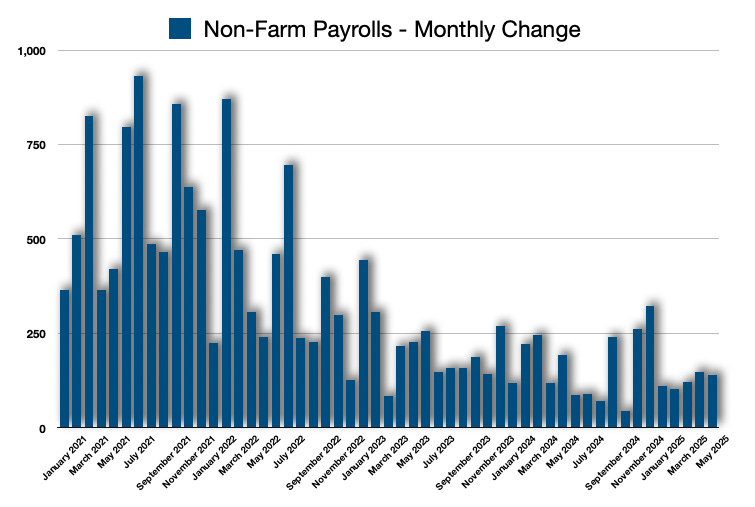

The Bureau of Labor Statistics released the employment situation this morning. The economy remains resilient in the face of tariffs. The good news about the tariffs, of course, is that they will go away via the courts at some point.

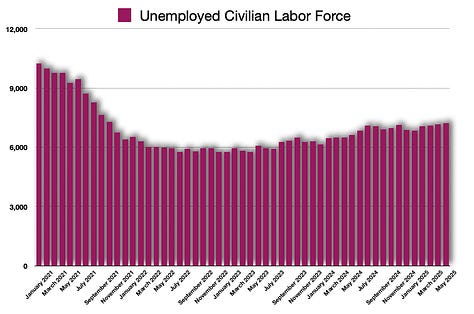

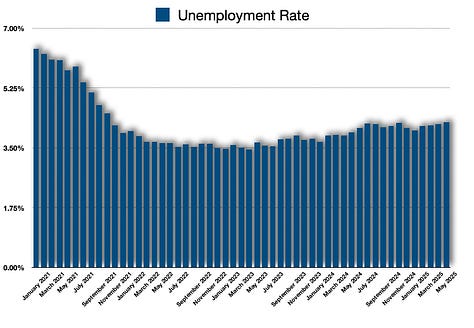

Overall, employment remains strong. The unemployment rate moved slightly higher to 4.2% from 4.1%. This remains well within what economists call ‘full employment’. Unemployment is often referred to as transitional employment, where an individual is considered to be between jobs. At this level, it compares to the pre-COVID economy and is better than the Dot-Com era economy.

But, this economy does not necessarily feel like it outperforms the Dot-Com era.

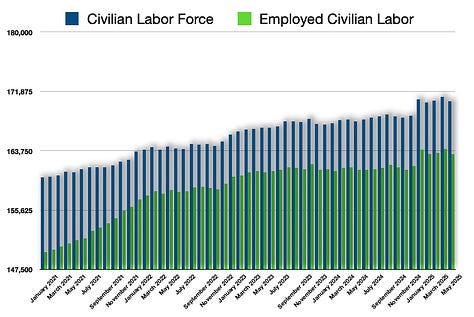

The employment situation remains consistent overall. However, the civilian labor force itself is relatively flat after the upward recalibration in January.

Overall, I expect unemployment to continue increasing, albeit at a very slow pace. Tariffs are a tax. Although the tariffs will go away, they are here for now, and the effects will happen.

