The Federal Reserve has signaled it will lower interest rates soon. The market is starting to price in a cut with the July meeting now being in play.

We get employment data on Thursday with non-farm payrolls, initial claims & continuing claims. This data may be a strong driver of what the Fed could do. Recent economic data suggests that employment is softening, but at a snail’s pace. This week, if we see unemployment numbers move up rapidly, market participants will front Fed moves, and interest rates will go down.

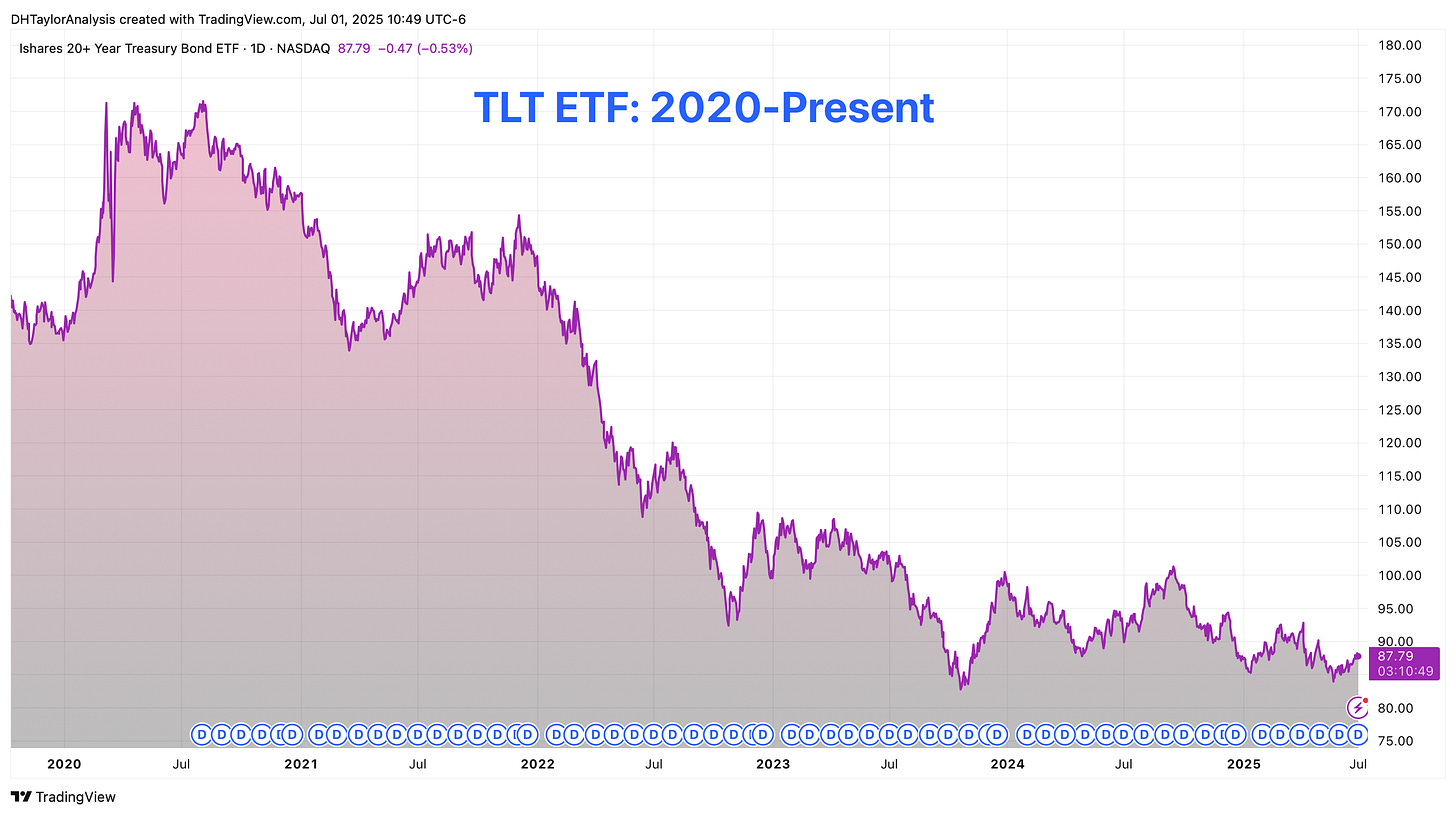

The question is: What happens to TLT ETF after the Fed lowers interest rates?

Understanding that would entail looking at the complete picture. The Fed’s main tool is the overnight interest rate. TLT ETF looks more to the longer end of the yield curve. Looking at all of the pieces of the puzzle is more important than simply the most immediate unemployment rate.

There is, after all, the Big Beautiful Bill, which is likely to turn into a massive debt bomb. That will have a far outsized effect on TLT ETF.

Listen to this episode with a 7-day free trial

Subscribe to D. H. Taylor Analysis to listen to this post and get 7 days of free access to the full post archives.