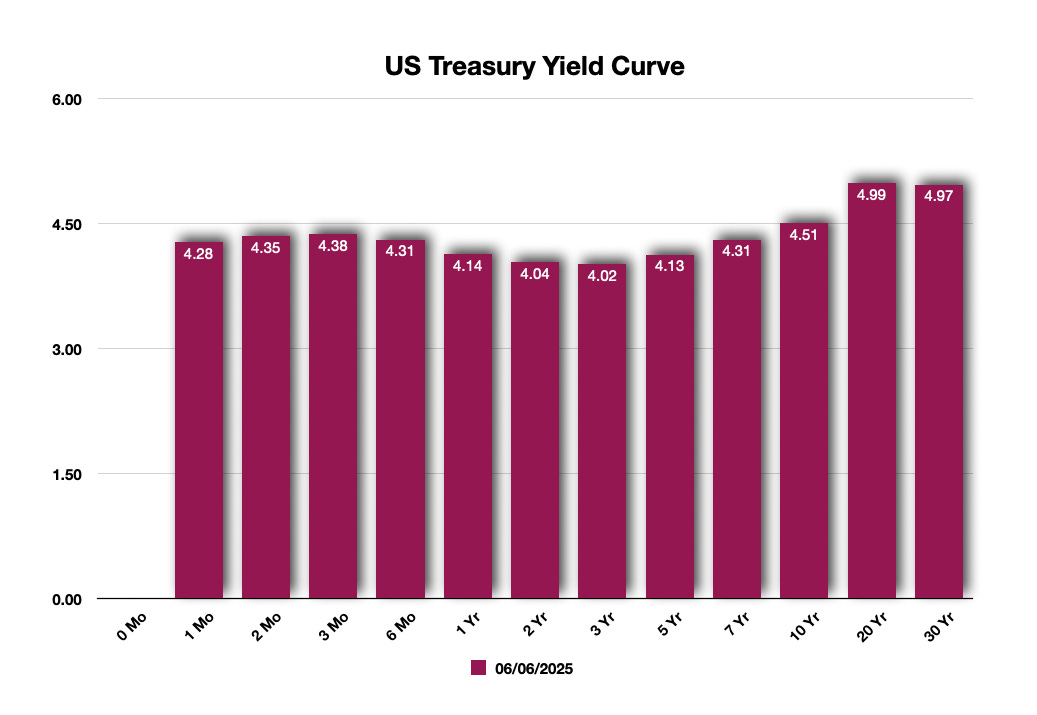

The US Treasury yield curve is inverted and has gone deeper into this inversion. The bond market is expressing its concerns about the budget deficit through rising bond yields. However, not all yields are rising to the same interest rate level. The middle terms are lower than the short-term yields and long-term yields: the classic inversion.

The yield curve starts at 0 time and 0.00% interest. Then, you move through the various time periods the Treasury issues debt instruments. For the next three months, interest rates are expected to remain the same. After those three months and all through the following three years, interest rates are expected to decline.

Then, interest rates rise significantly. Three stories are being told here:

In the near-term, the bond market expects the Federal Reserve to remain on pause until more information becomes available. The tariffs are a tax, and this will likely diminish economic activity within a consumer-driven economy.

Then there is the medium-term outlook, where the bond market expects the Federal Reserve to have lowered interest rates in response to slower economic growth and increasing unemployment.

From there, we see that longer-term yields are much higher. Bond market expectations are that the budget deficit will increase substantially over the next 10 years. Because of this, investors can demand more interest on money they lend to the United States.

The 10-Year Will Trend Higher

Via the Senate, I expect some of the issues within the budget to be minimized to some extent. However, overall, the basics of this bill will remain: the deficit will likely increase the debt. Interest rates will drift higher.

Higher is relative, however. A look at the past century of interest rates in the United States shows that the 10-year yield was unusually low:

The latest nearly two decades show that the United States has had access to very low interest rates. The most recent move up in the Treasury yields shows the 10-year Treasury yield is getting closer to its long-term median level.

So much for access to loose, inexpensive money.

From here, interest rates will remain higher.

TLT ETF

Many follow me because of my TLT ETF trades. I exited the TLT ETF in April when the price surged higher. I had every intention of getting back in on the dip. I don’t expect a solid dip to finish dipping until much lower levels are cleared.

I can easily see the $60.00 level get breached. If you line up the two charts, the sustained move higher in TLT began after the financial crisis, when the Federal Reserve introduced its quantitative easing (QE) policies into the economy.

I see the world’s central banks as the problem, not the solution. And, there are massive structural problems. Now, with the budget, there will be plenty of fuel to keep these ‘problems’ blazing for years.

My take is the same: Take advantage of this opportunity to get well ahead of everything.

The yield curve is telling us what will happen to interest rates. There were structural issues before that had caused the curve to invert. Now? The curve is inverted far more, and I am taking advantage of the long-term expectations the bond market is pricing.