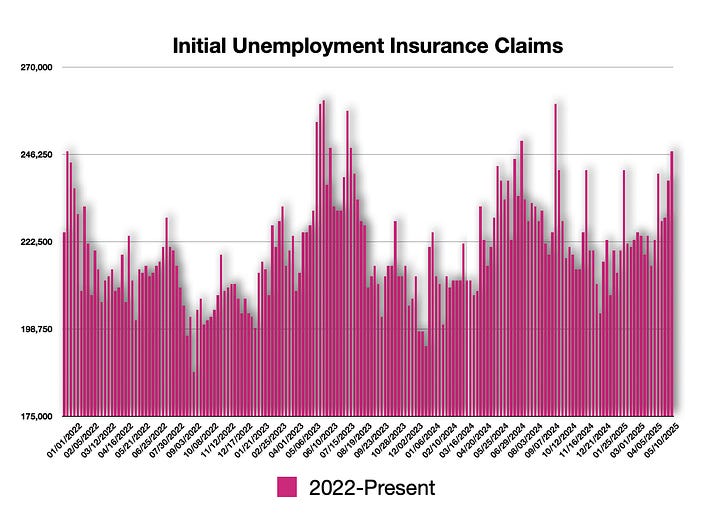

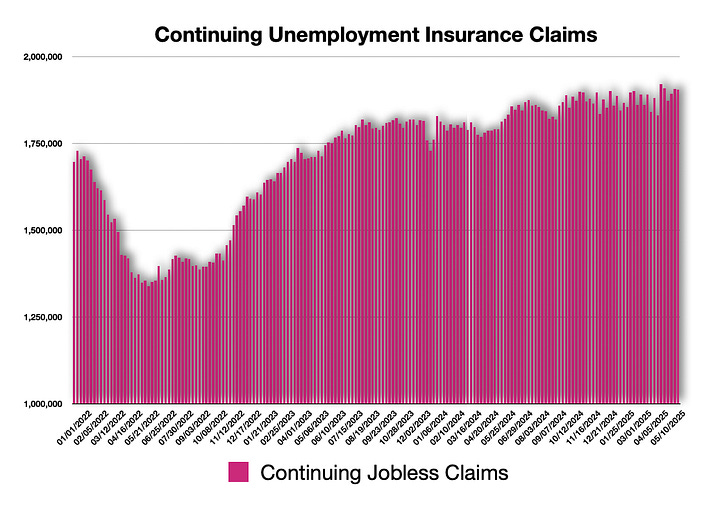

Regardless, going into this morning’s numbers, I was not surprised at the reading because I always pay attention to the Initial Claims numbers that hit every Thursday.

Initial Claims

You would always want to pay attention to the initial claims data that hits on Thursday to show what is happening with joblessness.

Whereas the employment situation the BLS pushes out leans more toward numbers that show how many just got fired, or remain unemployed, the initial claims data shows how many were just fired, or remain jobless.

Ultimately, both data points show the same thing… just differently. Regardless, I was able to see that the data would be within ranges because there were no real increases in initial claims.

Stock Market Today

The stock market bounced on the data release. I feel that the stock market has room to continue trending higher—I can see the all-time highs of February being taken out.

The stock market is the ultimate discounter of information. The biggest information we have now is that the tariffs will be removed at some point, and the stock market is taking any economic impacts in stride.

But, it is not the tariffs the economy needs to focus on: The budget deficit will have a bigger impact on growth rates.

Interest Rates

It is a privilege that we enjoyed ultra-low interest rates. That privilege is going away. We have higher interest rates than we did because of central bank policies here in the United States and elsewhere in the world. Those policies are being reversed. At the same time, the budget deficit is problematic… to the point that the United States just got its third downgrade from top-level ratings.

Lower ratings, driven by higher budget deficits, ultimately enable lenders to push for higher interest rates. There are economic costs associated with that.

First, the United States will have to pay higher interest on its existing debt. This snowballs more and more as time goes by. Simultaneously, higher interest rates are forced upon consumers. Equally, this erodes economic growth potential because what a consumer has to pay in higher interest rates, they cannot do additional expenditures.

While I expect the economy to continue growing, the pace will not be as rapid. P/E ratios will have to be lowered. That means the stock market will see slower increases, if not ultimately heading lower.