forward P/E ratio of 23.44, that would put V stock at $300.00—it is currently trading at $335.00. Visa could see a drop of about 10% given the law of averages.

But I suspect that the economy will falter over the coming year. Because of that, I also expect that companies like Visa are likely to miss because of the decline in economic activity. I believe Visa will slide below the $300.00 level through 2026.

My Take

In lieu of economic data coming out of the government, private-sector economic indicators are proving to be important. A lot can be discerned from these data points. But it is also the information from the credit card companies that are important.

Collectively, the consumer sentiment index as well as the money supply tell us where the consumer is, and the numbers look like they could show a lot of future negativity.

The overall feeling of the consumer would drive expenditures, which would drive firms hiring firing employees in response to shifts in the broader economy. We can see through the University of Michigan Consumer Sentiment index that the numbers are near all-time lows. Expenditures are likely to follow. This will show us what will happen next with the money supply.

Credit card companies also tell us a story that they believe the consumer will continue forward, albeit at a slower pace. This is why the respective credit card company stocks have slid the past week.

But the AI trade is still what is driving the stock market, and this is overshadowing other aspects of the stock market.

It is the Chipotle factor that really tells the story, however. Yes, consumers are being stretched. Those at the very lowest on the economic ladder are feeling the price increases from the tariffs the most, and they are spending less - Next week’s post will be on retailers to include Chipotle, Starbucks, McDonalds, Target, Walmart, & Costco. These companies will give investors a solid look at what the stock market could do, notwithstanding the AI surge.

Mostly, I think we are seeing a tale of two economies where the consumer on the lower end of the economic ladder is stretched too thin. While AI investment is driving a lot of what we see in the stock market, the portion of the consumer may start to weigh on the stock market more broadly.

I continue to look for the stock market to move higher because of the AI trade, but eventually the shutdown and its effects on the economy will begin to weigh on the stock market—traders cannot live on AI alone. Further, the stock market has taken off again because of sentiment that the Federal Reserve will pursue more accommodative policies. However, that is not as likely, and the stock market could retreat because of the most recent comments.

I will break down more of the consumer-related stocks next week.