Economists believe that the most considerable proportion of inflation increases was derived from housing. Interest rates fell to nearly zero percent. This drove a surge in mortgage rate refinancing and home purchases. Sellers sold homes at premiums, as buyers could afford higher prices due to the lower financing costs resulting from ultra-low inflation.

Price increases seeped through the entire economy, as well as rents for renters. With the entire economy driven by higher housing costs, all prices increased.

Housing prices have moderated, popped up higher again, and are now starting to decline again:

The above chart is the Case-Shiller Housing Price Index (Blue bars) along with the rate of change, the year-over-year growth rate in housing prices from the PCE Price Index, the housing portion.

There is a lag. First, the red bar is a year-over-year rate of change. Therefore, the lag is one year.

Housing prices are starting to decline again. The rate of growth in housing price pressures will continue to decline, but I doubt it will hit zero and go negative without a recession.

30-Year US Treasury Yield Versus Freddie Fixed

As you can see, the US 30-Year Fixed mortgage rate, as reported by Freddie, is an almost mirror image of the US 30-Year Treasury yield. As the starting basis for interest rates, Treasury yields are a crucial part of the financial world.

With the latest federal government budget proposal, there are significant concerns about the deficit growing substantially. Moody’s downgraded the US debt rating one notch below the ‘perfect’ score it had held for over a century (With that rating agency).

Interest rates were already elevated before this, as the Federal Reserve had raised them to combat inflation. Now, along with the already-elevated levels and concerns over future deficits, interest rates are going to continue to be pressured higher.

The good news in this is that home price rises will diminish. As this was the biggest portion of price increases from post-COVID inflation, lower price increases will alleviate a lot of the pressure for consumers.

The bad news in this, of course, is that all interest rates are elevated. The entire US Treasury yield curve is the starting basis for interest rates throughout the economy. While consumers will see decreased cost increases from housing & shelter, interest rates on student loans, auto loans, credit cards, and business loans are higher.

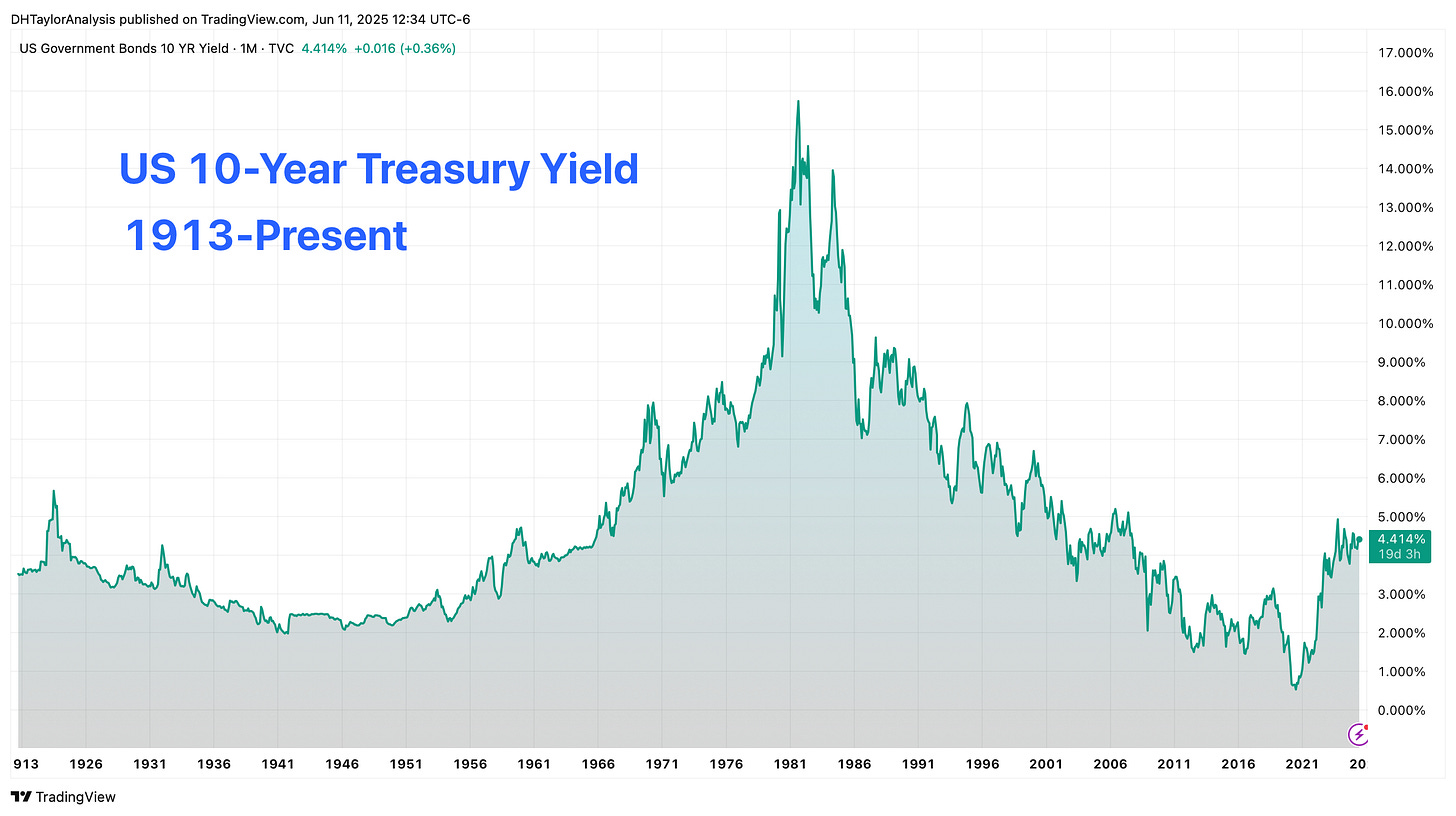

Long Term Interest Rates

From a long-term perspective, the 10-Year Treasury yield being at this level is not abnormal. What was abnormal was the lower levels of interest rates that the economy was enjoying.

From here, I can see interest rates remaining elevated, despite the Federal Reserve potentially lowering interest rates in the not-too-distant future.

The cause of this is a shift in policies from several central banks throughout the world, such as the Bank of Japan, slashing its Japanese Government Bonds (JGBs), which will allow for a more natural price discovery in a freer market. Note: The Federal Reserve is reducing its balance sheet and allowing for a small portion of its holdings of US Treasuries to expire.

Basically, central banks are no longer supporting bond prices through unnatural market manipulation.

The other significant issues, of course, are government budgets and their deficits, along with the costs of servicing debt levels.

The United States is not alone in this: Japan, the United Kingdom, the EU, and many other countries are in situations where rising debt levels and the costs of servicing them are weighing on the price of each country’s respective bonds.

Look for more content from me where I break all of this down and what this all means for each economy, their respective interest rates, stock market indices, and currencies.